If you want to open your own business in Germany, you have to register a Gewerbe. But no worries, the process of registering a Gewerbe is not difficult. However, it's quite normal to have some questions while filling out the form. To help you with this, this article summarizes all the steps to complete the registration form.

In Germany, no permit is required to conduct a Gewerbe (business). Anyone can engage in commercial activities. The only mandatory step is to notify the authorities, meaning the Finanzamt (finance office), that you are setting up a business. This is known as Gewerbeanmeldung (business registration).

They simply check whether you fulfil the basic requirements - such as being of legal age, having legal capacity and what kind of business you want to run.

Specific requirements exist only for certain businesses where you need to prove your qualifications to practice the Gewerbe. This applies to:

In these cases, a permit from the authority is required to conduct the Gewerbe. With the granted permit, you are allowed to pursue the business. Such a permit from the authority is also known as a "concession."

💡 Tip from Accountable: If you want to become self-employed with your own business, you must also fill out the "Questionnaire for Tax Registration" in addition to the business registration. Here you will find a guide and the offical form!

If you want to register a Gewerbe as a self-employed person, you register your business with the Gewerbeamt (trade office) responsible for the location of your business. This can be done in person, in writing, and sometimes online. However, personal registration can be advantageous, as any potential questions can be clarified directly in this case. You can also present an ID document and any necessary permits directly at the registration.

The fees for business registration are not uniformly regulated nationwide. However, they usually range between 20 and 65 euros.

You can complete the registration form using our following guide. If you are planning to register as Kleinunternehmer (small business), you only need to answer a few questions. You will then receive your Gewerbeschein (business licence).

➡️ Registering as self-employed? Find out if you're freelancer or Gewerbe?

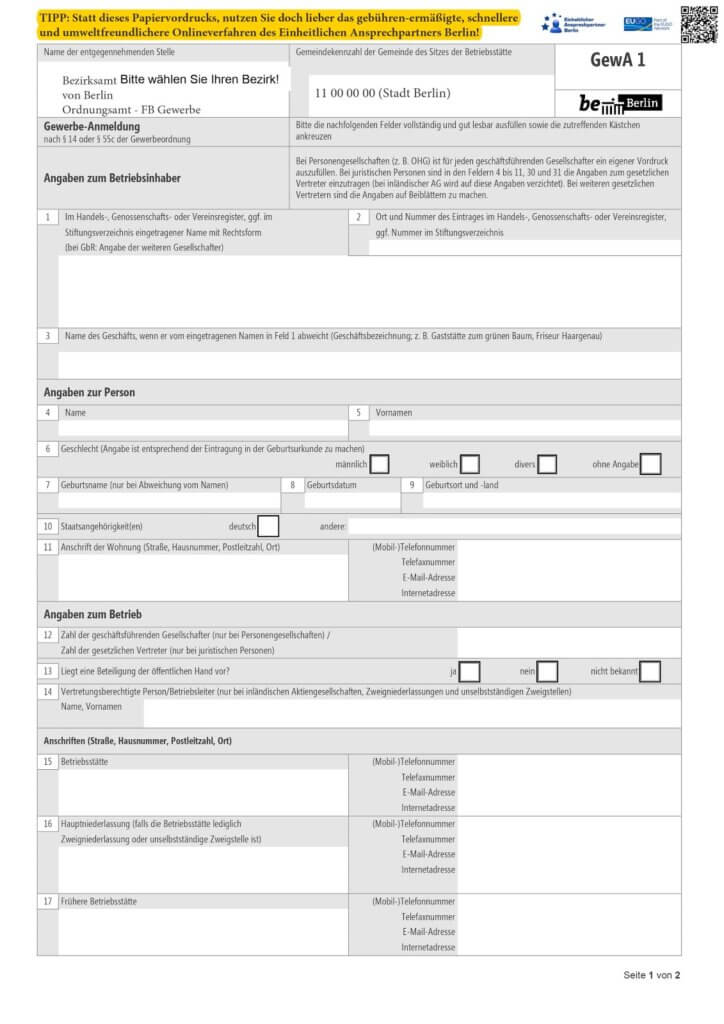

Before we go through each field together, you should have the general Gewerbeanmeldung (business registration form) in front of you. The IHK provides a digitally fillable form on their websites, for example, here for business registration in Berlin. Read through all the fields carefully before you start filling them out.

Source: Bezirksamt Berlin

Did you register in the Handelsregister (commercial register) as a Einzelkaufmann (sole trader), a legal entity, or a partnership registered in the commercial register, the company name with legal form must be stated in field 1. If there is a business designation, you can additionally specify this in parentheses.

If a Handelsregister (commercial register) or Genossenschaftsregistereintrag (cooperative register entry) exists, you must also enter the location and number of the register in field 2.

If the name of your business differs from your entries in field 1, you can specify your exact business designation additionally in field 3.

In these fields, you must provide information about your identity. This serves as a possible reliability check. The information includes:

For partnerships and legal entities, you must specify the number of managing partners or legal representatives in field 12. You can leave this field blank if you want to register a business as a Einzelunternehmer (sole trader).

