End of year taxes: Here’s what additional forms you have to submit as a freelancer

Read in 3 minutes

Self-employed persons in Germany are obliged to pay tax on their income and submit an annual income tax return. But that’s not all: there are also a few additional forms that you have to fill out and submit when completing your tax return.

In this article, we shine some light on these different forms and explain when you have to fill out which annex.

Income tax and its annexes

As a self-employed person in Germany, you are required by law to file an income tax return every year. This consists of the so-called “Mantelbogen“, or main form, in which you enter general information about yourself, as well as a few additional attachments, which can vary from person to person.

You must provide the following information in the main form:

- Your full name

- Your date of birth

- Your current address

- Your local Finanzamt (tax office)

- Your tax number

- Your marital status

- If applicable, information on children

➡️ You can find more information on how to complete your German income tax returns here.

These are the most important attachments for self-employed persons

In addition to the information on the main form, self-employed persons must fill out various other forms and submit them with their income tax return.

The EÜR annex for your income

If you have opted for the income surplus statement (and not for the far more complex double-entry bookkeeping) when registering your self-employed activity, then you are obliged to submit the so-called EÜR (Einnahmenüberschussrechnung) annex.

➡️ You can find more information about the Einnahmenüberschussrechnung here

In this form, you compare your business income with your business expenses and thus determine the profit that you have generated with your self-employment.

➡️ We have created a step by step guide to help you submit your EÜR here!

Annex S for freelancers

If you are considered to be a freelancer by the Finanzamt, you must also fill out the Annex S in addition to the Annex EÜR. This form is used to additionally explain the information given in the surplus income statement and thus make your income more comprehensible for the Finanzamt.

In this form, you must include the pre-calculated profit from your EÜR, as well as declare losses, additional profits from other activities or capital gains and, if applicable, profit shares from partnerships operating on a freelance basis.

Annex G for tradespersons

If you are not a freelancer but a tradesperson, you must fill out the Annex G instead of the Annex S. Other than that, the information in this form is pretty much identical in content to the annex S for freelancers.

This form also serves to explain your profit from your work in more detail and to make the information from the surplus income statement more comprehensible.

➡️ If you are not sure whether you are considered a tradesperson or a freelancer, you can find more information in this article

The KAP annex for capital gains

Another attachment that is potentially interesting for you is the KAP annex, in which you declare income from capital gains. Capital gains is income from interest, loans or the sale of shares. Since 2009, you have to pay 25% final withholding tax on this income.

This final withholding tax is usually paid automatically by your bank or financial institution, but in some cases, it may still be mandatory to fill out this form. In addition, there are also a few ways in which you can save some money by voluntarily filing this annex.

Other important forms

In addition to these annexes, you may also have to prepare and file an annual VAT return. This is obligatory if you are subject to VAT (value added tax), or Umsatzsteuer in German. Registered Kleinunternehmer (small entrepreneurs) are exempt from submitting an annual VAT return.

➡️ Don’t worry, the VAT return is not that difficult! This is how easy you file your German VAT return!

In the annual VAT return, you must list all VAT amounts paid in the year.

💡The annual VAT return must be submitted in addition to the regular VAT returns, which you must submit monthly or quarterly, depending on the requirements of the Finanzamt.

Additionally, if you are considered a Gewerbe (tradesperson), you must also submit an annual trade tax return. This again is similar to the annual VAT return: you have to list the total amount of trade tax you have paid, which you pay to the Finanzamt in advance on a quarterly basis over the course of the year.

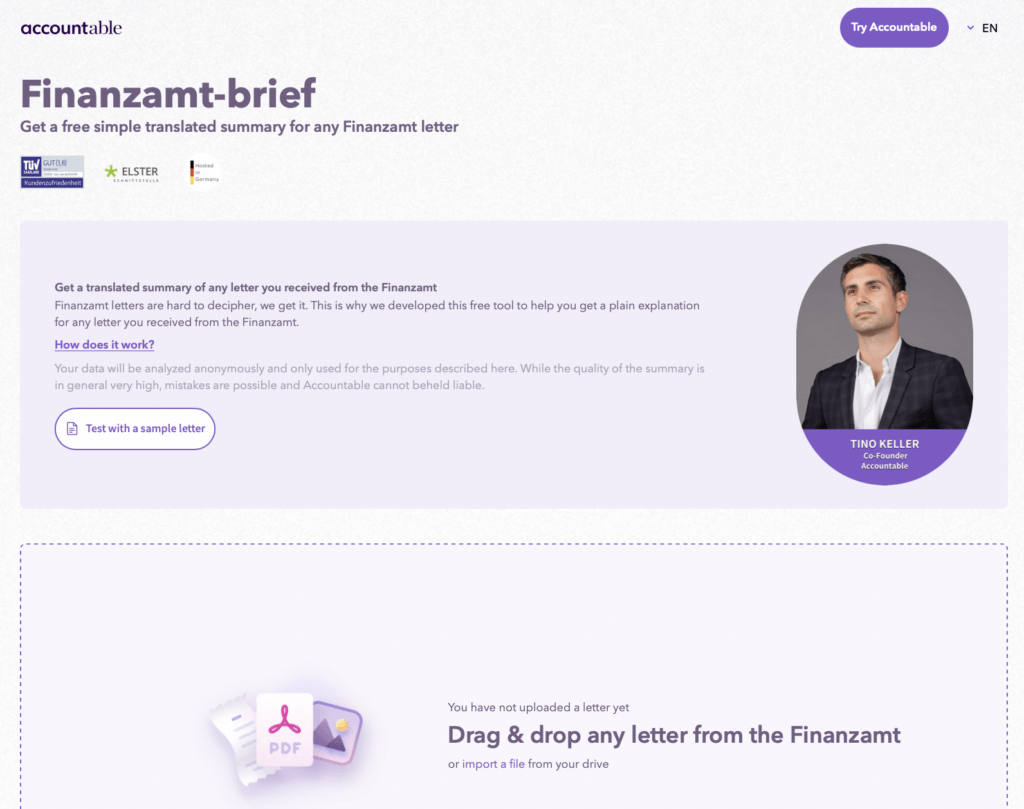

You received a letter from the German Finanzamt and are not sure what you have to do?

Use our free AI tool! Just upload the letter and it will analyze and translate it’s content for you!

💡Accountable is the tax solution for the self-employed. Download the free app or create an account online. This way, you have your bookkeeping and tax obligations like VAT return under control right from the start. Our team will also help you personally in the chat at any time!

Did you find what you were looking for?

Happy to hear!

Stay in the know! Leave your email to get notified about updates and our latest tips for freelancers like you.

We’re sorry to hear that.

Can you specify why this article wasn’t helpful for you?

Thank you for your response. 💜

We value your feedback and will use it to optimise our content.