Fragebogen zur steuerlichen Erfassung – VAT calculation

Read in 3 minutes

“In total, will you pay VAT to the Finanzamt this year or receive a refund?” That’s a new question in the form to register your self-employment in Germany. But it’s a tricky one, especially if you are just starting your own business.

That’s why here we explain exactly what to do, so that you can register your self-employment correctly!

Become self-employed with the Fragebogen zur steuerlichen Erfassung – mandatory info

In order to become self-employed and apply for your Steuernummer (tax number), you must fill out the so called Fragebogen zur steuerlichen Erfassung (Tax Registration Questionnaire) online and send it to the Finanzamt (tax office).

Most of the required information, like personal details, are easy to provide. But there is a new mandatory information, which is a bit more complicated to answer:

It is about the question how high your VAT burden will be. What exactly is meant by this you will find out now.

Deadline for the advanced VAT (Umsatzsteuer-Voranmeldung)

Previously

If you are subject to VAT, you need to submit a regular VAT return. However, when you submit it, you cannot decide for yourself. There are certain requirements from the Finanzamt that determine the period. Previously, in the first and second year of your self-employment, you always had to submit the advance VAT return monthly.

➡️ This is the letter you’ll get from the Finanzamt about the VAT return period.

But in order to make the first year easier for people who are just starting their own business and already have enough administrative things to deal with, there had been a change to take away a bit of pressure and administrative work.

New deadline for the VAT return

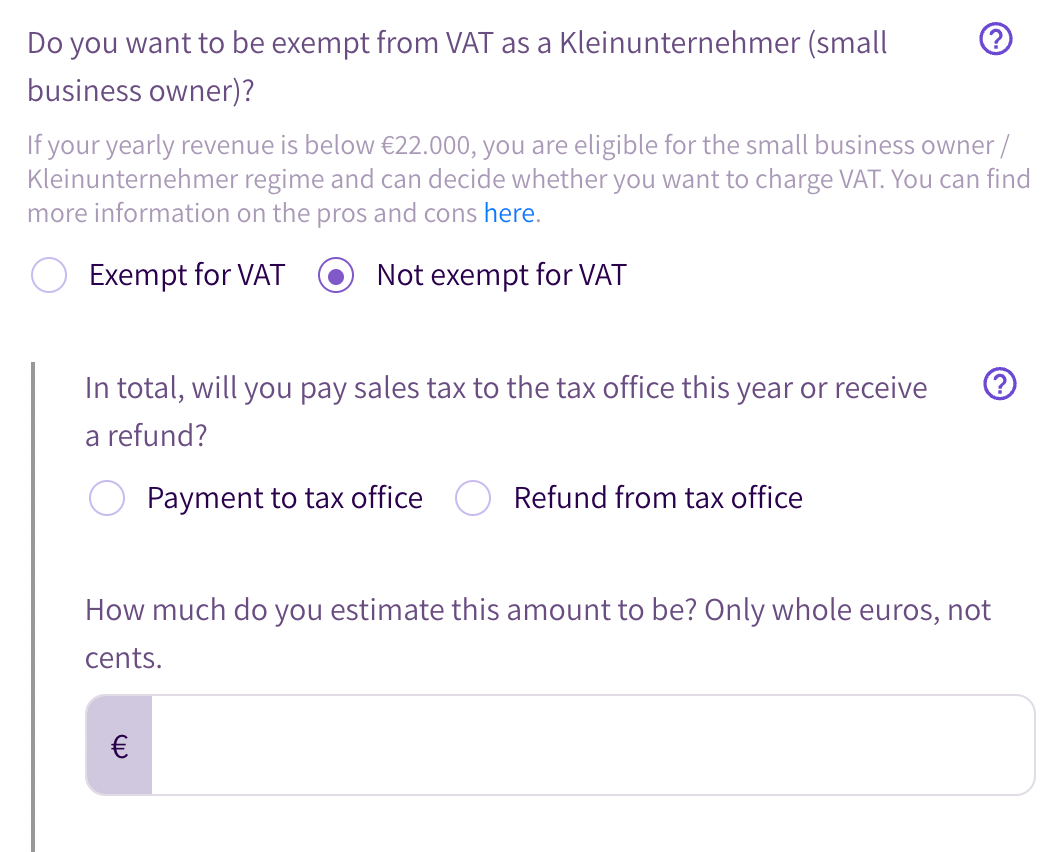

The general obligation to file your VAT monthly is no longer applicable. Instead, you may only have to submit the advance VAT return on a quarterly basis. The VAT return period now depends on the amount of VAT you will pay:

- If your VAT amount in the first year will be less than €7,500, you can generally file your VAT returns quarterly.

- Is your VAT in the first year more than 7.500€, you need to submit your VAT return monthly.

- Or will even be refunded more than €7,500 VAT by the Finanzamt in the first year? Then, you can submit a monthly advance VAT return.

💡 This is how the section in the Fragebogen zur steuerlichen Erfassung from Accountable looks like.

VAT burden (Umsatzsteuerzahllast) – how to estimate the VAT?

So now you know what the deadlines are and when they become relevant. But you’re probably wondering how you’re supposed to know how high your VAT payment burden will be in the first year of your self-employment. Don’t worry, for the time being the information must only be an approximate estimate. Of course, you can’t predict the exact amount.

