Fragebogen zur steuerlichen Erfassung: Calculate your profit as a freelancer

Read in 3 minutes

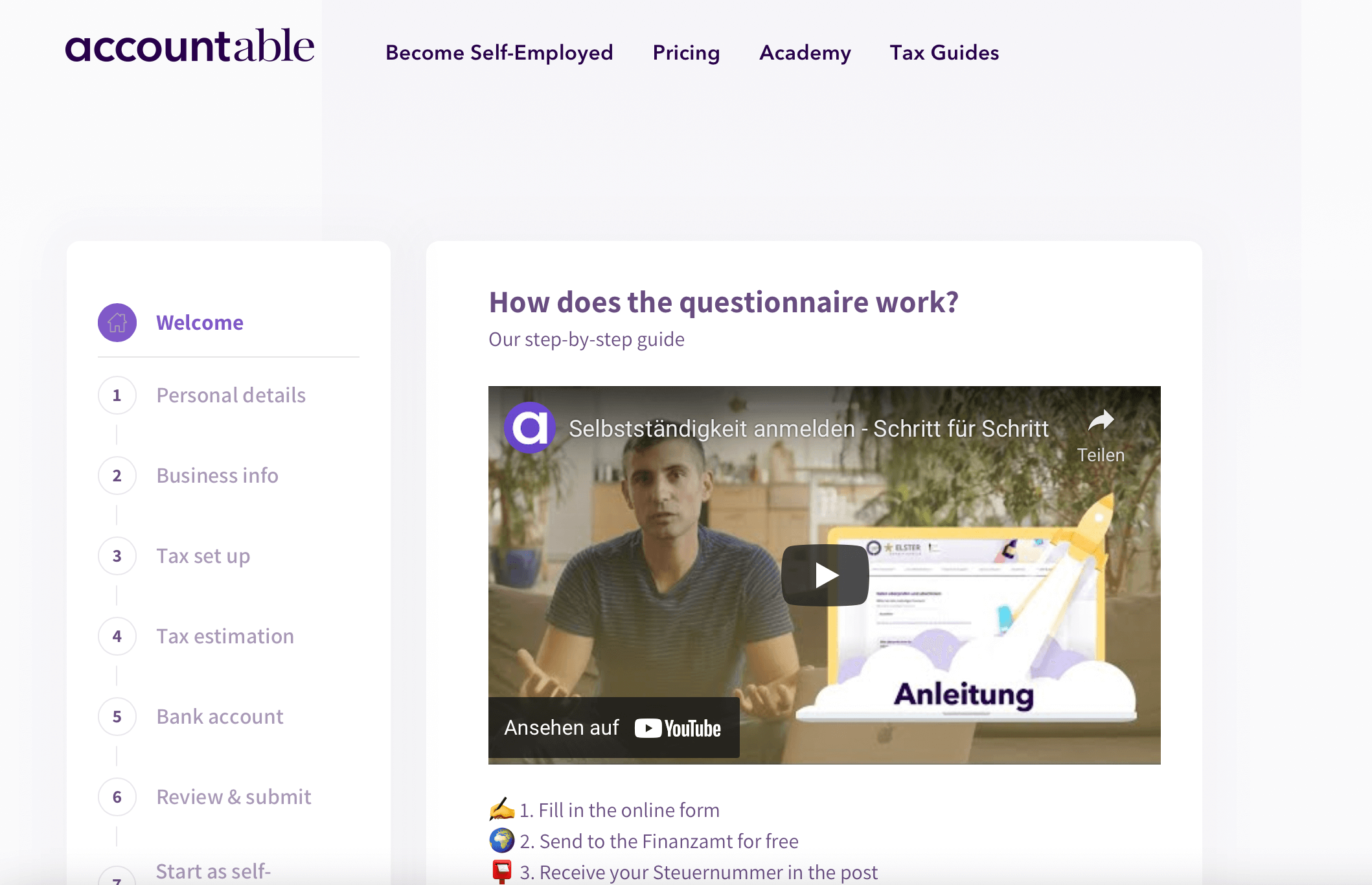

There is no way around the Fragebogen zur steuerlichen Erfassung (tax registration questionnaire) when you become self-employed. By filling out this form, you officially register your self-employment with the Finanzamt (tax office) and receive your Steuernummer (tax number), which you can use to issue invoices in the future.

