Do you know that feeling? You are checking your mailbox, notice a letter from the tax office, and immediately think: What did I do wrong now? Do I have to pay anything extra? Or did I miss a deadline?

But actually, more often than not these letters are there to help you by reminding you of deadlines or informing you about changes to your tax status.

Now, we do know that these letters can sometimes be hard enough to understand even for native speakers, which is why we decided to do a little breakdown of the most common letters you will receive from the tax office if you are freelancing in Germany.

In addition, we have created a special AI tool, that is explaining them to you!

Here’s what we will look at:

If you want to start freelancing in Germany, you will have to register with the tax office. This is done by filling out the Fragebogen zur steuerlichen Erfassung, or questionnaire for tax collection.

➡️If you want to save time, simply fill out our digital version of the questionnaire and submit it to your respective tax office.

After submitting the document, you will have to sit still for a little bit, as you are not allowed to issue freelance invoices without your new tax number. It should take about 2-4 weeks for that number to arrive in your letterbox, depending on how busy your tax office is.

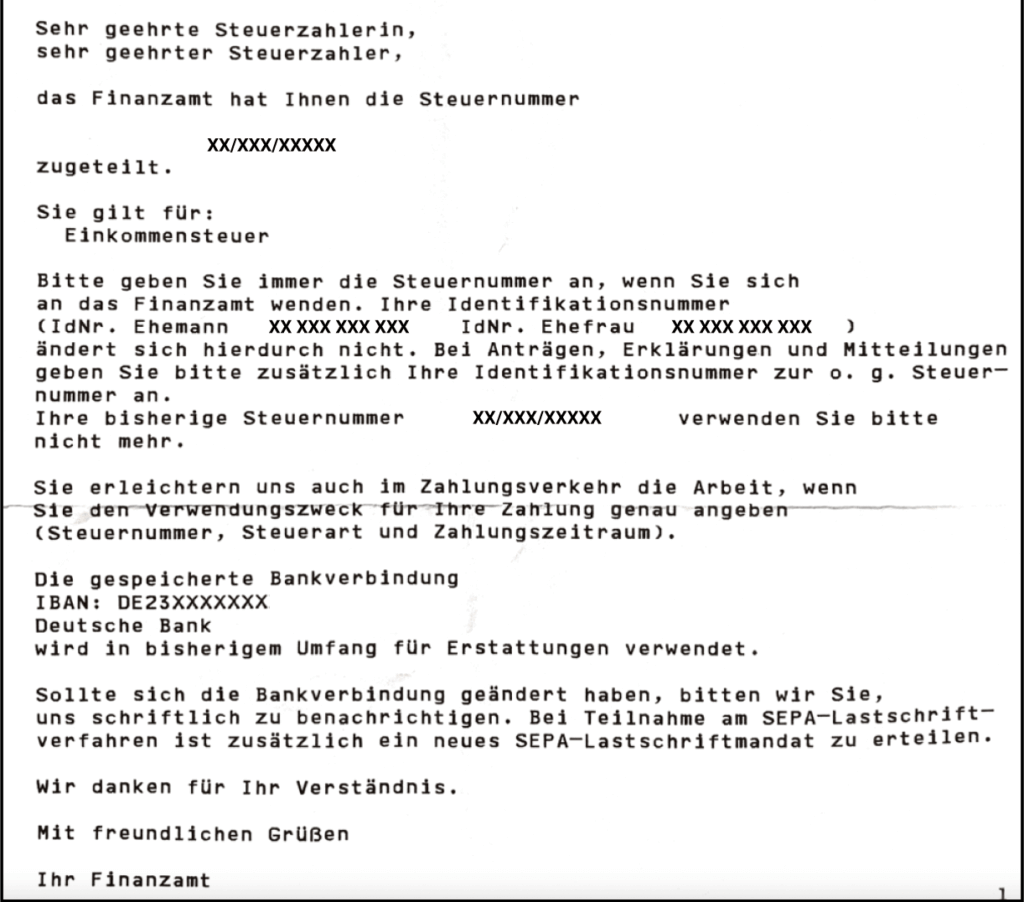

Here’s what that letter looks like:

In this letter, you will find your new tax number - which means you can start working as a freelancer and issuing invoices for your new self-employed business.

