You are registered as a Kleinunternehmer (small business owner) but your business is doing very well and you exceed the turnover limit of €25.000? First of all, this is very good news, congrats! But what do you actually have to do in this case? We explain how the change from Kleinunternehmer to standard taxation works.

You can register as a Kleinunternehmer if you don't make more than €25,000 in revenue in the first year of your self-employment and also don't exceed €100,000 in the following year.

💡Since January 1, 2025, new rules apply to Kleinunternehmer (small businesses) in Germany, especially regarding revenue limits. Here’s a simple overview:

The revenue limits:

Other important changes:

So what to do now if, for example, you receive more orders than expected and exceed this turnover limit? If this happens in the first year of your self-employment, you'll retain your status as a Kleinunternehmer for the rest of the year. From the second year onwards, however, you will have to switch to standard taxation. This means you are subject to VAT and need to charge and pay VAT.

Important💡: It's crucial to know that you must keep an eye on your finances yourself. The Finanzamt (tax office) will not notify you if you exceed the Kleinunternehmer limit. So, if you notice that your turnover is approaching €25,000, it is important to keep a close eye on it. If you then happen to exceed the limit, you are subject to VAT in the following year.

The Finanzamt will then automatically expect you to charge VAT. So be careful, because even if you didn't realize that you exceeded the limit, the Finanzamt will demand the VAT payments. So in the worst case it's possible that the Finanzamt will demand high additional payments from you if you don't notice in time that you are subject to VAT and don't start charging VAT on your invoices.

Tip from Accountable💡: With tax software like Accountable, you get notified automatically when you get close to the threshold. Test Accountable now. Plus, when you connect your bank to the app, you'll always know how much you should set aside for your taxes and how much money you'll have after paying taxes.

➡️ Find out everything about why you need a business bank account.

Do you want to register as self-employed? Fill in the official Fragebogen zur steuerlichen Erfassung for free and submit it directly to the Finanzamt

Go to the form

It can also make sense to waive the Kleinunternehmer rule, even though your turnover is below €25,000. For example, if many of your clients are located abroad or you have high business expenses at the beginning.

