You received a complicated letter written in German by the Finanzamt? No worries, after you registered as self-employed, you will get several letters, one of them is to inform you about the way you need to file VAT. In this article, we explain what information you can take from this letter step by step.

The letter you received tells you about your status concerning Istversteuerung and Sollversteuerung. You're wondering what the hell that means? It's actually not too complicated. The Sollversteuerung (debit taxation) is "taxation according to agreed charges", while Istversteuerung (actual taxation) is "taxation according to received charges."

In simplified terms, with Sollversteuerung the VAT you need to submit to the Finanzamt is already due when you issue an invoice. With Istversteuerung, the VAT is due when the money is received. The Istversteuerung is therefore more favorable for many freelancers, because you don't have to pay VAT before you get the money from your client. However, you must meet some rules, in order to be eligible for it.

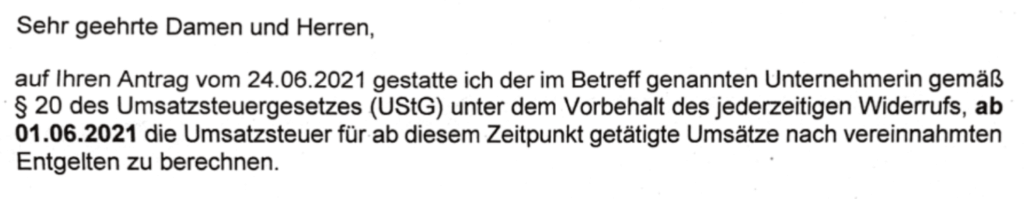

The first paragraph informs you in a typical long, German sentence, that you are allowed to make use of the Istversteuerung.

💡Tip from Accountable: You have troubles understanding the letter from the Finanzamt? Use our free AI tool to scan the letter and receive an instant summary and explanation of what you have to do! Test it now for free!

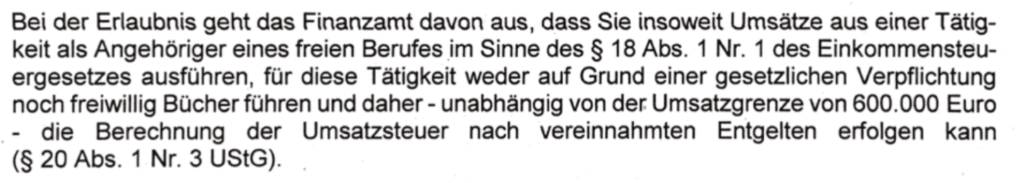

The next part explains why you are eligible for Istversteuerung, and don't need to do Sollversteuerung. Mainly, because for your freelance-work, you will use the profit & loss statement in order to compute your profit (and not double-entry bookkeeping) and you didn't make more than 600.000€ in the previous year.

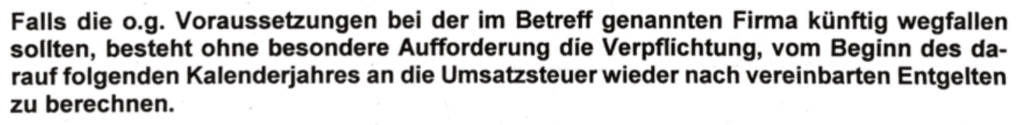

The last paragraph informs you that, should one of those rules not apply to you anymore, you need to switch to Sollversteuerung from the following year on, without any further notice.

You see, the letters that the Finanzamt sends you look kind of scary and complicated at first, but once you understand them, they hold a lot of important information about your start as a self-employed person.

Tip from Accountable💡: Accountable is a tax software and app that covers all your tax returns and bookkeeping obligations as a freelancer. Of course, we also support the Istversteuerung, so that you can submit your taxes stress-free to your Finanzamt. You can try it here for free!

20 Kapitel knallhart recherchiert und vom Steuerprofi geprüft

Kostenlos herunterladen

Author - Sophia Merzbach

Sophia has been a key member of the Accountable team for many years, bringing a unique blend of journalistic precision and in-depth tax expertise to her work.

Who is Sophia ?Thank you for your feedback!

Useful

How much income tax is deducted from your income is largely determined by your tax class. There are ...

Read moreWorking as a self-employed professional has many advantages: You are your own boss and you can choos...

Read moreWorking with international clients can be tricky, depending on where exactly they’re located, whet...

Read moreIch kann ohne Accountable nicht, auch sehr familiäre Unterstützung, tolle Erfahrung bis jetzt

Ayhan Kahraman

Der Austausch und die Hilfe ist SUPER.

Katja Schmidt

Accountable ist sehr einfach zu bedienen. Und macht Steuern für Solo selbständige so einfach wie nie zu vor.

Anonym

Accountble ist einfach zu bedienen und übersichtlich.

Regine Müller-Waldeck

Die Kommunikation war sehr gut und sehr genau. Im Fall wie es bei mir war hätte ich mich gefreut ein Telefonat zu führen. Es wäre auch sehr gut eine Telefonnummer zu haben wo man sich an einen Mitarbeiter wenden hätte können. Heute bekommt man sehr viele Spam Nachrichten die täuschend echt sind.

Peter Goerke

Ich bin schwer begeistert, die Platform ist wirklich ausgereift, man ist kein Versuchskaninchen, außerdem ist es trotz Digitalisierung sehr persönlich und direkt, ich fühle mich richtig aufgehoben und die Kundenservice ist unübertroffen, einziges Manko ist das ext. Steuerbüro Consentes, auf Fragen wird nicht oder spät geantwortet, verlangen jedoch einen horrenden Betrag nur um mit dem Finanzamt zu sprechen, da greife ich lieber selber zum Hörer, das soll das Erlebnis mit Accountable, aber in keinem Fall schmälern, endlich eine All-in-One Lösung, die hält was Sie verspricht!

Anonym

Bis jetzt alles Top, guter Sapport.

John Niehaus

sehr guter technischer support zum Abo. Steuerfragen hatte ich noch nicht.

Sergej Rothermel

Sehr guter Kundenservice, individuell und verständlich. Ausgezeichnete Fachkompetenz! Besser als jeder Steuerberater hier bei uns. Absolut empfehlenswert!

Birgit Kleinert

Zuerst einmal möchte ich mich ganz herzlich bedanken, für die intensive und professionelle Betreuung meiner Steuerangelegenheit. Bei wirklich all meinen Fragen und es waren nicht wenige, hat Daniela mir geholfen. Besonders hervorheben möchte ich, das man hier auf eine Frage die man bezüglich der Steuer stellt, nicht lange auf seine Antwort warten muss. Accountable, ein "Rund-um-Sorglos-Paket"! Vielen Dank Peter Albuscheit

Peter Albuscheit