Managing taxes can be a daunting task, especially for self-employed professionals in Germany. From understanding complex regulations to navigating through tax procedures, knowing you have someone to support you can save you a lot of worries and stress.

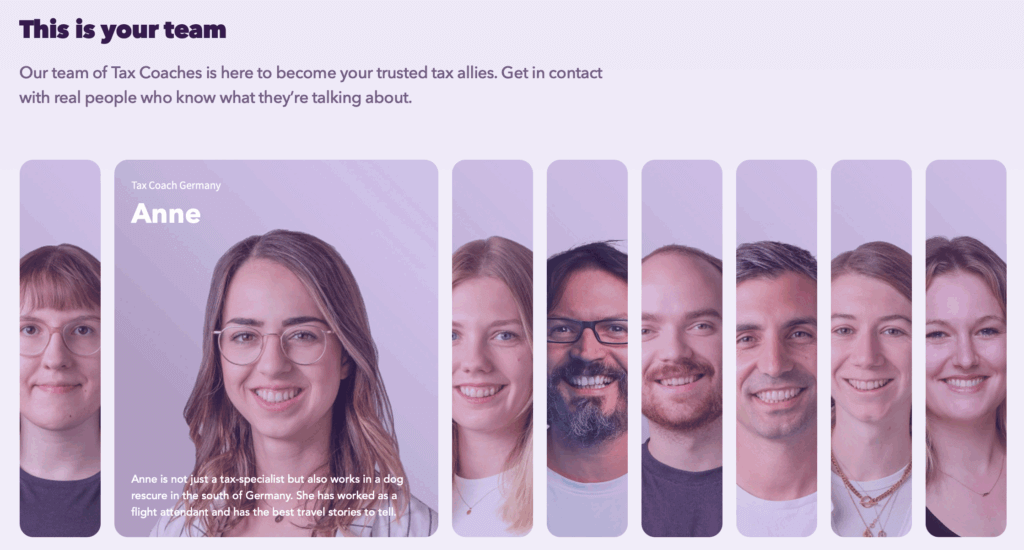

At Accountable, we understand these challenges and offer a solution with our team of dedicated Tax Coaches. In this article, we will show you how our Tax Coaches will support you in your tax journey and how they help to make bookkeeping and taxes smoother and more manageable for you.

💡Tip from Accountable: Accountable is a tax software designed for freelancers and Gewerbetreibende (trade persons) in Germany. It covers all the bookkeeping and tax obligations and is available as app and on web. Test it now for free!

Tax matters can be complicated, and the last thing you need is a barrage of technical jargon and ambiguous explanations. Accountable's Tax Coaches are aware of this and will simplify complex concepts and provide practical help in plain English. Also, instead of vague statements like "it depends," they offer actionable guidance that you can easily understand and act upon. With this clear communication, we want to help you make informed decisions and stay in control of your tax obligations.

Accountable's Tax Coaches provide basic tax knowledge, but they also specialise in helping you navigate and utilise the full potential of the Accountable software. From explaining how to write correct invoices in the app to offering tips on how to save taxes, our Tax Coaches ensure that you have a comprehensive understanding of the software's features and capabilities.

For example, if you're unsure about the correct category for an expense, they are there to confirm or suggest the appropriate classification. They can also assist you in understanding numbers, tax computations, and interpreting letters from the Finanzamt (tax office).

💡Have a burning tax question in the middle of the night? You can always ask the Accountable AI Tax Advisor. It provides

Unlike traditional tax advisors who often leave unanswered emails or struggle with follow-ups due to high client demand, our Tax Coaches ensure that you receive a personal answer to your questions within 24 hours. We do our best to offer you prompt and personalised support, that's why you can contact us through email and chat-messaging or even schedule a free phone call or a one-on-one video call in some of our paid plans.

Furthermore, at Accountable, we value user feedback and actively collaborate with our development team to optimise the app based on your suggestions.

When you encounter issues or face challenges with tax-related matters, Accountable's Tax Coaches are committed to finding solutions. They don't give up until the problem is resolved. In contrast, tax advisors might struggle with proactively addressing your concerns due to their workload. With our Tax Coaches, even when it takes some time, you can rely on the persistence and dedication of the whole team, including our developers if needed, to ensure that you receive a solution to your problem.

In addition to one-on-one support, Accountable offers free webinars that cover a variety of tax topics relevant to freelancers and Gewerbetreibende in Germany. These live sessions are designed to give you actionable insights, step-by-step guidance, and practical tips straight from our Tax Coaches.

