Tracking and managing business expenses is one of the most important, but also most time-consuming, parts of being self-employed. That’s why the expenses screen in Accountable is designed to simplify your bookkeeping as much as possible, help you stay tax-compliant, and maximize your deductions.

From scanning receipts and linking bank transactions to automating recurring costs and managing VAT, the expenses screen in Accountable does the heavy lifting for you. In this article, we’ll explore all of these features, so you know how to make the most of your finances and bookkeeping with less stress and more write-offs.

Looks like a lot, right? But no worries, each of these features is designed with freelancers and self-employed professionals in mind, people like you, who often manage their own finances without the help of a tax advisor. So whether you're logging your first expense or preparing for quarterly tax filings, these tools are here to make your workflow faster, clearer, and fully compliant.

Let’s dive into what each feature does and how it helps you stay in control of your business expenses, without the overwhelm.

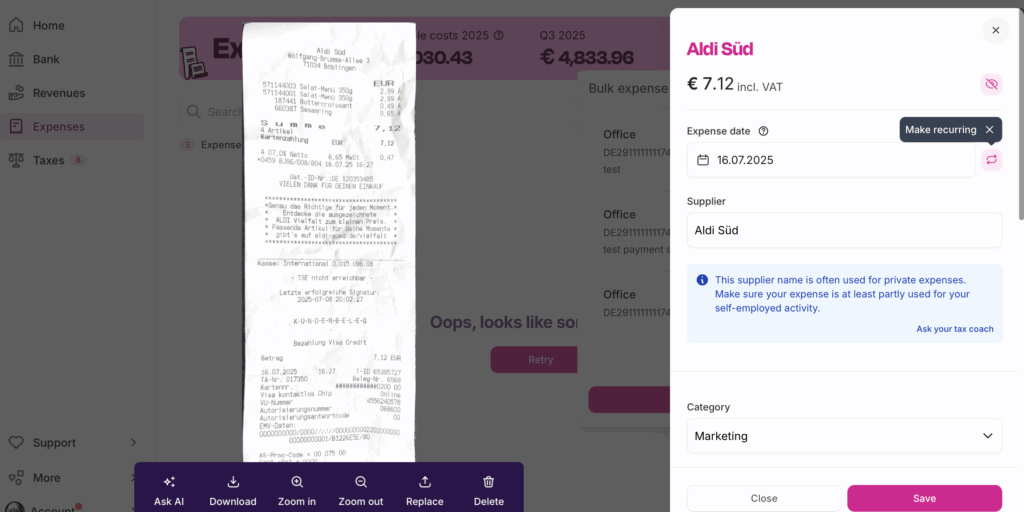

The basic core feature of the expenses screen in Accountable is the ability to log a new business expense. This is especially useful when you receive an invoice via email or want to save a receipt on-the-go. So you can easily take a quick scan with your phone or upload a receipt. The correct amount, date, and supplier will be detected for you or you can edit it yourself. Each expense can be categorized, for example, as rent, phone bills, travel costs, or software subscriptions, making sure it's correctly tracked and ready for your tax return. This feature ensures that nothing slips through the cracks.

With the option to scan, logging expenses becomes faster and more effortless. Simply use your phone’s camera to snap a photo of a receipt, and Accountable will do the rest. Thanks to built-in OCR (optical character recognition) technology, key details like the date, amount, and supplier are automatically extracted and filled in for you. This not only saves time but also reduces the risk of manual errors, perfect for freelancers who are always on the go and want to stay on top of their bookkeeping without having to sit down at a desk and do this manually every time.