Estimate income and expenses

To calculate your VAT amount, try to estimate how high your profit will be in the first year. For example, if you have already secured a loyal client base and orders for the next few months, but at the same time have few expenses? If so, your income will probably be higher than your expenses and you will pay VAT to the Finanzamt.

Or do you already know that in the first year you will first focus on expensive purchases and building up your workplace? In this case, you will probably have more expenses than income and receive a refund from the Finanzamt.

➡️ How you can calculate your profit, you can read here.

Calculating your VAT – the formula

To calculate as accurately as possible the amount you will either have to pay or be reimbursed, you can use this formula:

Amount of VAT payment in the year = (sales x VAT rate) – (VAT paid on business expenses)

Example

A graphic designer estimates that she will earn 36,000€ in the first year. On her invoices, she also indicates the 19% VAT. To start her professional work, she buys a new computer, a second monitor, and a professional graphics program. This is how she would have to calculate the amount:

(Sales: 36.000€ x 0,19) – (Paid VAT for business expenses: approx. 426€) = 6.414€

So the graphic designer assumes that she has to pay 6.414€ VAT to the Finanzamt and enters this amount in the field in the questionnaire.

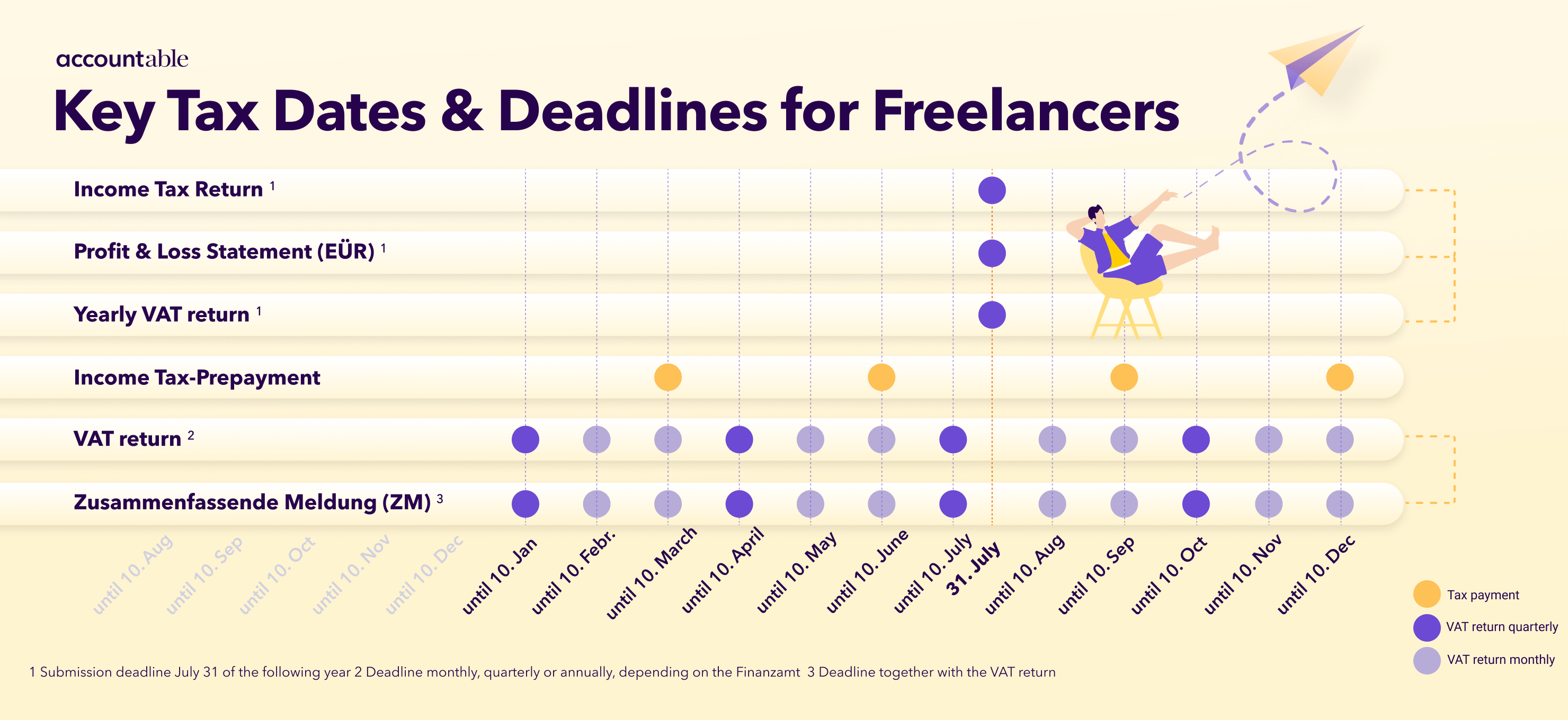

Never miss a tax deadline with the Accountable tax calendar

Did you find what you were looking for?

Happy to hear!

Stay in the know! Leave your email to get notified about updates and our latest tips for freelancers like you.

We’re sorry to hear that.

Can you specify why this article wasn’t helpful for you?

Thank you for your response. 💜

We value your feedback and will use it to optimise our content.