Step by step guide – income tax return with Accountable

Read in 3 minutes

Self-employed professionals are obliged to submit their income tax once a year to the Finanzamt. There are several software solutions and the official ELSTER platform to put together your income tax return. You can also use Accountable to prepare it and send it directly to the Finanzamt. Here we show you how it’s done!

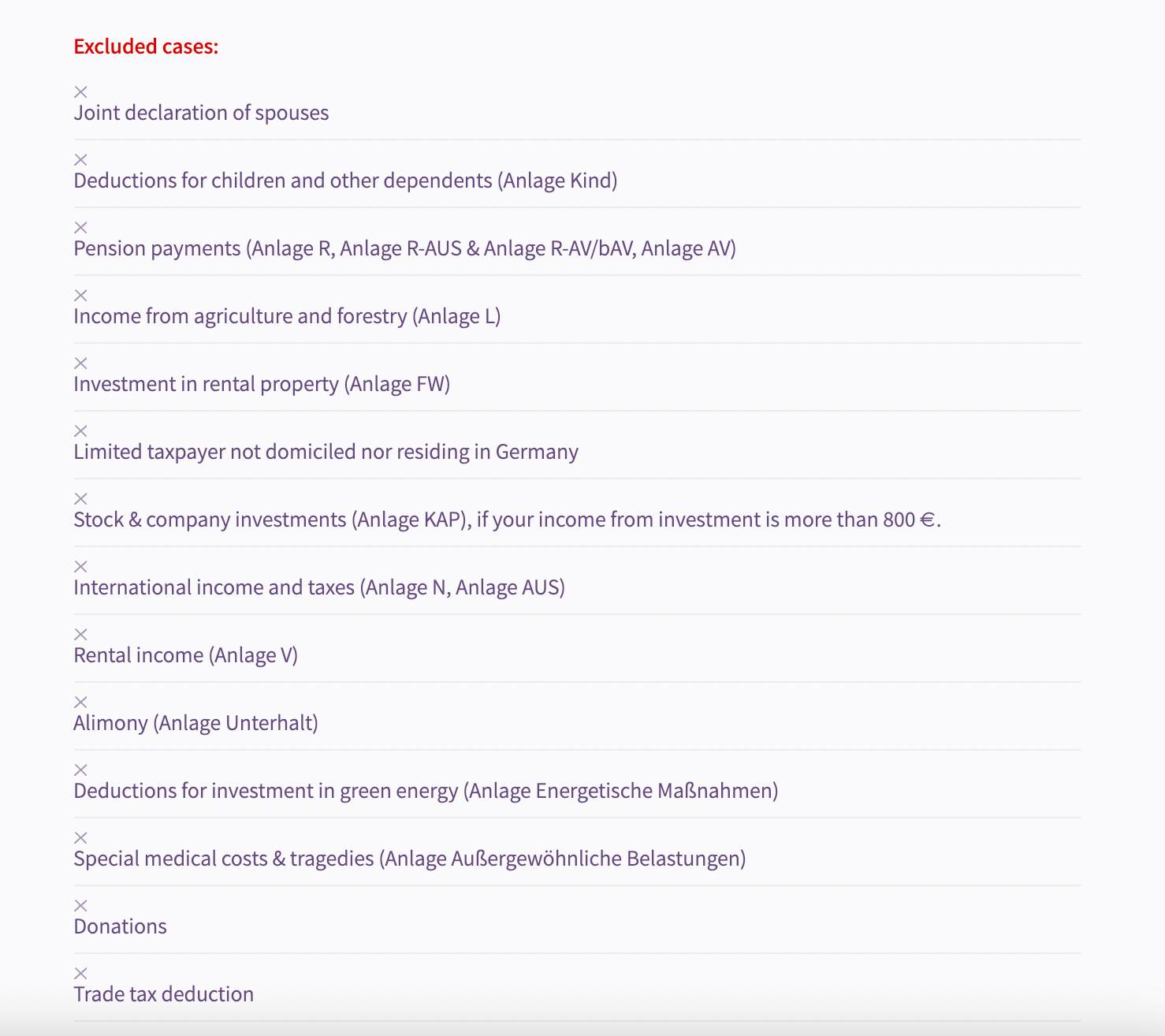

Who can prepare the income tax return with Accountable?