In field 13, you must check whether there is public sector involvement in the business. Public sector involvement exists if it is a company in which the federal government, states, or municipalities hold capital shares or have votes in the management/administrative body of the company.

In field 14, you must specify the authorized representative for your business. This information is omitted for Aktiengesellschaften (public limited companies). For branches or dependent branches, the authorized representative must also be specified.

In field 15, you enter the address of your business. If this location is only a branch or a dependent branch, you must also specify the address of your main office in field 16.

If your business was previously active at another address, you must also enter this in field 17.

You also have the option to enter a phone number, fax number, email address, and the website of the business location in the fields.

➡️ Change Business Address: Here's how.

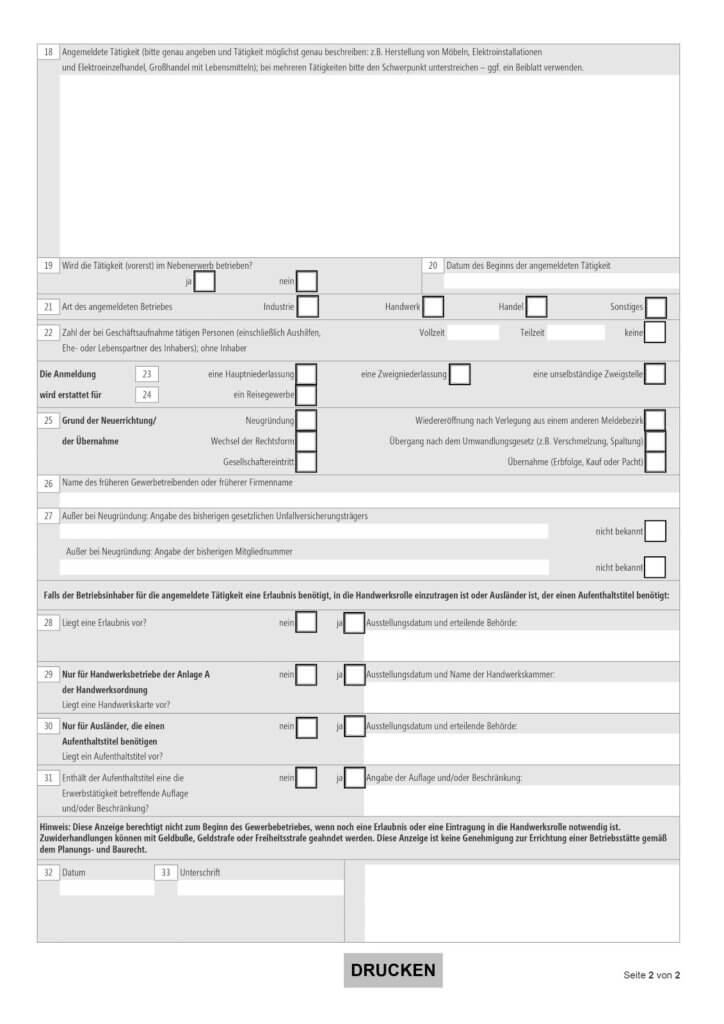

Source: Bezirksamt Berlin

The registered activity of your business must be described comprehensively and precisely in field 18. General statements are not sufficient (example: "Trade with goods"). However, the following types of descriptions are permissible: wholesale trade with pet food, electronics retail, furniture restoration, etc.

In the next two fields, you state whether you carry out the business full-time or part-time and the date when you will start the business.

In field 21, you specify the type of operation your business is in, and in field 22, the employees at the start of the business must be entered. This field must always be filled out, even if you do not employ any staff or this is still unknown. In this case, you simply enter a 0.

In fields 23 to 27 you must provide information on the type of business (e.g. boat builder) and whether it is a new business, a takeover or a reopening.

If your business requires licences or permits (e.g. trade licence or business permit), these and their existence must be entered here. You must also enter whether you have a residence permit.

Finally, you must enter the date of the day you fill out the application and personally sign the form.

You see, registering a business is not particularly difficult. However, it is important to carefully fill out the form to avoid mistakes and questions from the Finanzamt or Gewerbeamt.

As a next step, remember to also fill out the "Questionnaire for Tax Registration" and submit it to your Finanazmt (tax office) in addition to the Gewerbeanmeldung (business registration form).

Afterwards, you can already focus on your business and start working. Don't forget to keep your accounting and taxes under control from the beginning. This will save you a lot of stress and work later.

💡 With Accountable, you can manage your bookkeeping and all tax returns directly with one tool. Try the free app or web version now!

20 Kapitel knallhart recherchiert und vom Steuerprofi geprüft

Kostenlos herunterladen

Author - Alexander Frank

Alexander Frank is a highly accomplished tax advisor and partner of Accountable, bringing a wealth of knowledge and experience to his role.

Who is Alexander ?Thank you for your feedback!

Useful

How much income tax is deducted from your income is largely determined by your tax class. There are ...

Read moreWorking as a self-employed professional has many advantages: You are your own boss and you can choos...

Read moreWorking with international clients can be tricky, depending on where exactly they’re located, whet...

Read more