Register as self-employed in Germany: Fill in the Fragebogen zur steuerlichen Erfassung online

Read in 4 minutes

Want to become a freelancer in Germany or start your own business? Fortunately, this is becoming easier and easier in today’s digital world. One of the first steps along the way is tax registration. Everyone who becomes self-employed in Germany must complete the so-called Fragebogen zur steuerlichen Erfassung online. In this article, we will show you how to complete the Fragebogen zur steuerlichen Erfassung online with Accountable.

What is the Fragebogen zur steuerlichen Erfassung?

Registering with the Finanzamt (tax office) is one of the first things you have to do as a self-employed person. To do this, you need to fill out the so-called Fragebogen zur steuerlichen Erfassung. With this, you inform the Finanzamt about your self-employed activity and receive a Steuernummer (tax number), which you need to be able to issue legally correct invoices.

Before you register, you should already know whether you will be working as a Freiberufler (freelancer) or as a Gewerbetreibender (trade person). If you are a Freiberufler, you only have to complete the Fragebogen zur steuerlichen Erfassung in order to register your self-employment with the Finanzamt. If you are a Gewerbe, you have one more step to take. To register a Gewerbe, you must also apply for a Gewerbeschein (trade license) from your local Gewerbeamt (trade office).

💡Tip from Accountable: It’s totally normal when you’re not sure whether your profession is defined as Feiberufler or Gewerbe, since the differentiation is not always clear. So we have compiled the most important differences for you here!

Apply for a tax number with Accountable

You can find the Fragebogen zur steuerlichen Erfassung online on several platforms. For example, you can fill it out directly on the ELSTER website. Although ELSTER is the official portal of the Finanzamt, the form is written in typical German ‘tax language’ and is not always easy to understand. But we want to make registering your self-employment as easy as possible for you and therefore also offer the official form free of charge on our website.

You can apply for your tax number directly using our Fragebogen zur steuerlichen Erfassung. We offer secure transmission via our ELSTER interface and registration and transmission are free of charge. We have also added short helper texts for difficult questions to make it easier for you to complete the form. In addition, if you have any questions, our tax coaches can also help you via chat!