The letter also includes some helpful notes about your old tax number, which you shouldn’t use anymore, even if you are only freelancing on the side and are still employed. You can use the new tax number for both your self-employed activities as well as your income tax declaration for wages from being employed.

➡️Here’s what you need to know about the different German tax numbers.

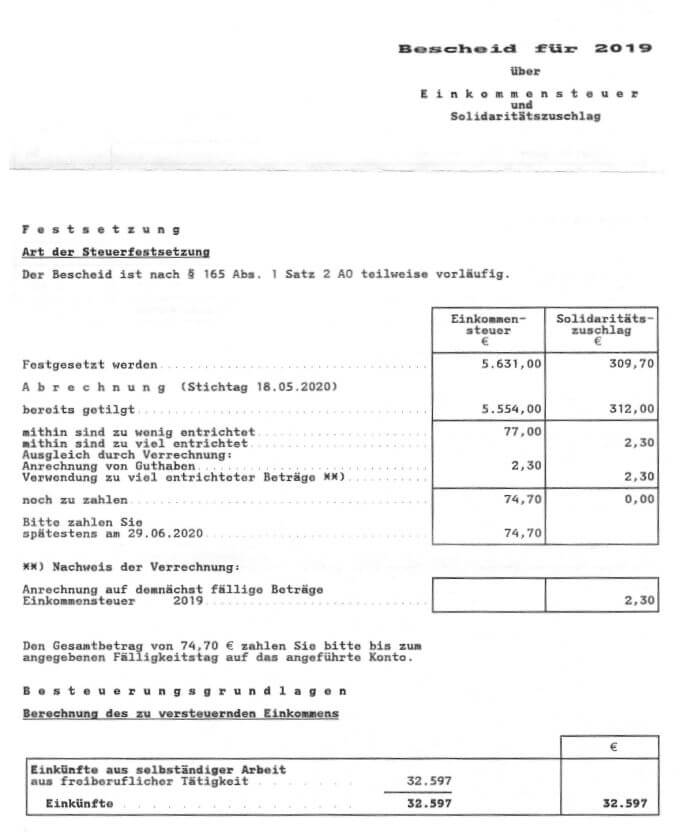

As a freelancer in Germany, you are obligated to file an annual tax declaration. After submitting your details, you will have to wait for the final tax assessment of the tax office. How long you have to wait is again depending on how busy the tax office is. In larger cities like Berlin, Munich, or Cologne, it can take a bit longer, whereas smaller cities might be quicker in their assessment. So be prepared to wait for anything between 3 weeks and 2 months.

When the tax office has assessed your income tax declaration, they will issue a letter to you explaining their assessment. The letter will include the respective tax tiers they used to calculate your taxable income as well as information about which deduction they accepted to reduce your income tax obligations.

Additionally, this tax assessment includes calculations on how much you are obligated to pay for the solidarity surcharge, or Solidaritätszuschlag (Soli) in German.

💡As of 2021, the exemption threshold for the solidarity surcharge has been lifted substantially. Find out how much money this will save you here.

Furthermore, your tax assessment letter will also include an overview of how much you might have already paid the tax office and how much money you are still owing. Already issued transactions will be offset with the open amount, so you will only have to pay the difference to the tax office.

Also, please note the deadlines for your open payments, as any delays might lead to fines. You can learn more about reminders and collection letters below.

If you are working for yourself, your tax is not automatically subtracted from your income as it would be if you were employed. Instead, you are responsible to calculate your tax liability on your own, and save money throughout the year to then pay your owed income tax at the end of the financial year.

This can quickly become a big worry in the back of your head - and the tax office has to wait for their money as well.