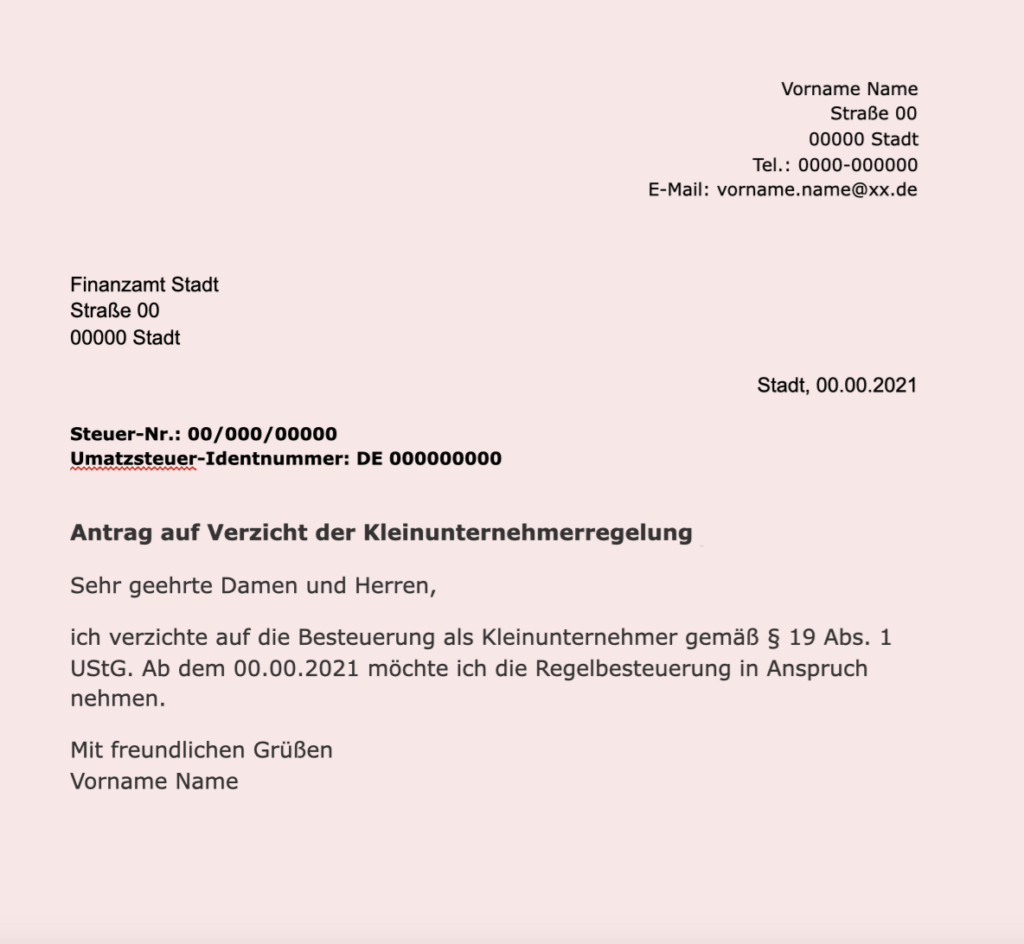

You don't even have to prepare a specific application for this. As soon as you submit a VAT return and pay it to the Finanzamt, it already counts as an official waiver of the Kleinunternehmer rule. However, this waiver binds you for five years. During this time, you cannot return to the Kleinunternehmer rule, even if your turnover remains below the limit. Also, note that a change is always possible only with the new year. You cannot change the status during the year.

If you already know that you'll be subject to VAT in the next year, you only need to start charging VAT in the new year. Your revenue in the current year is still without VAT. This even applies to invoices that are not paid until the new year.

Generally, it's possible to switch between the Kleinunternehmer rule and the standard taxation, you don't have to stay in one of the regulations forever. However, don't forget the regulations such as the above-mentioned five years when waiving the Kleinunternehmer rule.

Tip from Accountable💡: You suddenly become subject to VAT and don't know how to do your advance VAT return? Don't panic, Accountable will help you prepare. You can also submit it directly through the app!

