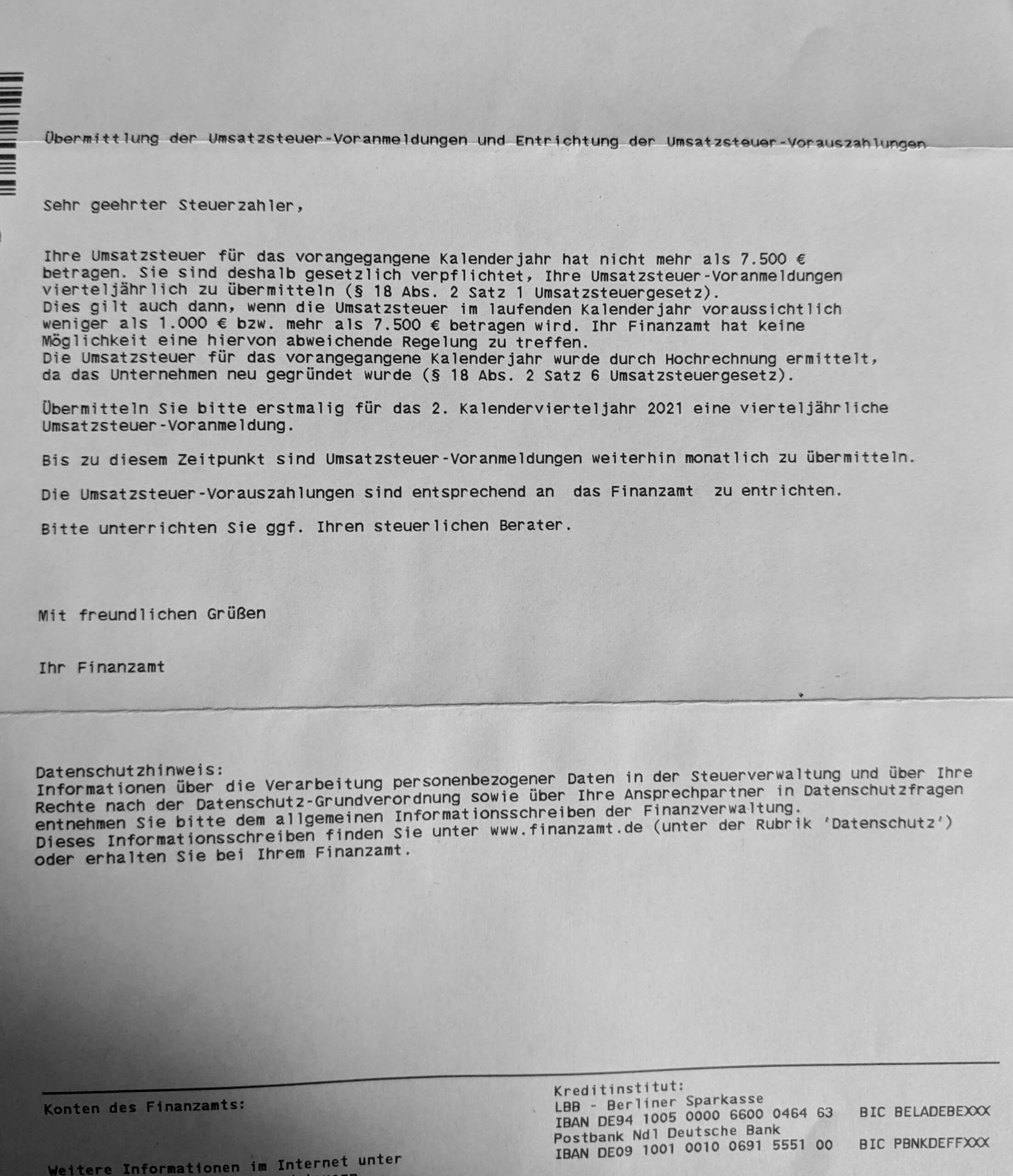

The Finanzamt sent you a letter and you're not sure what to do now? No worries, when the amount of VAT you filed the year before falls into a certain bracket, you will get a letter telling you when to submit your VAT return for this year. In this article, we explain what information you can take from this letter step by step.