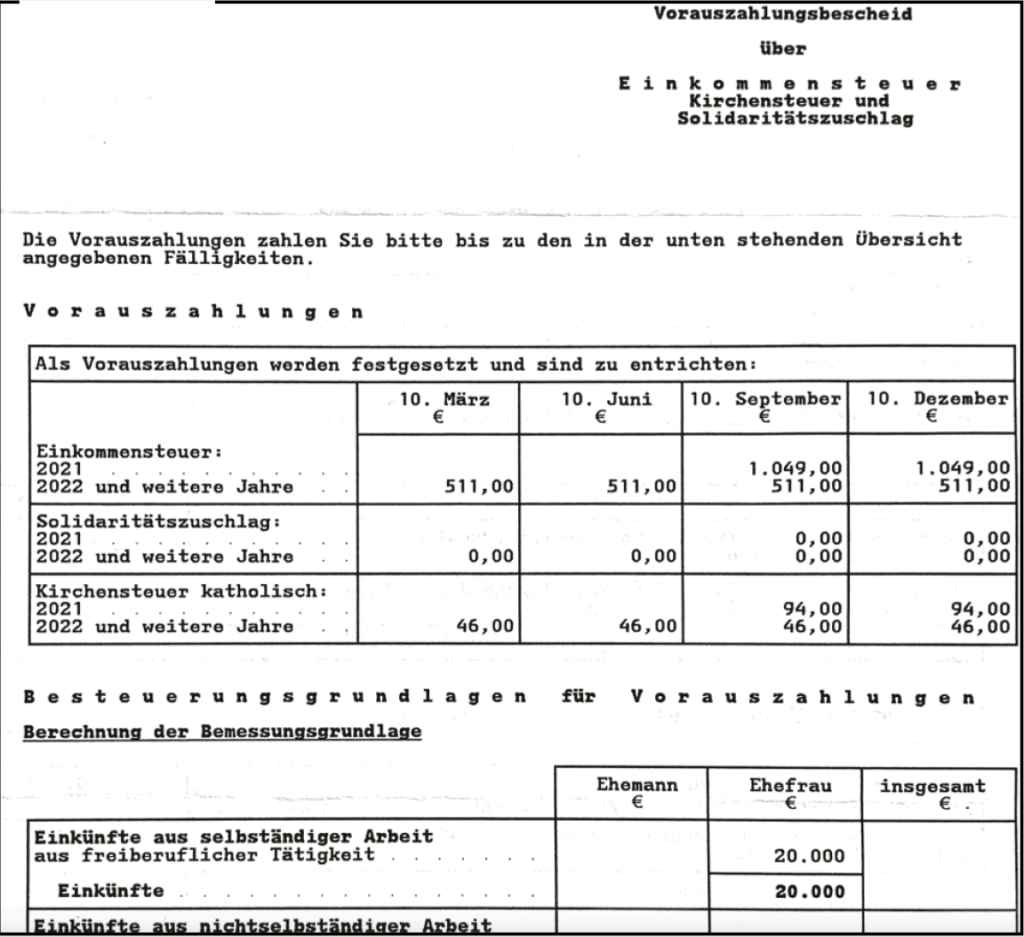

Which is why self-employed people in Germany usually have to pay tax prepayments based on their income from the previous year. The tax office will issue a letter telling you how much they have assessed, including the dates these payments will be due for payment.

This is one of the more important letters, as it states the exact amounts you will have to pay as well as the due dates. So make sure to keep this letter in a safe spot - or at the very least take a photo of it!

➡️You can find more detailed information about the prepayment letter in this article.

If you are working for yourself, you are probably familiar with the term VAT, or value added tax. In Germany, this is called Umsatzsteuer.

If you don’t know anything about VAT yet, maybe these articles can be of help:

You will probably receive at least two letters from the tax office regarding VAT: One letter for you to choose which type of taxation to apply, and a notification in case you are registered as a small business owner and your income has exceeded the VAT exemption threshold.

Let’s take a closer look at those two letters.