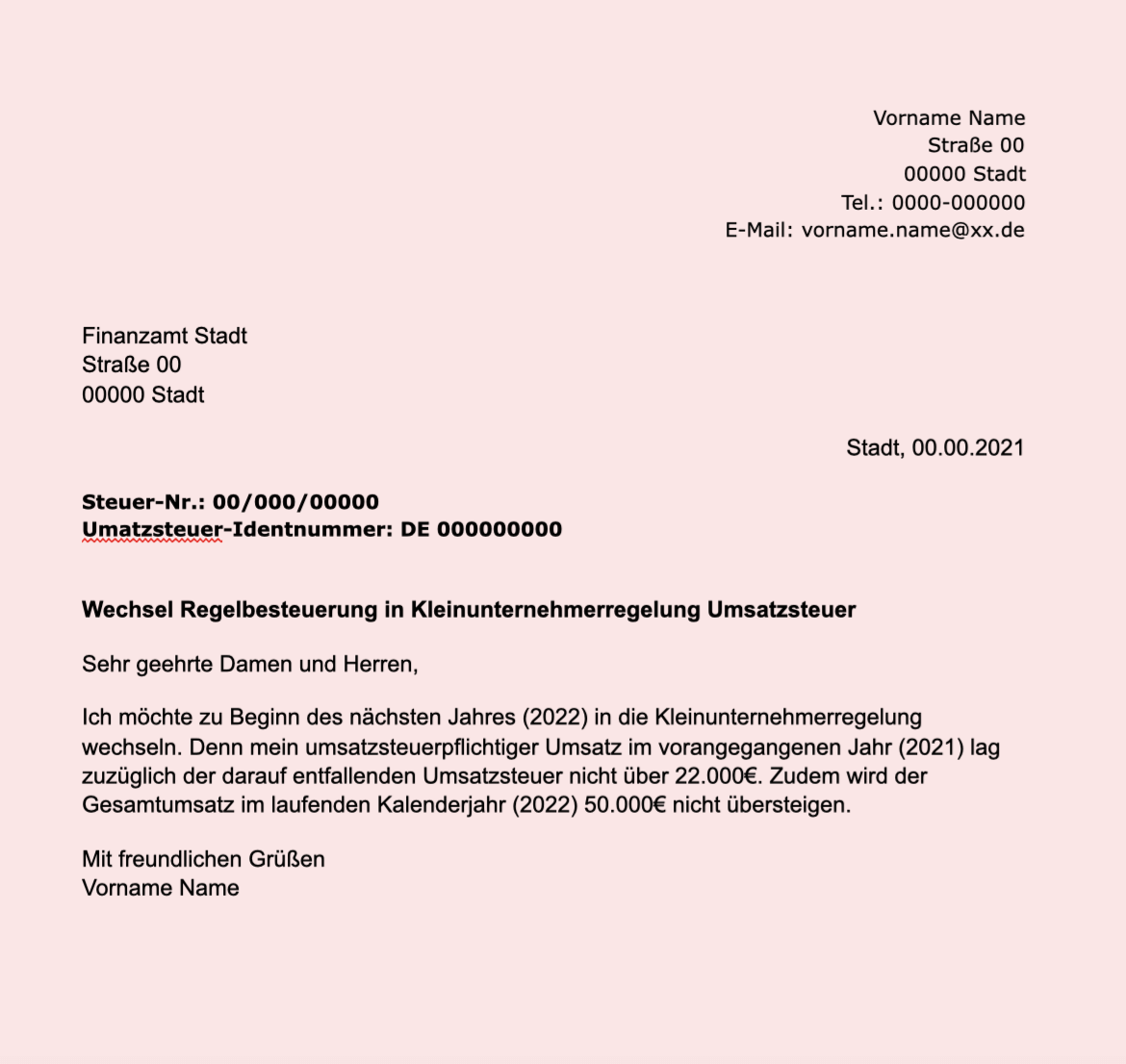

To change back to being a Kleinunternehmer, simply send an informal letter to your Finanzamt. From the next calendar year on, you don't have to charge VAT. Of course, this only applies if you then make less than €25,000 in revenue. You can also inform your Finanzamt with a letter that you waive the Kleinunternehmer rule. You can use these informal templates as a sample letter to inform your Finanzamt of the change.

20 Kapitel knallhart recherchiert und vom Steuerprofi geprüft

Kostenlos herunterladen

Author - Sophia Merzbach

Sophia has been a key member of the Accountable team for many years, bringing a unique blend of journalistic precision and in-depth tax expertise to her work.

Who is Sophia ?Thank you for your feedback!

Useful

How much income tax is deducted from your income is largely determined by your tax class. There are ...

Read moreWorking as a self-employed professional has many advantages: You are your own boss and you can choos...

Read moreWorking with international clients can be tricky, depending on where exactly they’re located, whet...

Read moreMir wurde sehr schnell und kompetent geholfen. Der Kontakt war super freundlich und zuvorkommend! Auch für eine weitere Rückfrage wurde sich mit viel Geduld die Zeit genommen, um mir den Sachverhalt detailliert zu erklären.

Christine Höhne

Die Erklärungen waren total plausibel und ich habe mich über die zeitnahe Antwort gefreut.

Lina Gertzmann

Ich bin immer sehr zufrieden mit euren Antworten, die auch immer innerhalb von 24 Stunden erfolgen.

Sandy Kratochwil

Der Umgangston ist super freundlich! Die Antworten kommen immer schnell und sind qualitativ echt gut und verständlich!

Benedikt Schönauer

Meine Erfahrungen mit Accountable sind bisher nur Positiv. Ich als Kleinunternehmer habe jetzt alles in einer App und es ist super easy zu handhaben. Meine Buchhaltung war noch nie so leicht. Ein mega Pluspunkt ist noch, dass man ein Kostenloses Geschäftskonto einrichten kann, welches direkt mit allen Buchhaltungsfunktionen verknüpft ist.

"Tim Friedrichs"

Mit Accountable habe ich meine Buchhaltung im Griff, kann easy meine Umsatzsteuervorauszahlungen einreichen und Rechnungen stellen. Die Steuer-Coaches helfen mir immer schnell, wenn ich mal eine Frage habe. Durch Accountable komme ich bisher locker ohne Steuerberater:in aus. Und wenn ich doch mal Bedarf habe, kann ich mir über Accountable ein/e Expert/in buchen. Alles in allem eine runde Sache. Ich habe Accountable schon oft weiterempfohlen. (Und ganz ehrlich, das Logo von Accountable ist ja wohl sowas von nice.)

Ute Mayer-Dohmen

immer bemüht alle Fragen und Probleme schnell zu klären.

Halil Ibrahim Baran

Arbeiten mit Accountable ist für mich sehr hilfreich und meinen Anliegen werden schnell bearbeitet. Eine der besten Entscheidungen die ich dieses Jahr getroffen haben.

"Hardy Thiele"

konkrete Antworten auf Fragen, gute Vorbereitung und Kommunikation untereinander, sehr gut!

Nils Ohlsen

Hallo Simon, bin Dankbar das ich Accountable benutzen darf. Ich brauche aber Bitte eine Antwort auf mein Anfragen ùber die Steuercoaches, dies dauert zu Lange gerade while ich dann warte sehr Lange auf eine Antwort obwohl ich in den Promax Version bin. Bitte daher um einen Antwort auf mein Anliegen gerade geht es um die EKSteurerklarung von 2024. Danke und einen schønen Tag noch. Freundlichen Grùssen aus Lùbeck, Stuart Brown

Stuart Brown