Step by step registration with Accountable

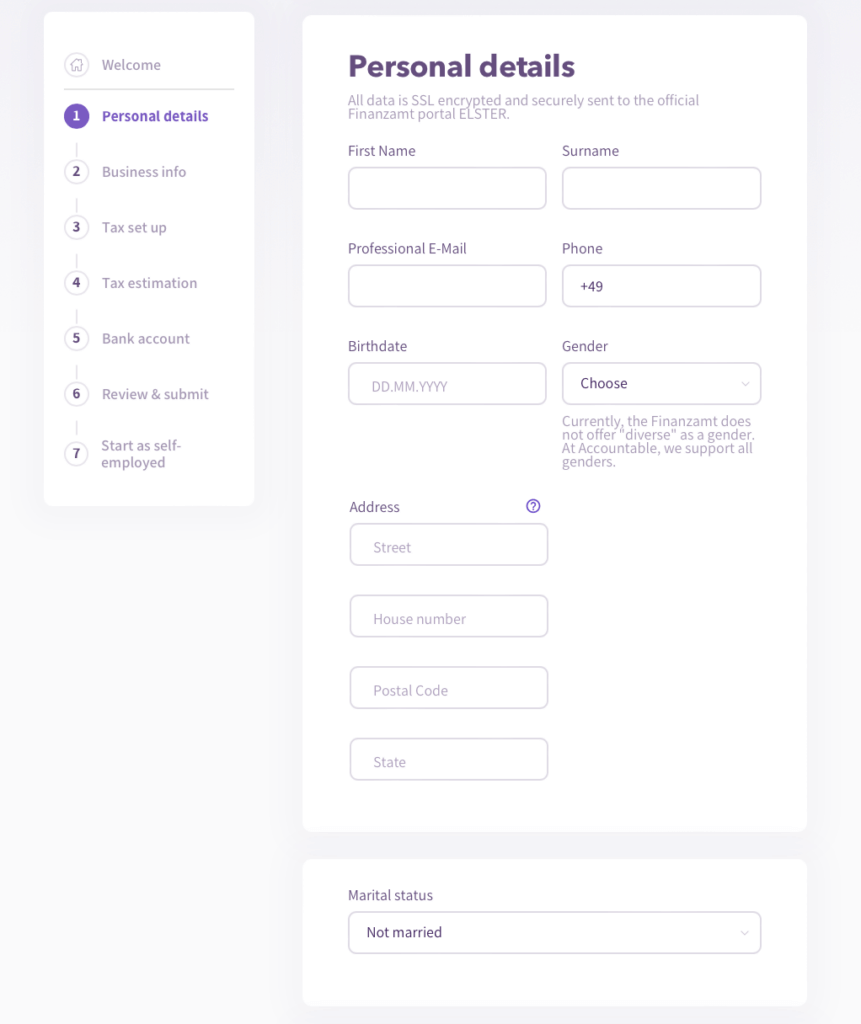

Let’s go through the registration process together step by step using our form. The form consists of five parts: Your personal details, your business details, your tax details, your tax estimate and your bank account.

Step 1: Your personal details

The first page is about entering your personal data. The screenshot below show you what you need to enter and where. Next to the simple contact details you also need to state whether you are married and your religious affiliation.

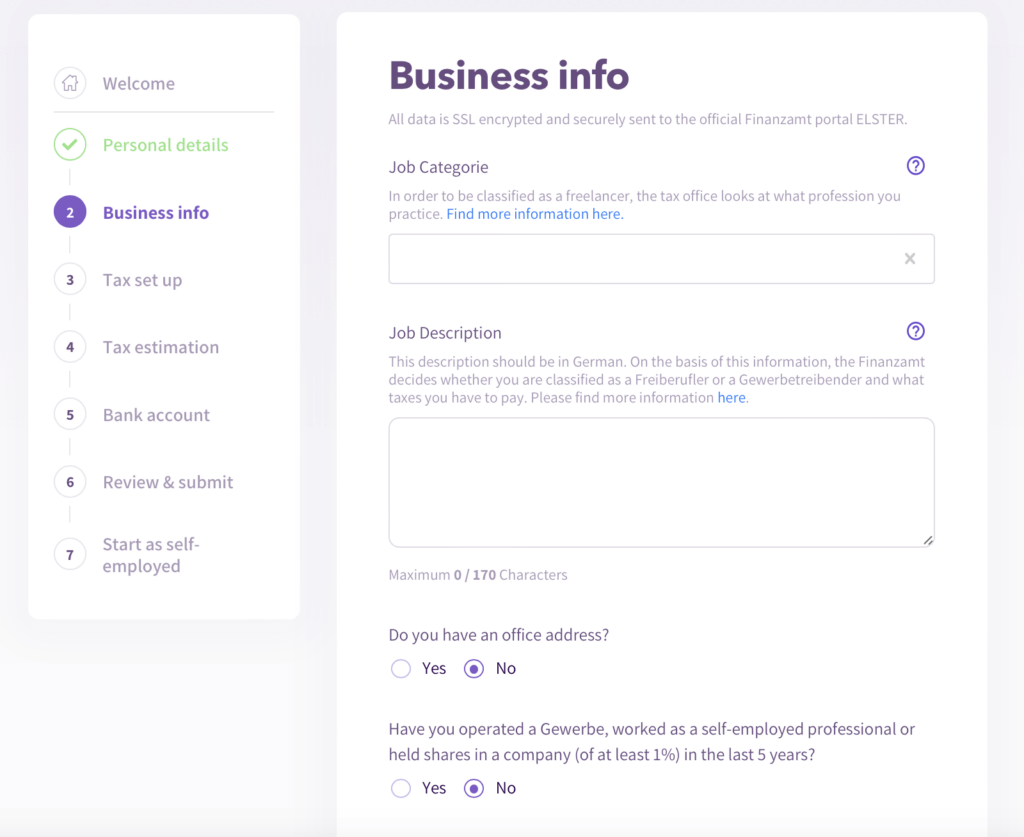

Step 2: Your business details

This is where you provide information about your planned self-employed activity. You should be specific when describing your profession, as this will be used to classify your activity as Freiberufler (freelance) or Gewerbe (trade) self-employment.