When it comes to your VAT return, you can't choose when to submit it to the Finanzamt yourself. There are certain rules that determine when you need to file your VAT.

So if your VAT amount in the previous year was between 1,000 to 7,500€, you need to submit your VAT return for this year every quarter. That's when you'll get a letter by the Finanzamt notifying you about those changes.

Even when this year the amount of your VAT return will be less than 1,000€ or more than 7,5000€, you are still required to file your VAT quarterly.

The next paragraph of the letter tells you when to submit your first quarterly VAT return. If it will be the 2nd quarter, for example, you would need to submit the VAT until the 10th of July. It's always the 10th of the month that follows the quarter. This date also applies to the according VAT payment.

Tip from Accountable💡: You need to submit your VAT quarterly? Or monthly, or yearly? You can do it directly in the Accountable app, we've got you covered for every scenario!

Use our free AI tool to scan your letter and get an explanation and translation of it.

20 Kapitel knallhart recherchiert und vom Steuerprofi geprüft

Kostenlos herunterladen

Author - Sophia Merzbach

Sophia has been a key member of the Accountable team for many years, bringing a unique blend of journalistic precision and in-depth tax expertise to her work.

Who is Sophia ?Thank you for your feedback!

Useful

How much income tax is deducted from your income is largely determined by your tax class. There are ...

Read moreWorking as a self-employed professional has many advantages: You are your own boss and you can choos...

Read moreWorking with international clients can be tricky, depending on where exactly they’re located, whet...

Read moreIch kann ohne Accountable nicht, auch sehr familiäre Unterstützung, tolle Erfahrung bis jetzt

Ayhan Kahraman

Der Austausch und die Hilfe ist SUPER.

Katja Schmidt

Accountable ist sehr einfach zu bedienen. Und macht Steuern für Solo selbständige so einfach wie nie zu vor.

Anonym

Accountble ist einfach zu bedienen und übersichtlich.

Regine Müller-Waldeck

Die Kommunikation war sehr gut und sehr genau. Im Fall wie es bei mir war hätte ich mich gefreut ein Telefonat zu führen. Es wäre auch sehr gut eine Telefonnummer zu haben wo man sich an einen Mitarbeiter wenden hätte können. Heute bekommt man sehr viele Spam Nachrichten die täuschend echt sind.

Peter Goerke

Ich bin schwer begeistert, die Platform ist wirklich ausgereift, man ist kein Versuchskaninchen, außerdem ist es trotz Digitalisierung sehr persönlich und direkt, ich fühle mich richtig aufgehoben und die Kundenservice ist unübertroffen, einziges Manko ist das ext. Steuerbüro Consentes, auf Fragen wird nicht oder spät geantwortet, verlangen jedoch einen horrenden Betrag nur um mit dem Finanzamt zu sprechen, da greife ich lieber selber zum Hörer, das soll das Erlebnis mit Accountable, aber in keinem Fall schmälern, endlich eine All-in-One Lösung, die hält was Sie verspricht!

Anonym

Bis jetzt alles Top, guter Sapport.

John Niehaus

sehr guter technischer support zum Abo. Steuerfragen hatte ich noch nicht.

Sergej Rothermel

Sehr guter Kundenservice, individuell und verständlich. Ausgezeichnete Fachkompetenz! Besser als jeder Steuerberater hier bei uns. Absolut empfehlenswert!

Birgit Kleinert

Zuerst einmal möchte ich mich ganz herzlich bedanken, für die intensive und professionelle Betreuung meiner Steuerangelegenheit. Bei wirklich all meinen Fragen und es waren nicht wenige, hat Daniela mir geholfen. Besonders hervorheben möchte ich, das man hier auf eine Frage die man bezüglich der Steuer stellt, nicht lange auf seine Antwort warten muss. Accountable, ein "Rund-um-Sorglos-Paket"! Vielen Dank Peter Albuscheit

Peter Albuscheit