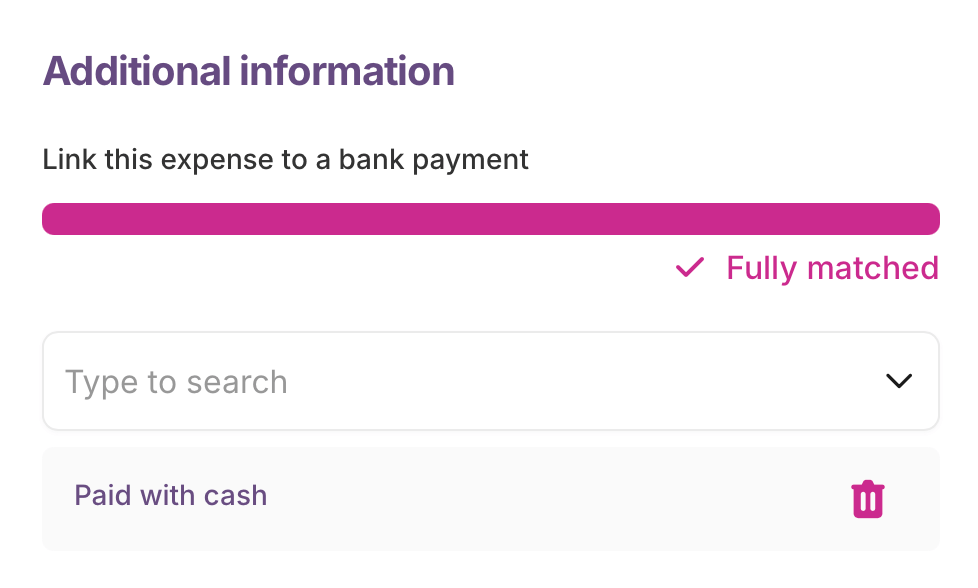

By linking your bank account to Accountable, you can automatically import your business transactions into the app. This makes it easy to match each payment to the correct expense, saving you time and ensuring accuracy. When a transaction comes in, Accountable suggests possible matches based on the amount, date, and supplier. You can confirm the match or manually link it to an existing expense. This feature is especially valuable for freelancers who want to avoid digging through bank statements and keep their bookkeeping up to date with minimal effort.

The recurring expenses feature lets you automate the costs that come up regularly in your business, such as rent, insurance, subscriptions, or Internet fees. Instead of manually logging these expenses every month or quarter, you can set them up once and have Accountable add them automatically to your bookkeeping! You can easily edit or stop a recurring schedule whenever needed, and each time the expense appears, you’ll have the option to review it and attach the correct receipt or invoice. This ensures your recurring costs are never forgotten and always properly recorded, saving you valuable time and reducing the risk of errors.

Here’s how to set up recurring expenses in Accountable:

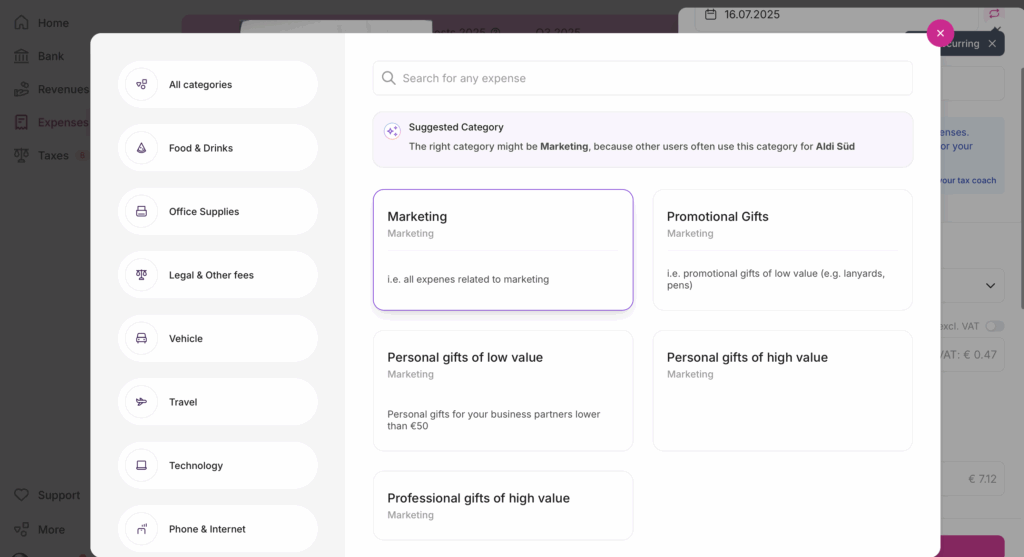

With categorization suggestions, Accountable makes expense tracking smarter as it prevents you from picking wrong categories for your expenses. Based on your past expenses and the details of new transactions, the app automatically proposes the right category for each cost - whether it’s office rent, phone bills, travel, software and so on. Even better, the correct VAT rate is pre-filled depending on the type of expense, so you don’t have to worry about tax rules or manual calculations. This feature not only saves you time because you don't have to search for the right category, it also ensures your expenses will be deducted correctly later.

Not all expenses fit neatly into a single category - that’s where split expenses comes in. This feature allows you to divide one receipt across multiple categories, such as part business and part private use. You can even assign different VAT rates or deduction types to each portion. It’s the perfect solution for freelancers who want to ensure every euro is recorded accurately, without over- or under-claiming.

Finding a specific expense has never been easier. With the search filters you can sort your expenses by date, category, VAT status, supplier, or amount. The search function lets you quickly pull up individual costs when you need to double-check a payment or prepare for tax season. This feature is a lifesaver for freelancers dealing with hundreds of transactions a year.

With duplicate detection, Accountable helps you avoid recording the same expense twice. The app automatically alerts you if a similar expense or transaction already exists, so your bookkeeping stays accurate and clean. This feature is especially useful when dealing with recurring payments or when uploading multiple receipts, ensuring you don’t inflate your costs by mistake.