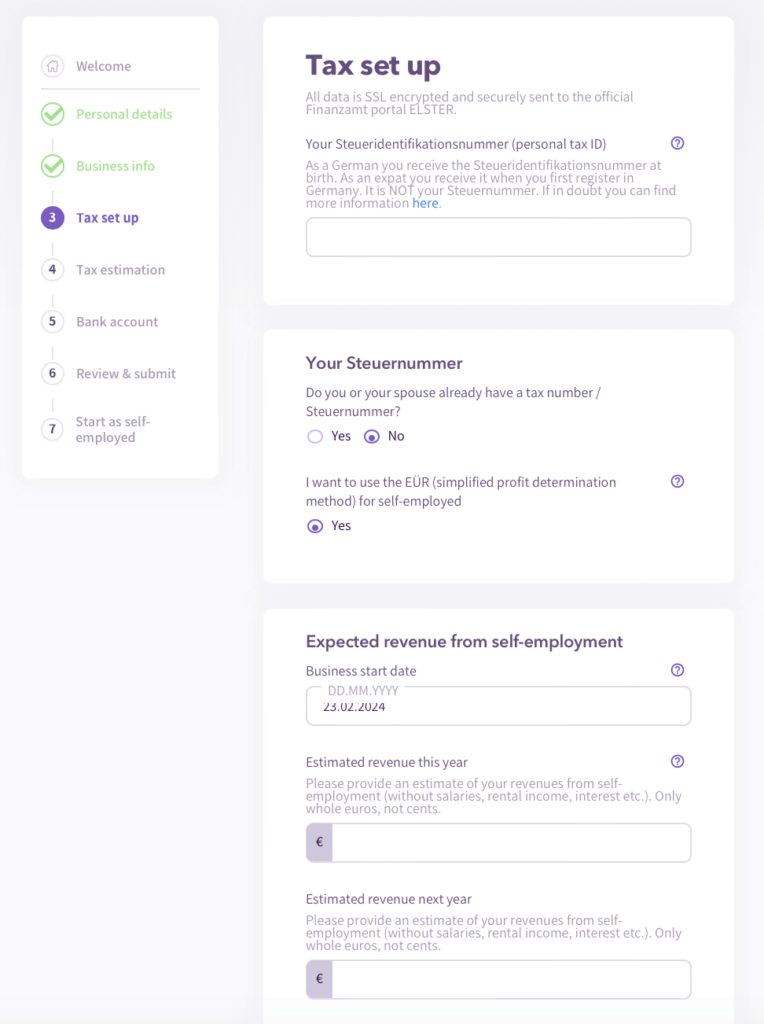

Step 3: Your tax details

This step it’s all about your tax details. Don’t worry, we provided helper texts, so you can be sure you enter the correct details. Just make sure you have your Steuer ID and your Steuernummer at hand, in case you already have one.

What can seem difficult is the next step: Stating your projected revenue. It is fine to give an estimation here. On this page, you also need to decide if you want to make use of the Kleinunternehmer regulation. You can do so if you will earn less than 22.000€ in the first year. More about this here.