With Accountable you can’t only file your VAT return and take care of your bookkeeping – you can also prepare your annual income tax return. At the moment Accountable does not cover all specific cases, so here you can find the list of cases not (yet) supported.

Step by step guide – income tax return

Your income tax return includes three parts. These must be filed separately in Accountable:

- EÜR – Einnahmenüberschussrechnung (profit & loss statement)

- Umsatzsteuerjahreserklärung (yearly VAT return)

- Einkommensteuererklärung (general income tax return)

Go to the Accountable website and log in to your account. In the side menu navigate to the tax screen.

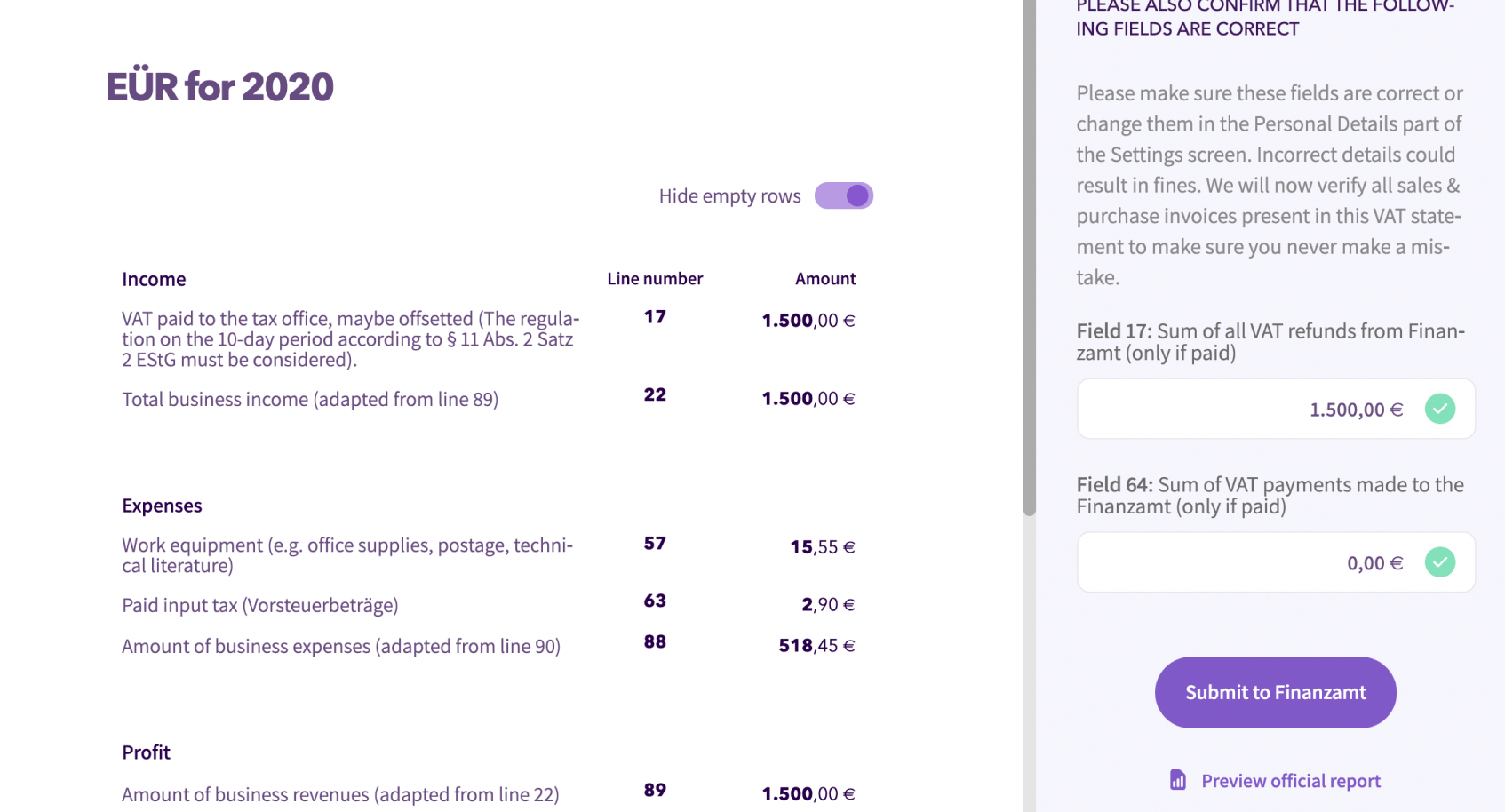

Submit your EÜR

In the list on the tax screen you will find the EÜR for the corresponding year. The EÜR is a simplified method of profit calculation that you can use as a self-employed person. Simply put, your profit (or loss) is calculated by subtracting your expenses from your income. What remains is your profit.

