If your home is the hub of your whole professional activity, expenses incurred maintaining an office at home are fully deductible. By deducting home office expenditures as business expenses, you may minimize your taxable income and reach a smaller tax burden.

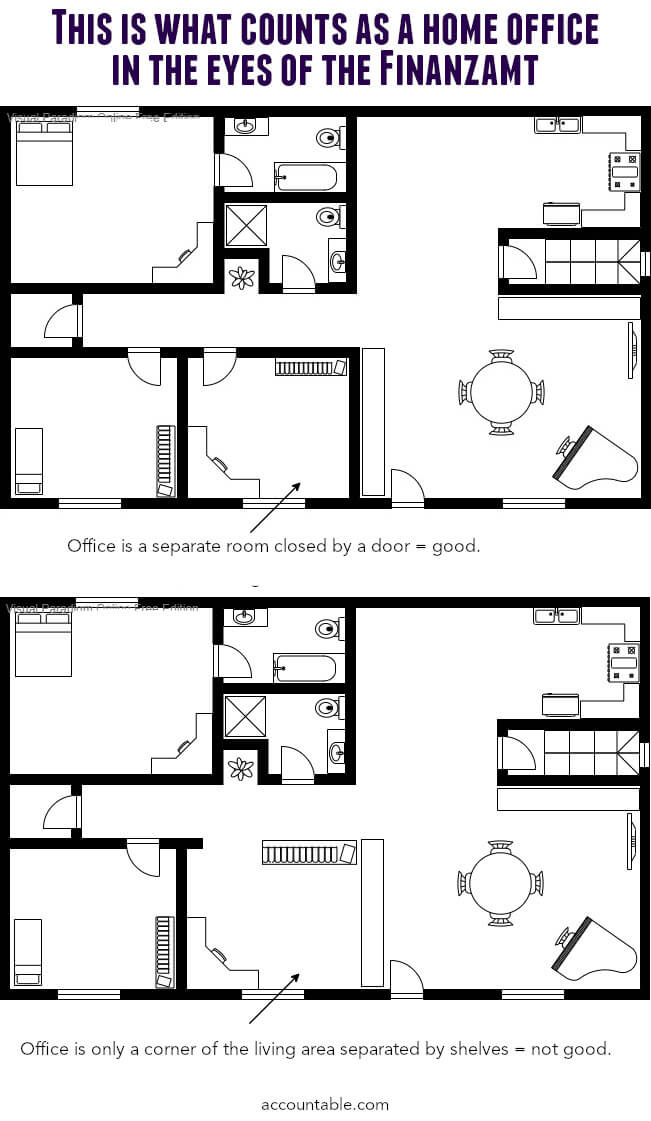

Various professional and spatial conditions must be met in order to be able to deduct the costs of an office at home.

The Finanzamt can check if those requirements are met by sending in a questionnaire, so you can certify you fulfill all of them.

You can deduct those expenses as part of your home office expenses:

For most of those, you will need to divide these pro rata - according to the area of your home office to the total living area (including home office space). This means that if you live in a 100sqm home and your home office is 10sqm, you can deduct 10% of the expense (e.g: rent)

Don't forget to include the costs of furnishing your office, such as shelves, a desk, or an office chair, as business-related expenses. These expenses are fully deductible too. The only condition is that you use these items almost exclusively for professional or business purposes. You can immediately deduct items up to 952 euros (VAT included). Anything above that amount, you will need to depreciate them over several years (Abschreibung).

For self-employed persons, those costs are assigned as business expenses. You will assign them to “Betriebsausgaben” in the form “Anlage S”.

Keeping track of those expenses can be tricky. Thankfully, using an app like Accountable makes it easy. You are sure to assign those expenses in the right categories, making your life much easier when it comes to doing your tax return yourself, or with a Steuerberater.

You can find a detailed guide on deductible expenses for your tax return in Germany here.

20 Kapitel knallhart recherchiert und vom Steuerprofi geprüft

Kostenlos herunterladen

Author - Sophia Merzbach

Sophia has been a key member of the Accountable team for many years, bringing a unique blend of journalistic precision and in-depth tax expertise to her work.

Who is Sophia ?Thank you for your feedback!

Useful

How much income tax is deducted from your income is largely determined by your tax class. There are ...

Read moreWorking as a self-employed professional has many advantages: You are your own boss and you can choos...

Read moreWorking with international clients can be tricky, depending on where exactly they’re located, whet...

Read moreMeine Erfahrungen mit Accountable sind bisher nur Positiv. Ich als Kleinunternehmer habe jetzt alles in einer App und es ist super easy zu handhaben. Meine Buchhaltung war noch nie so leicht. Ein mega Pluspunkt ist noch, dass man ein Kostenloses Geschäftskonto einrichten kann, welches direkt mit allen Buchhaltungsfunktionen verknüpft ist.

"Tim Friedrichs"

Mit Accountable habe ich meine Buchhaltung im Griff, kann easy meine Umsatzsteuervorauszahlungen einreichen und Rechnungen stellen. Die Steuer-Coaches helfen mir immer schnell, wenn ich mal eine Frage habe. Durch Accountable komme ich bisher locker ohne Steuerberater:in aus. Und wenn ich doch mal Bedarf habe, kann ich mir über Accountable ein/e Expert/in buchen. Alles in allem eine runde Sache. Ich habe Accountable schon oft weiterempfohlen. (Und ganz ehrlich, das Logo von Accountable ist ja wohl sowas von nice.)

Ute Mayer-Dohmen

immer bemüht alle Fragen und Probleme schnell zu klären.

Halil Ibrahim Baran

Arbeiten mit Accountable ist für mich sehr hilfreich und meinen Anliegen werden schnell bearbeitet. Eine der besten Entscheidungen die ich dieses Jahr getroffen haben.

"Hardy Thiele"

konkrete Antworten auf Fragen, gute Vorbereitung und Kommunikation untereinander, sehr gut!

Nils Ohlsen

Hallo Simon, bin Dankbar das ich Accountable benutzen darf. Ich brauche aber Bitte eine Antwort auf mein Anfragen ùber die Steuercoaches, dies dauert zu Lange gerade while ich dann warte sehr Lange auf eine Antwort obwohl ich in den Promax Version bin. Bitte daher um einen Antwort auf mein Anliegen gerade geht es um die EKSteurerklarung von 2024. Danke und einen schønen Tag noch. Freundlichen Grùssen aus Lùbeck, Stuart Brown

Stuart Brown

Super hilfreiche Antworten und immer schnell geholfen 👍🏻

Dennis Baltes

Details und Verlinkungen

Julian Scheinert

Ich kann ohne Accountable nicht, auch sehr familiäre Unterstützung, tolle Erfahrung bis jetzt

Ayhan Kahraman

Der Austausch und die Hilfe ist SUPER.

Katja Schmidt