Thinking about becoming Self-employed Part 1: Here is all you need to know before!

Read in 8 minutes

Self-employment is a very desirable career path—but it also comes with a lot of responsibility, and mistakes are easily made when you are not fully prepared for this new chapter of your life.

That is why we have compiled a complete starter guide for people who are thinking of becoming self-employed, including some helpful information around budgeting, finding a freelance job, and the most common mistakes to avoid.

Content

- What you should know before becoming a freelancer

- The pros and cons of being self-employed

- The costs to consider

- Finding a freelance job

- How to determine if you are a freelancer or a sole trader

- 5 common mistakes

What you should know before becoming a freelancer

Working for yourself means that you get to decide when, where, and how much you want to work. But there is a bit more to having your own business than choosing your hours and your place of work.

➡️ The ultimate guide on how to start freelancing in Germany as an expat

If you are self-employed, you need to show initiative in order to find paying clients, and have a sense of responsibility when it comes to organising your finances. In addition to that, you should brush up on your project management skills, to stay on top of your deadlines when juggling work for different clients.

It also can’t hurt to have at least a basic understanding of the German tax system, as paying and organising taxes is a huge part of every freelancer’s life. A great start would be to get familiar with some of the most common German tax terms, as well as the different tax numbers and their importance.

➡️ Here’s a glossary of all the words you need to know as a freelancer in Germany

Finally, you should do some research about how to draft an official invoice, so when you are actually getting started, you are already familiar with the specific rules and regulations around the invoicing process in Germany.

➡️ Here’s how to create the perfect invoice in Germany

The pros and cons of being self-employed

Just like everything in life, being self-employed also has a few pros and cons you should consider before diving head first into your freelance business.

The pros of being self-employed

One of the biggest advantages that comes with working for yourself is having the freedom to decide when and where you want to work and what projects you are focusing on. At the end of the day, you get to choose the clients you want to work with, as well as the type of work you are doing. On top of that, being your own boss comes with the perks of getting unlimited time off, as well as a free choice of work hours and location.

Another big pro of working for yourself is that there is absolutely no limit to your income. The more you work, – or the more you raise your rates – the more money you make. How good you are at your job therefore has a direct impact on your financial situation, which can be a big motivational factor.

Finally, in addition to sharpening your professional skills, you are also learning a bunch of soft skills that are beneficial for both your personal as well as your professional life. This includes a more structured way to work, active problem solving as well as a more mindful handling of your own resources and time. This can also have a positive impact on your confidence, which then in turn influences the quality and quantity of your work.

The cons of being self-employed

When you are self-employed, you are literally working for yourself. There is no team that can have your back and take over when you are feeling sick, and no one to outsource unwanted tasks to. Now, even if over time, you could put together a team and start outsourcing certain processes, you are still carrying a lot of responsibility on your shoulders, and you should mentally and physically prepare yourself to carry this burden.

Another potential negative of freelance work is that you don’t have a fixed income. This means that, especially in the early days, you are probably facing a lot of fluctuation in your bank account. It takes some time to build up a reliable client base, so make sure you are prepared for some of the lower income months by putting away some savings and budgeting accordingly.

Finally, not everyone is equipped to cope with irregular working hours and tight deadlines. If you are working on a bigger project, it is possible that you’ll have to cancel on plans with friends, or even reschedule a planned vacation. To avoid a potential burnout, you should have some boundaries in place as well as some strategies for how to cope with a rising workload.

These are the costs to consider

One of the biggest aspects to take into consideration before you become a freelancer is how much money you will have to pay. This mainly relates to payments that fall into one of the following categories:

- taxes

- insurances

- retirement money

- business bank account

- work equipment

Taxes for freelancers

If you are working and living in Germany, you have to pay taxes. How much you will have to pay is calculated based on your taxable income in your annual income tax declaration. Now, while employed workers don’t have to worry about putting money aside for taxes, freelancers have to calculate their tax burden on their own, given that they legally are their own employer.

💡Tip from Accountable: A reliable method to calculate your income tax burden is using the official income tax calculator by the federal ministry of finances. Start calculating now!

Another tax to consider is VAT, or Umsatzsteuer in German. Freelancers generally have to include VAT on their invoices, and declare the amount of withheld tax to the tax office in their VAT returns, or Umsatzsteuervoranmeldung.

➡️ Here’s how to file your German VAT return

However, there is a way to avoid having to charge VAT completely: The small business owner rule, or Kleinunternehmerregelung. This can make your life a lot easier, especially when you just got started working as a freelancer.

➡️ Here’s everything you need to know about the small business rule

And if you are considered to be a sole trader, you will also have to pay trade tax.

➡️ Here’s a complete guide on how much money you should set aside for taxes as a self-employed person

Insurances for freelancers

An extremely important factor when setting up your freelance business in Germany is making sure you have the insurances in places that are right for you.

There are many different insurances to consider depending on the type of work you do, how much money you are making, and how risk taking you are. Generally speaking, you should look into the following basic insurances as a freelancer:

- health insurance

- pension insurance

- liability insurance

- disability insurance

➡️ Here’s a full guide to insurance for freelancers in Germany

Retirement plans for freelancers

Another aspect you should familiarise yourself with is pension insurance for freelancers, as you are not automatically paying into a retirement scheme unless you are employed.

You rather have to actively seek out a plan that works for you, either with the German pension insurance or with a private pension provider.

➡️ Here’s how German pension insurance works and how it’s relevant to freelancers

Business bank account for freelancers

You are free to choose if you want to open a business bank account for your freelance business, or use your personal bank account for business transactions. However, many German banks actually have a clause in their terms of use that won’t allow the use of a private bank account for business related transactions.

Coupled with the confusion mixing your personal and professional expenses can cause, setting up a separate bank account will definitely be worthwhile.