If you have consistently created or imported invoices and professional expenses in the Accountable app throughout the year, your EÜR will be calculated automatically. Now, you just have to submit it in the web version. Just click on “Submit to Finanzamt”. Great, the first step is already done!

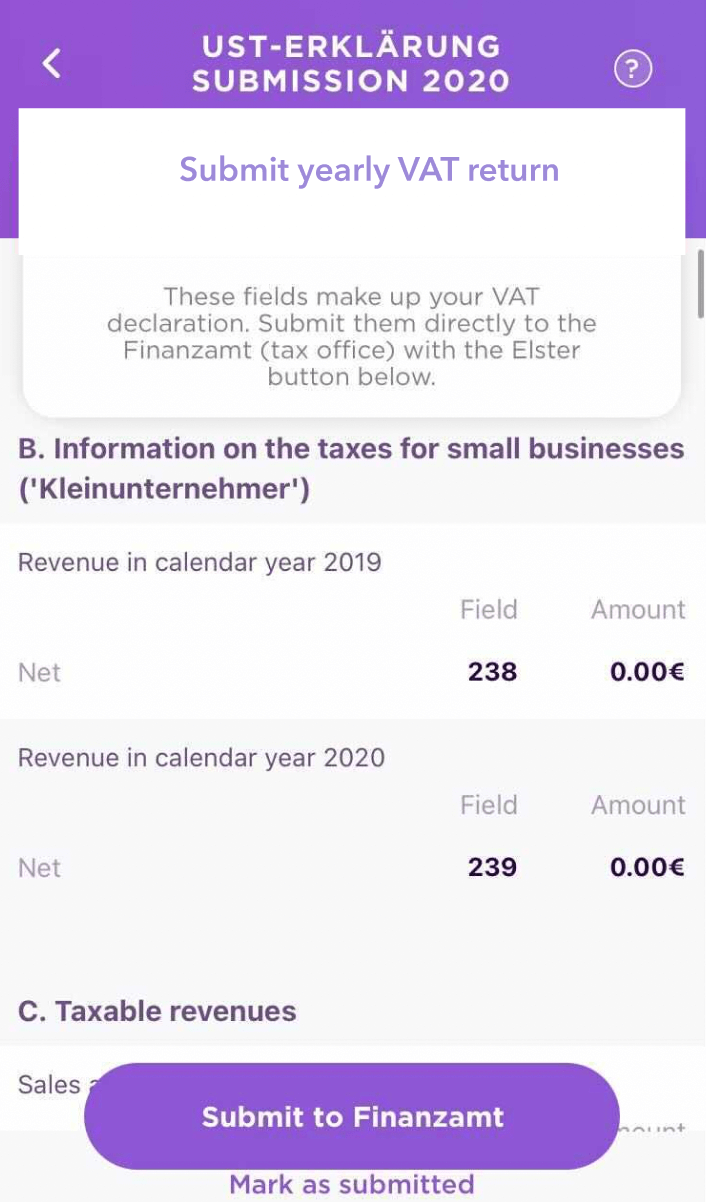

Subject to VAT? That’s how you submit your yearly VAT return

The next step is to submit your yearly VAT return. This is where you state your VAT returns you filed throughout the year, as well as your annual revenue and income. You can easily submit this directly from the mobile app.

If you go to the tax screen and select the VAT return for the corresponding year, the complete calculation will already be displayed. Then click on “Send to Finanzamt” and you will be guided through the verification process and finally to the submission. Voila, now only the last part is missing.

⚠️If you are registered as Kleinunternehmer, you don’t need to file VAT returns during the year. However, the submission of the yearly VAT return is also obligatory for you. In this case, just contact our team and we will help you with that.