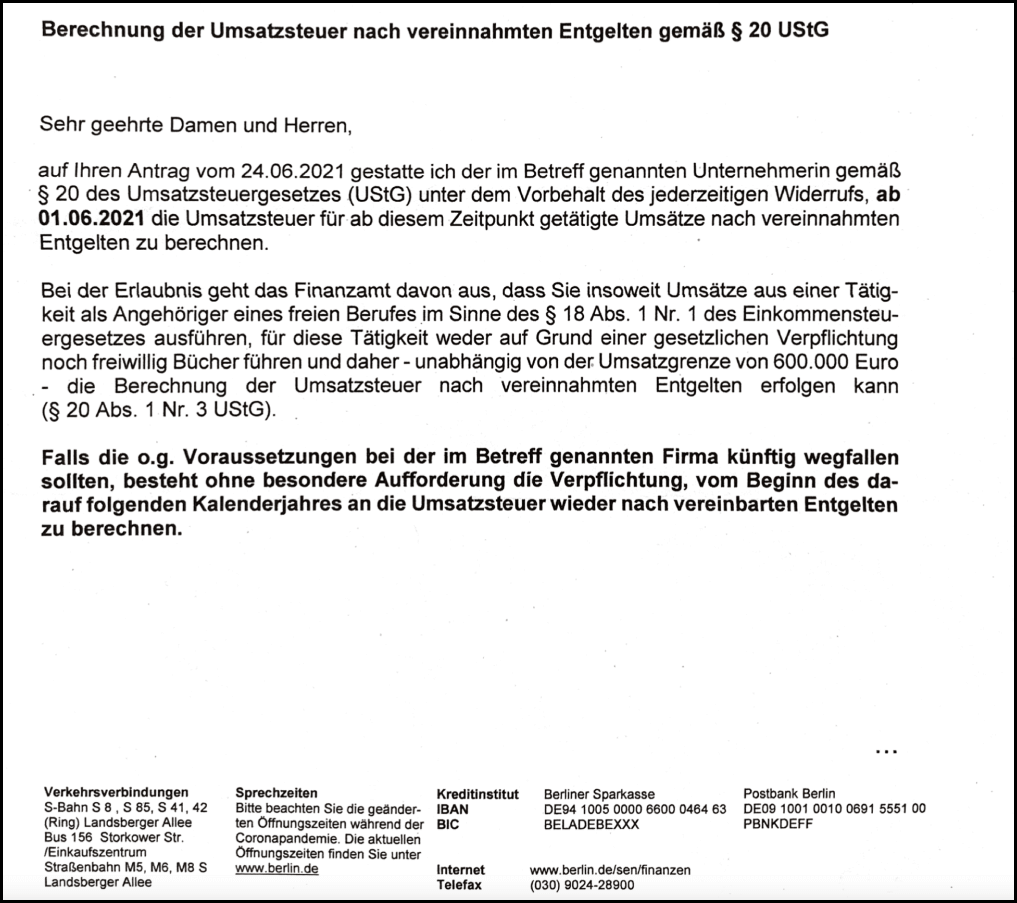

There are two ways to organise your accounting: By actual and debit taxation, or Ist- und Sollversteuerung in German. The Sollversteuerung (debit taxation) is “taxation according to agreed charges”, while Istversteuerung (actual taxation) is “taxation according to received charges.”

Or in more simple terms, if you choose to be taxed by debit taxation, you will have to pay VAT based on the issued invoice date. This of course means that if your client hasn’t paid the invoice yet, you still have to pay the VAT rate to the tax office.

The actual taxation however calculates your VAT charges based on the date your invoices have been paid.

Upon your freelance registration, you have to choose one of the two taxation types. Your choice will then be acknowledged by the tax office in a letter:

This letter includes a note about the respective deadlines for your choice of taxation (the letter above references actual taxation) as well as an explanation as to why this type of taxation is applicable to you.

➡️Find a more detailed translation of this letter here.

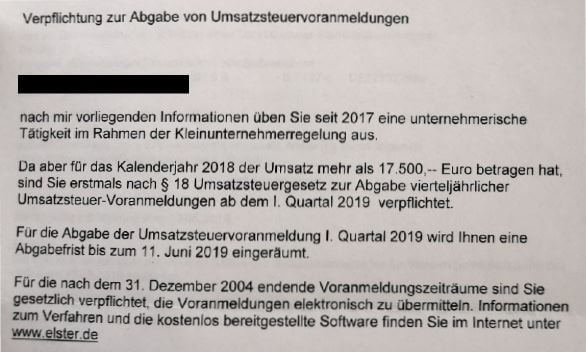

If you are registered as a small business owner, or Kleinunternehmer in German, you will be exempt from paying and charging VAT on your invoices. However, if you exceed the income threshold for small business owners, you automatically have to start charging and paying VAT - and you will also get a letter from the tax office informing you about your change of status.

➡️Don’t know anything about the small business owner rule? Find out more in this article.