➡️ Here’s all the reasons why you need a separate banking account as freelancer

Work equipment for freelancers

Depending on your specific job, you will probably need to buy some equipment before you are getting started. This usually is at least a laptop, or a stationary computer, as well as a work phone or some office furniture such as a proper desk and a proper chair.

If you need an office space to facilitate your business, or may even need to buy additional gadgets or machinery, you should definitely allow some breathing space in your budget for those expenses.

Finding a freelance job

There are many different ways to start freelance work. But even if you already know what services or product you want to offer as your freelance business, you should take some time and answer the following questions:

- What would I like to do?

- Which skills do I already have?

- Which new skills can I learn?

You then have to decide whether you want to start working full time straight away, or if you’d prefer a smoother transition and start out with a part time freelance commitment.

➡️ These 7 jobs are perfect for a side gig!

Alternatively, you can also sign up for freelancer platforms such as Upwork or Freelancer, and start advertising your services on there. That is an easy way to get your foot in the door and kickstart your freelance career.

➡️ Invoicing your clients on Upwork: This is how it works

How to determine if you are a freelancer or a sole trader

In Germany, becoming self-employed isn’t just about having a great idea for your new business, or paying your taxes on time. It’s also about getting properly registered. And for that, you need to know if you are classified as a freelancer (Freiberufler) or a sole trader (Gewerbetreibender). This categorisation ultimately determines which taxes you will have to pay, as a freelancer won’t have to worry about trade tax.

But you can’t choose if you are a freelancer or a sole trader, it is rather predetermined by the type of work you do.

Freelancers usually are…

… scientists

… artists

… authors

… teachers

… educators

Whereas typical trades include…

… craft and industrial enterprises,

… commercial enterprises,

… and the activity of intermediary or restaurant business

➡️ Still not sure which category you fall in? This article might help.

Becoming self-employed: Here are 5 common mistakes

All the motivation and drive in the world won’t stop you from making mistakes.

You are not saving enough money for tax

One of the most common mistakes is not putting enough money aside to cover your income tax burden. This is usually due to a fluctuating income, and the lack of adapting your overall tax burden on a month to month basis, based on your income.

💡Tip from Accountable: Apps like Accountable can help you get a better understanding of your actual income, by giving you a clear overview of your earnings and spendings. You can then use your current income to calculate your tax burden and adjust how much money you set aside to pay your taxes.

You don’t have a retirement plan in place

Young people often forget how important it is to prepare for retirement, as this seems literally a lifetime away. However, you are missing out on valuable income when you don’t take care of your retirement plan, so be sure to start exploring your options sooner rather than later.

You are not claiming your business expenses

There are many ways to save taxes, and one of them is by claiming your business expenses in order to lower your tax burden. However, many freelancers are not fully using this opportunity to save, simply for the fact that they are unaware which expenses they can deduct.

💡Tip from Accountable: We have developed an easy tool to help you figure out which business expenses you can claim on tax. Head on over to our calculator and start saving taxes now!

You are missing receipts for business expenses

Did you know that the tax office can ask for receipts from claimed business expenses up to 10 years after the fact? And if you can’t present them with proof, you may be facing serious consequences. That’s why you should make sure to always keep all the receipts for your professional expenses.

💡Tip from Accountable: Why not use the integrated photo recognition of our app to store your receipts digitally? This not only saves you from keeping physical copies in your office, but also makes searching for an expense a lot easier.

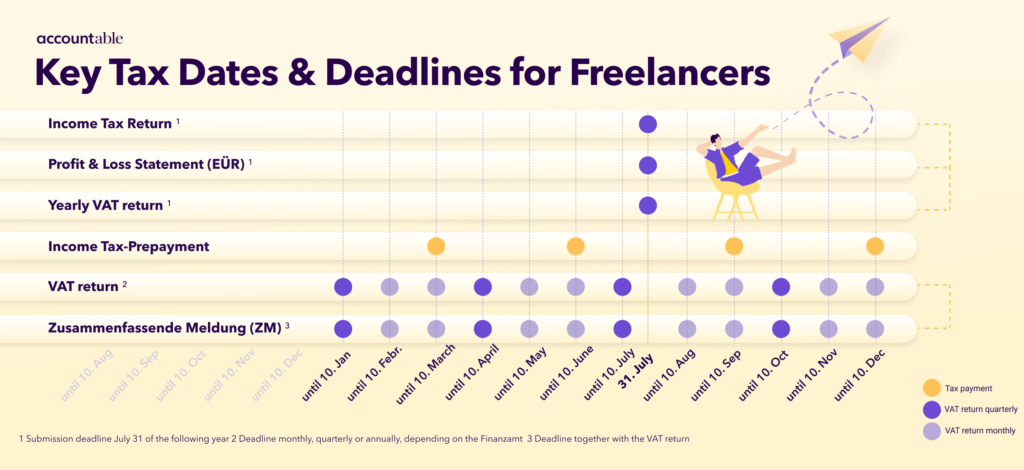

You don’t know the most common tax deadlines

Missing a tax deadline can have serious financial implications for you. That’s why you should be aware of some of the most common tax deadlines there are for freelancers, starting with the actual German financial year (January to December), and including the dates when your income tax return or your VAT returns are due.

➡️ Explaining the most common letters you’ll get from the German tax office

Are you ready to become self-employed? Register as a freelancer now and pave the way to your new professional future. Register your business here!

Did you find what you were looking for?

Happy to hear!

Stay in the know! Leave your email to get notified about updates and our latest tips for freelancers like you.

We’re sorry to hear that.

Can you specify why this article wasn’t helpful for you?

Thank you for your response. 💜

We value your feedback and will use it to optimise our content.