In the Fragebogen you will be asked important questions about your planned self-employment, among others about the expected income and your expected profit. We will explain what information you need to fill in, what the difference is between expected income and expected profit, and how accurate this information should be.

Expected income from your self-employment: what is it exactly?

After you have had to enter your personal and business details in the first two steps of the Fragebogen, step three is about your tax data. Here you enter your Steuer ID and, if you already have one, your Steuernummer and indicate whether you want to use the simple profit calculation for self-employed persons (called Einnahmenüberschussrechnung).

Next up is your expected income from your self-employment. Here you will be asked about the start of your self-employed business and about your expected revenues for the current and the next year.

So, you have to estimate the income from your self-employed job. You need to make sure that you really state your turnover: that is, the sum of all your expected income from self-employment before deducting your costs.

In step three of the form, you can also specify whether you want to charge VAT on your invoices and have the option to make use of the Kleinunternehmerregelung (small business regulation). If you have clients not only in Germany but also in the EU, you can also apply for a VAT ID that you’ll need for invoices to clients in other EU countries.

What is the expected profit?

The next step is about your tax estimate. This estimate is the basis for the Finanzamt to calculate your quarterly advance payments for income tax and possible Gewerbesteuer (trade tax) if you registered a Gewerbe. It is therefore very important that you are as realistic as possible in your estimates, even if it is not easy to calculate it, especially at the beginning.

First of all, be aware that turnover is not the same as profit. So this is a different number than the one you gave in step three. While turnover represents all of your revenues or income, profit is calculated differently. Your profit is what you have left after deducting all costs, such as salary, office supplies, production or raw materials. This so-called net profit is the relevant amount for the calculation of your actual tax at the Finanzamt.

💡Tip from Accountable: It’s easy to fill out the free Fragebogen zur steuerlichen Erfassung online and digitally on the Accountable website.

What happens if I miscalculate?

The information you provide in the Fragebogen zur steuerlichen Erfassung has a great influence on your taxation. So your information should be as realistic as possible. But of course, we are all only human, so it can happen that you enter an incorrect amount or that your income and profits are significantly higher than you initially expected.

💡Tip from Accountable: When you become aware that you miscalculated, it’s always advisable to let your Finanzamt know, so they might adjust your prepayments.

Generally, it is advisable to remain conservative instead of predicting great success, especially at the beginning of your freelance career. Because the Finanzamt will calculate your expected tax liability on the basis of this information. So when you state high amounts, you may also have to make high advance tax payments. In the worst case, this may then be financially unsustainable for you and your liquidity may be jeopardized.

What happens when you state smaller amounts than you’ll actually make in profit? The worst thing that can happen is an higher payment at the end of the year. In such a case, the Finanzamt would also expect a higher advance payment from you for the next year. The amount of this advance payment depends on the amount of the additional payment and, if applicable, the expected profits of your self-employment.

Conclusion: Think well ahead and keep an eye on your finances

In summary, before you become self-employed, you should think about your income and profit and always keep an eye on your finances. Especially as a freelancer, you will always have to deal with taxes and should regularly set aside money so that an unexpected tax payment does not lead to your existence being at stake.

💡Tip from Accountable: With our app, you have have a real time overview of the amounts you need to set aside for taxes!

Become self-employed with the free Fragebogen zur steuerlichen Erfassung now!

Did you find what you were looking for?

Happy to hear!

Stay in the know! Leave your email to get notified about updates and our latest tips for freelancers like you.

We’re sorry to hear that.

Can you specify why this article wasn’t helpful for you?

Thank you for your response. 💜

We value your feedback and will use it to optimise our content.