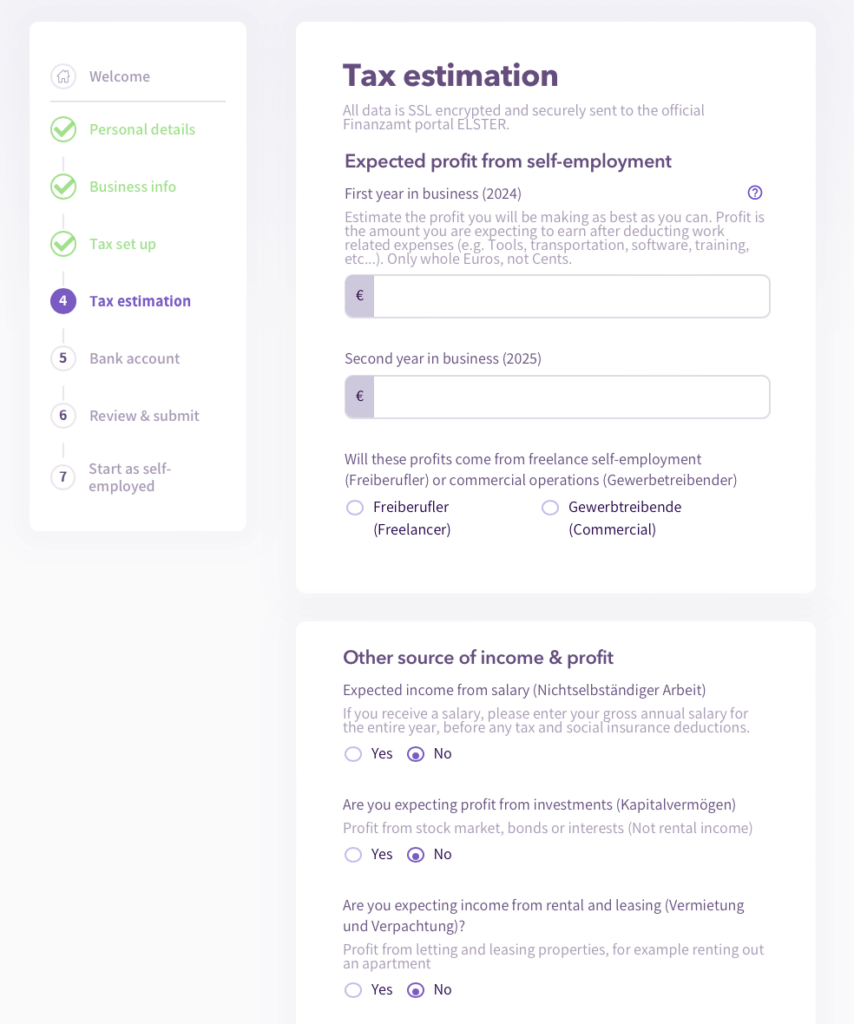

Step 4: Your tax estimate

The next step is still about your taxes. While you had to estimate your revenue in the previous step, now you need to estimate your profit. The profit is the amount you are expecting to earn after deducting all your work-related expenses. Next up you can state other sources of income you might have, for example when you’re also working as an employee.