Please note: Before 2020, the income threshold was 17,500€, as you can see mentioned in the letter above. As of 01/01/2021, this threshold has been increased to 22,000€.

In this letter, the tax office is noting that you have earned more than you are allowed under the Kleinunternehmerregelung (small business owner rule). This means you will automatically switch over to standard taxation, and will have to charge and pay VAT.

Depending on when you receive this letter, it is possible that you will have an extended deadline to issue your first VAT return.

Please note: Even if you get this letter some time during the year, you will have to pay VAT for the whole financial year. That’s why you should always monitor your income and start charging VAT as soon as you exceed the small business owner threshold.

💡An awesome way to track your income and your expenses is using the automatic photo recognition in our app. Simply upload a picture of your invoices, and Accountable will keep track of your income for you.

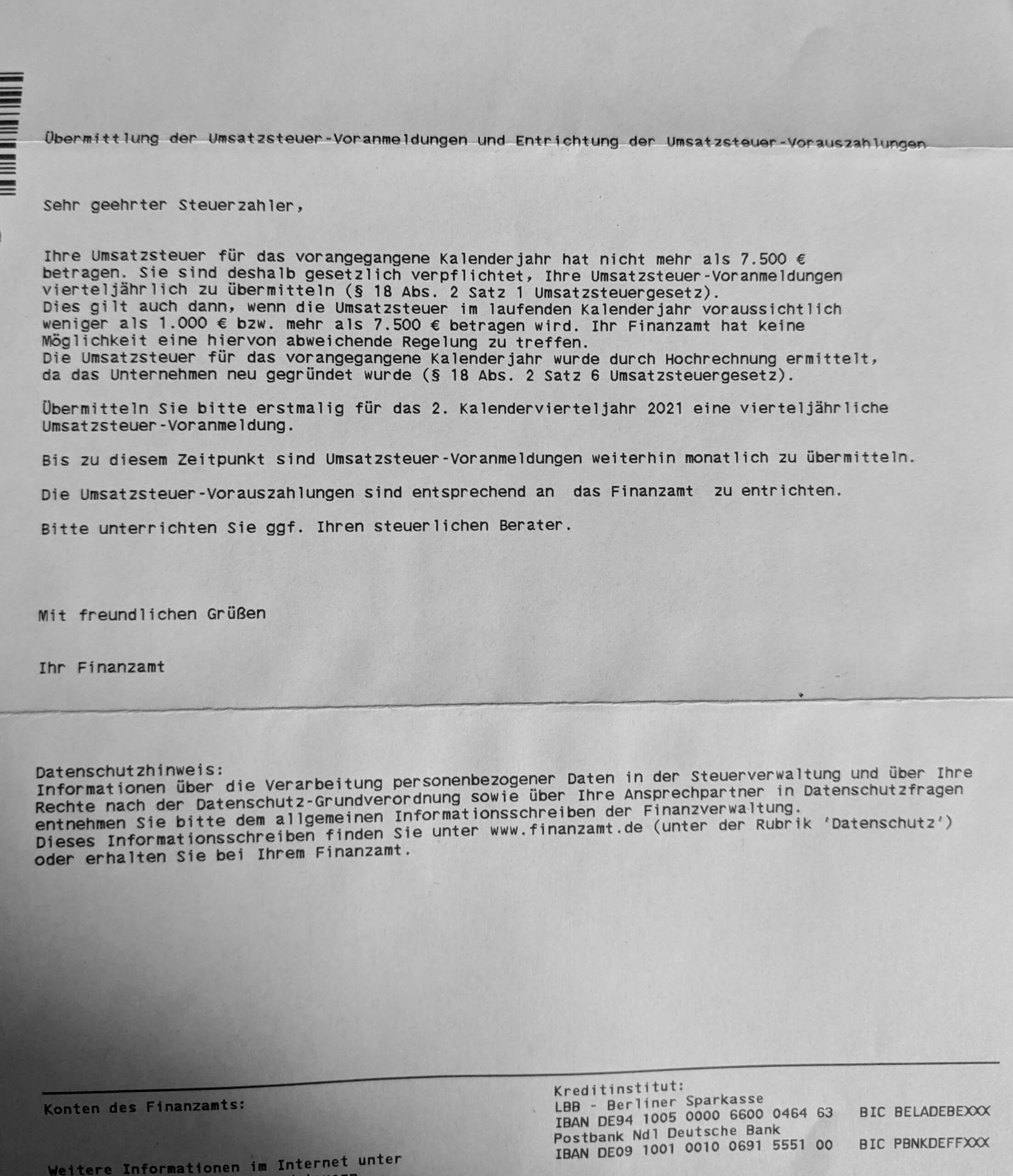

If your VAT from the previous year is exceeding a certain amount, you will receive a letter from the tax office. This letter will inform you about a change in deadline for when you have to submit your VAT returns.

➡️ You can find a more detailed explanation of this letter in this article.

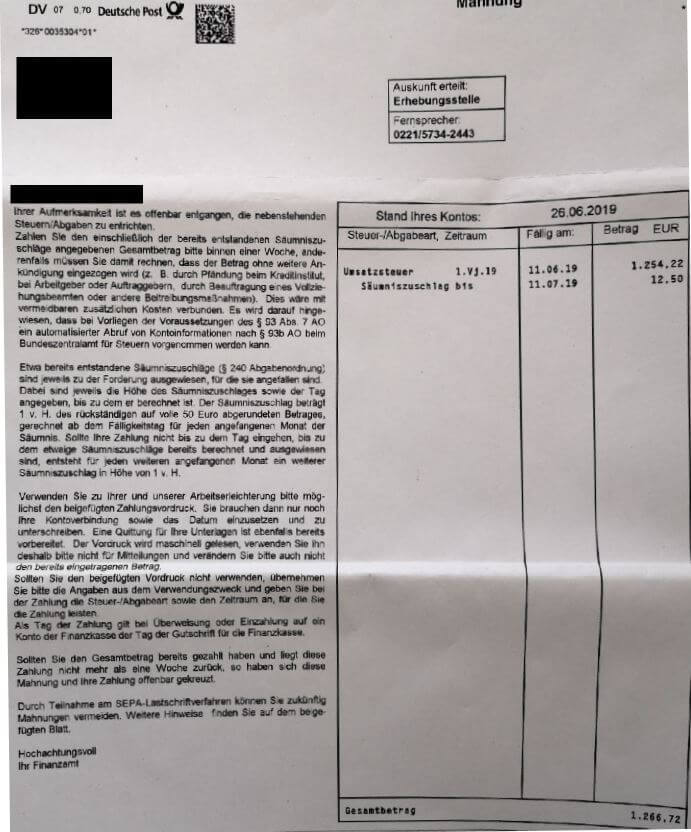

It is totally normal to forget a deadline or miss a payment once in a while. Usually, the tax office will remind you if they are missing certain documents or are waiting for open payments. But if you ignore these letters for too long, chances are you will receive a collection letter.