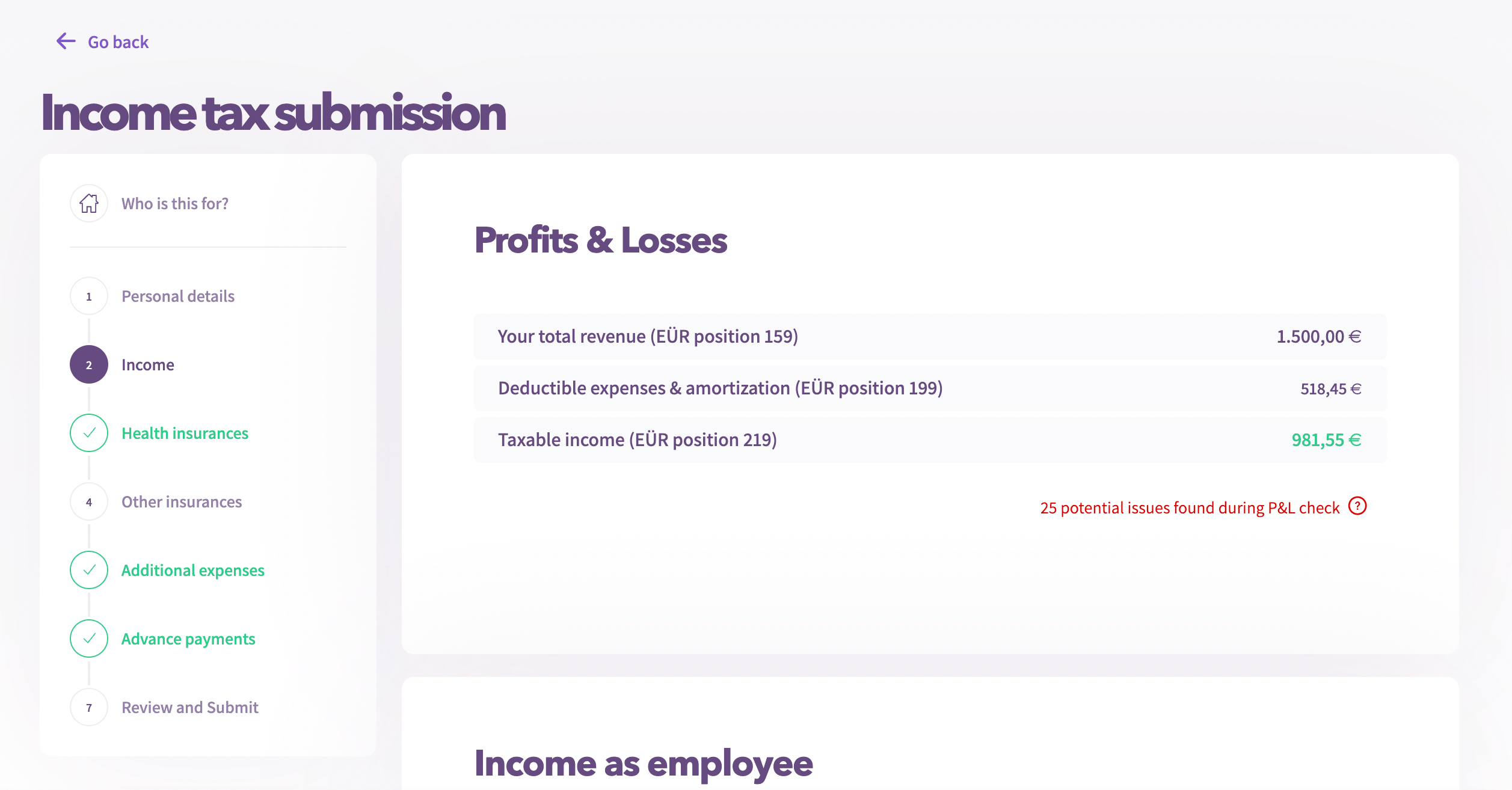

Submit your income tax

Now it’s time for your actual income tax submission. For this, go back to the web version of Accountable. Here, you can select income tax in the tax screen. In the following windows, you will be guided through the required information that is needed for the return.