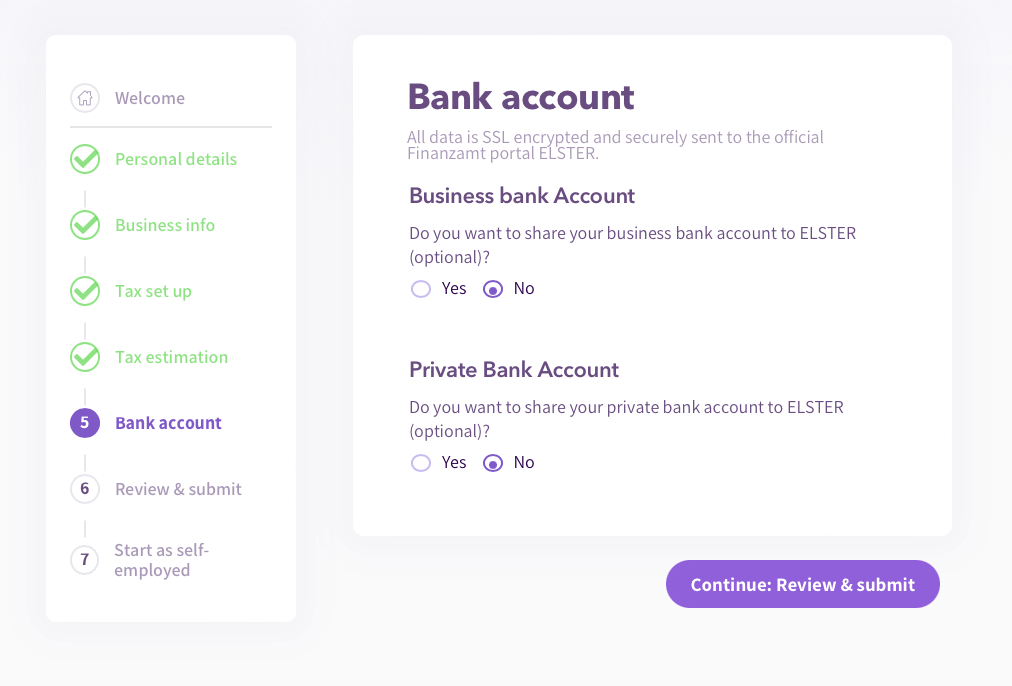

Step 5: Your bank account

Almost done! Now you can share your bank details with your Finanzamt, so tax payments will be automated and easier in the future. But you can also leave this for later.

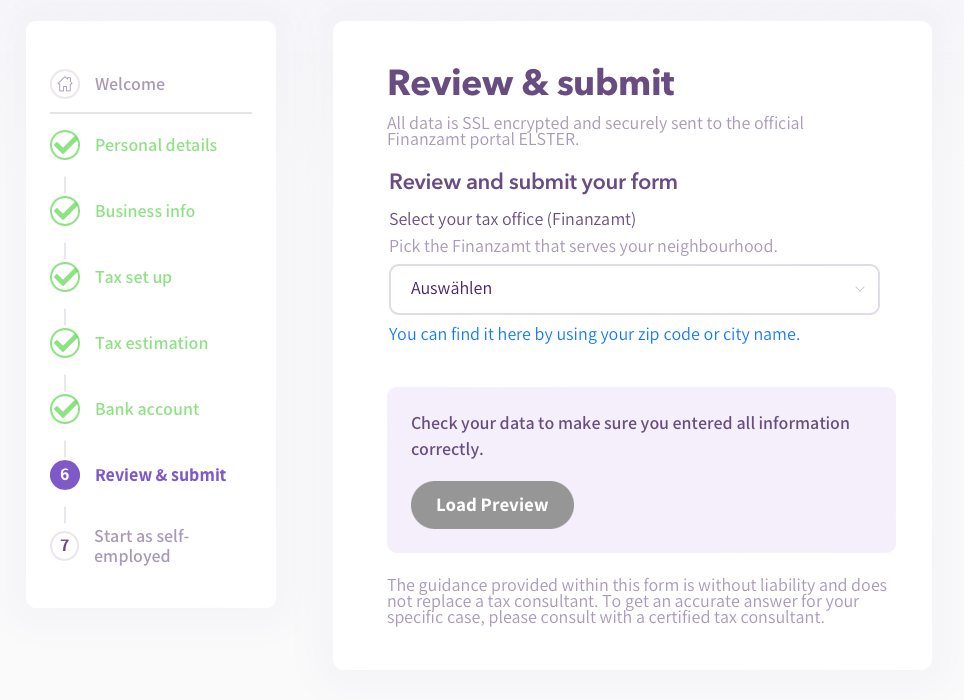

Done! In the last step you will be able to select your Finanzamt and to check your data one more time before submitting the form directly via ELSTER to your Finanzamt.

Then you have to wait for the letter with your Steuernummer and some more info about your status as a self-employed professional. The time it takes to process your application can vary greatly, depending on your Finanazmt. Usually, it takes between 2 and 4 weeks.

➡️ This is how the letter looks like!

💡If you are looking for an English language software for your bookkeeping and your tax obligations as a self-employed professional in Germany, Accountable got you covered! With the app and web version, you can write invoices, save your expenses, and submit all tax returns, like VAT returns and income tax. What makes Accountable unique is our AI Assistant as well as our in-person advice from our tax coaches. Check it out and test it for free!

Did you find what you were looking for?

Happy to hear!

Stay in the know! Leave your email to get notified about updates and our latest tips for freelancers like you.

We’re sorry to hear that.

Can you specify why this article wasn’t helpful for you?

Thank you for your response. 💜

We value your feedback and will use it to optimise our content.