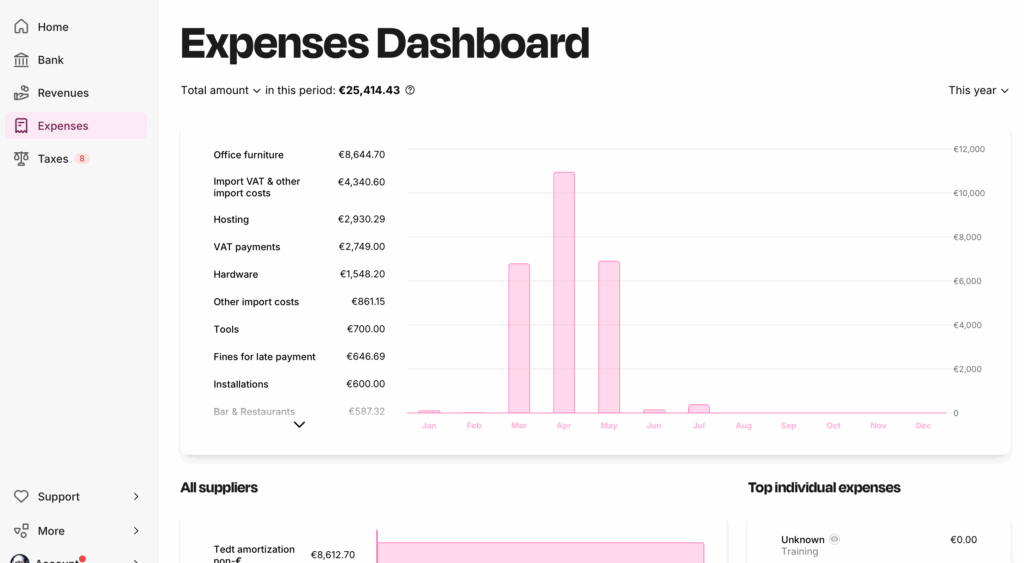

Accountable makes it easy to share and review your financial data with the exports feature. You can export all your expenses to PDF for safekeeping or to share with your tax advisor. The app also provides clear monthly or quarterly overviews in the expenses dashboard, where you can track how much you’ve spent in each category, review your suppliers, and identify your top individual expenses. This way, you always have a clear overview of where your money goes, what you’re spending, and where you could deduct more.

Accountable notifies you of any expenses that are unverified, unmatched, or missing a supporting document. The app also gives you smart prompts to upload the correct attachment, so you stay compliant and audit-ready. This feature ensures that nothing slips through the cracks, giving you peace of mind that your bookkeeping is always complete and won’t lead to follow-up questions from the Finanzamt.

20 Kapitel knallhart recherchiert und vom Steuerprofi geprüft

Kostenlos herunterladen

Author - Sophia Merzbach

Sophia has been a key member of the Accountable team for many years, bringing a unique blend of journalistic precision and in-depth tax expertise to her work.

Who is Sophia ?Thank you for your feedback!

Useful

How much income tax is deducted from your income is largely determined by your tax class. There are ...

Read moreWorking as a self-employed professional has many advantages: You are your own boss and you can choos...

Read moreWorking with international clients can be tricky, depending on where exactly they’re located, whet...

Read moreEasy to use platform.

Anonymous

Super schnelle Antwort und mein Anliegen war Ruck-Zuck erledigt :) Danke.

Aileen Reuter

Sehr ausführliche, zeitnahe und präzise Antwort, keine merklich vorgeschriebene Antwort. Anne hat sich Zeit genommen meine Fragen genau zu beantworten:)

Henri Hainz

Sehr professioneller und zuverlässiger Service. Das Team ist freundlich, kompetent und immer hilfsbereit. Ich habe mich bestens betreut gefühlt und bin sehr zufrieden. Klare Empfehlung!

Rayan Fauzi Jamil

Schnell und hilfreich , bin sehr zufrieden

Lyubov Titova

Absolut 100%ge Antworten und hilfeleistungen in allen Fragen. Sehr kompetentes Team nur zum weiterempfehlen.

"Marcel Klein"

Ich bin sehr zufrieden. Alle meine Fragen sind sehr kompetent geantwortet

Iryna Mozes

Mir wurde sehr schnell und kompetent geholfen. Der Kontakt war super freundlich und zuvorkommend! Auch für eine weitere Rückfrage wurde sich mit viel Geduld die Zeit genommen, um mir den Sachverhalt detailliert zu erklären.

Christine Höhne

Die Erklärungen waren total plausibel und ich habe mich über die zeitnahe Antwort gefreut.

Lina Gertzmann

Ich bin immer sehr zufrieden mit euren Antworten, die auch immer innerhalb von 24 Stunden erfolgen.

Sandy Kratochwil