Whether you simply want to understand how taxes work in Germany, optimise your tax savings or learn how to get the most out of the Accountable app, our webinars make complex topics easier to grasp. Plus, you can ask questions in real-time and get direct answers from the experts.

Attending these webinars is a great way to boost your confidence, stay up-to-date with tax regulations, and connect with a community of freelancers navigating the same challenges.

While the Accountable Tax Coaches offer comprehensive support, it's important to understand their limitations. They aren't certified tax advisors and thus can't offer official tax advice. While the Tax Coaches offer extensive support, they do not provide tax or legal advice. In such cases, they will guide you towards certified tax advisors to address your specific needs.

They also do not encode your documents, review your accounting, submit your taxes on your behalf, contact the Finanzamt (tax office) in your name, perform tax computations, or handle the registration process for self-employment.

However, you can ask about any of those topics and our Tax Coaches will suggest next steps or get you in contact with the right person for your issue. For example, should you require official tax advisory services and you are a user of Accountable, they will connect you with certified tax advisors who possess the necessary qualifications and expertise.

At Accountable, we want to provide more than just tax software for freelancers. We want to give you the personal support and feeling of security that software can't offer. With their actionable assistance, software support and commitment to resolving issues, our Tax Coaches provide personalised guidance to help you manage your taxes with confidence.

By leveraging their expertise and the Accountable software, you gain a better understanding of tax regulations and don't have to be afraid of mistakes.

Already have a question? Send us a message!

20 Kapitel knallhart recherchiert und vom Steuerprofi geprüft

Kostenlos herunterladen

Author - Tino Keller

Tino Keller is the Co-founder behind Accountable, driven by a mission to revolutionize how freelancers, self-employed professionals, and small business owners manage their taxes.

Who is Tino ?Thank you for your feedback!

Useful

How much income tax is deducted from your income is largely determined by your tax class. There are ...

Read moreWorking as a self-employed professional has many advantages: You are your own boss and you can choos...

Read moreWorking with international clients can be tricky, depending on where exactly they’re located, whet...

Read moreUnkomplizierte, vor allem schnelle Abwicklung. Ein paar übereinander Schneidungen gab es zwar bezüglich E-Mail-Versand, aber ansonsten hat alles reibungslos geklappt und ich bin dankbar für die zuvorkommende Hilfe.

Pamela Klauke

Definitely how fast the team answer your questions, always very eager to help with every kind of problem

Anonym

Super übersichtlich, einfach zu verstehen. Das erste mal, das ich das Gefühl habe, selbst meine Steuer zu verstehen. Normalerweise habe ich nach dem ein Steuerberater meien Unterlagen neu sortiert hat, überhaupt keinen Überblick mehr gehabt ... Kurz um: I love it

Ramona Schmidt

Die App ist super einfach aufgebaut. Für alle mehr als verständlich. Es gibt tolle verschiedene Optionen um Antworten zu bekommen. Wenn die KI nicht helfen kann, antworten die Steuer Coaches immer sehr schnell und sehr freundlich, so dass man direkt weiter arbeiten kann. Hab Accountable schon mehrfach weiterempfohlen.

Anonym

What I really appreciate is that you can quickly help me with my doubts about taxes, invoicing, and how to do things right in Germany. I've never been freelance and I am not German, so for my this support is crucial, especially because it's so hard to find an advisor in Berlin that I was almost going to give up, but I am happy I started with Accountable. The only thing I would do better is to see in my dashboard the status of the application as freelance to the finanzamt, since that was done through your site and there is no connection to that in my dashboard.

Francisco Javier Aguilar Sanchez

Mein Steuercoach hat zunächst versucht meine Frage besser zu verstehen und Nachfragen gestellt. Nachdem der Sachverhalt nicht direkt geklärt werden konnte, blieb man hartnäckig und hat sich mit Kollegen ausgetauscht, bis ich eine Lösung hatte. Das war genau so, wie ich es mir vorgestellt hatte. Bin sehr zufrieden

Michael Hofmann

Ich bin echt begeistert von Accountable.

Anonym

Ich hatte ein Problem mit dem Importieren von Eingangsrechnung (Fahrtkosten). Die Aufgabe hat Anahita übernommen und gelöst. Mein Problem wurde ernst genommen, sie hat Kontakt gehalten und schlussendlich wurde es von der IT gelöst. Vielen Dank.

Heinz Wiemers

Simon gave me a quick response and explained everything very kindly and clearly. I really appreciate his excellent customer support.

Yuki Shiroi

super einfach , Unterstützung von jede Seite ! Ki super gut ! TOP !

Alexander Abel