➡️Find out what happens if you miss a VAT deadline

In this example, the taxpayer forgot to pay VAT, which is why the tax office issued a 12.50€ fine. The fine now has to be paid on top of the required VAT.

If you don’t pay this amount by the set date, you will be issued with additional fines.

➡️Freelancing in Germany? Put these tax dates in your calendar!

Alright, now you know the most common letters from the tax office. So next time you see that familiar envelope, don’t panic and just refer back to this article.

And if you do receive a letter you don’t understand, or that maybe isn’t justified in your opinion, it can definitely pay off to get help from a tax expert or accountant.In addition to that, Accountable offers multiple options for accounting and bookkeeping, and also for quickly communicating with the tax office. You can register your new freelance business online via our website, and you can also track your income and expenses in our free app and automatically generate and submit your VAT returns.

20 Kapitel knallhart recherchiert und vom Steuerprofi geprüft

Kostenlos herunterladen

Author - Sophia Merzbach

Sophia has been a key member of the Accountable team for many years, bringing a unique blend of journalistic precision and in-depth tax expertise to her work.

Who is Sophia ?Thank you for your feedback!

Useful

How much income tax is deducted from your income is largely determined by your tax class. There are ...

Read moreWorking as a self-employed professional has many advantages: You are your own boss and you can choos...

Read moreWorking with international clients can be tricky, depending on where exactly they’re located, whet...

Read more