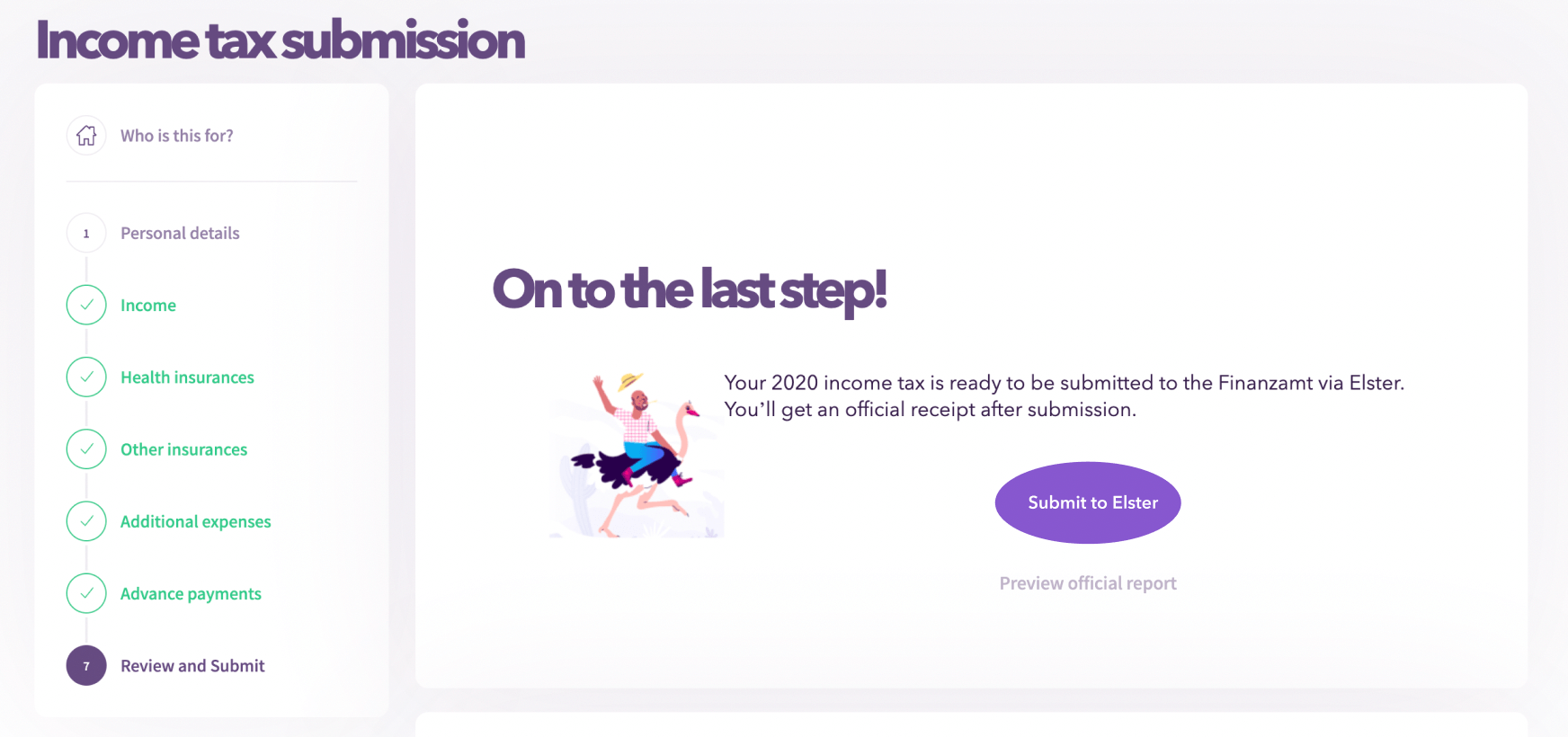

Here you can add additional data like information on income as employee, health insurance and so on. Finally, you will get to the “Submit to ELSTER” page, where you can send your income tax report directly via ELSTER to your Finanzamt. Now you have submitted your complete tax return and are done for the year!

You want to prepare your income tax return with Accountable? Click here and start now!

Did you find what you were looking for?

Happy to hear!

Stay in the know! Leave your email to get notified about updates and our latest tips for freelancers like you.

We’re sorry to hear that.

Can you specify why this article wasn’t helpful for you?

Thank you for your response. 💜

We value your feedback and will use it to optimise our content.