You invested in a cryptocurrency such as Bitcoin, Ethereum or Dash? Now you're wondering whether you have to pay tax on the purchase and what exactly you need to state in your tax return? Here you find out everything you need to know about taxes and cryptocurrencies.

Although cryptocurrencies are not considered official currencies or investments in Germany, such as real estate or savings accounts, they do provide an economic benefit and fall under 'sonstige Wirtschaftsgüter' ('Other Assets') for tax purposes. Therefore, they may be taxable.

To know how much tax is due, it is important to note the purchase price and the time of purchase. So record when you bought cryptocurrency and how much you paid. Especially if you buy frequently or own different coins, it is worth creating a table of purchases and sales.

When selling, it is generally assumed that those shares you bought first, will also be the ones you sell first. This method is called FiFo - 'First in First out'.

Especially because crypto is still a relatively new tax issue for the tax authorities, it is possible that your Finanzamt (tax office) will take a closer look and demand additional information from you. So always remember to document your purchases and sales well.

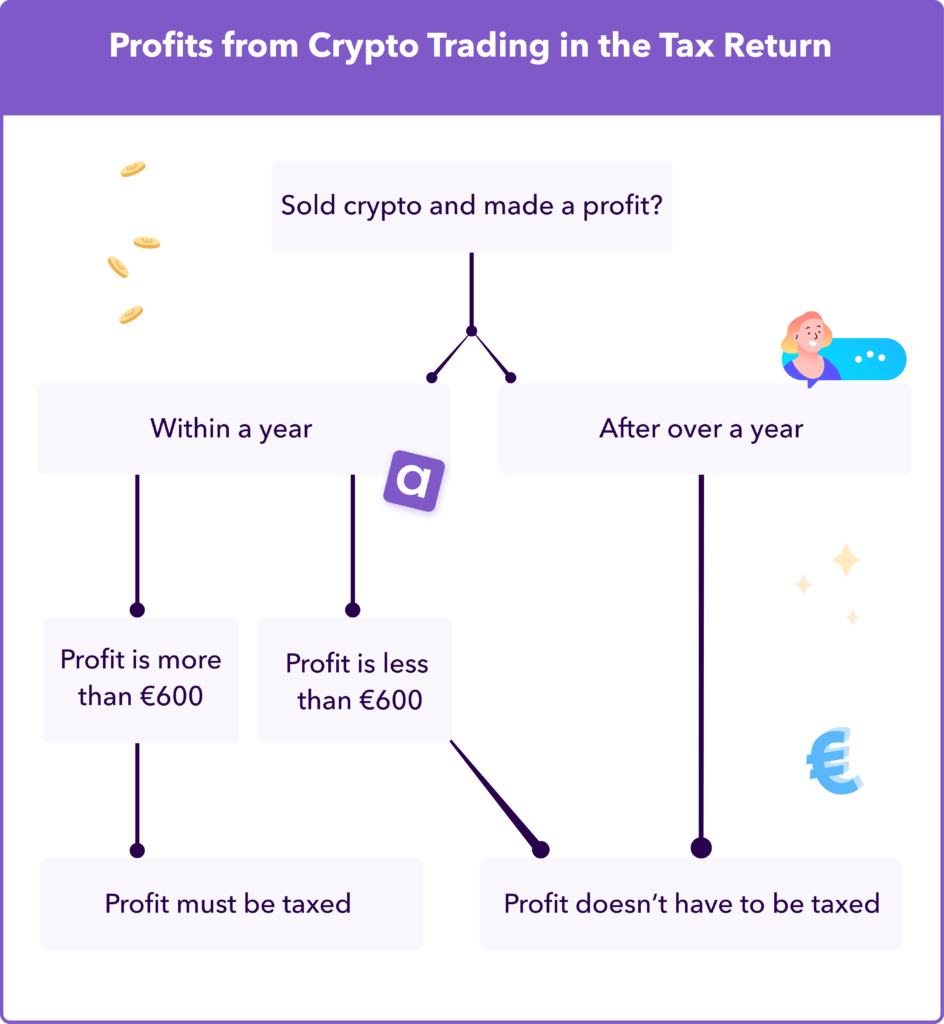

Are you trading cryptocurrencies as a private individual? If you buy digital currencies such as Bitcoin, Ethereum or Theter within a year and sell them again in the same year, it's possible that you have to pay tax on them. Because if you make a profit on the sale, you have to pay tax on it.

In this case profit is defined as the difference between the purchase price and the selling price. It is thus calculated by deducting your purchase price and any transaction fees from the selling price.

When selling crypto consider that if you want to sell your shares after a year has passed, you do not have to pay tax. So if you keep your cryptocurrency for longer than 12 months, there is no tax on your profit.

There is also the exemption limit of €600 (called Veräußerungsgewinn). If you earn less than €600 from the crypto sale, this remains tax-free. However, if your profit from the sale exceeds this limit, the entire amount will be taxable. So if your profit is €601, you have to pay tax on the entire profit and not just €1.

Also note that this €600 applies to all of your private sales transactions. So if, in addition to the sale of cryptocurrencies, you also have profits from the sale of gold or vintage cars, for example, the total profit from all sales must not exceed the €600 exemption limit.

If you sell your shares in a cryptocurrency, they are taxed at your individual income tax rate. Depending on how high your income is, you have a certain tax rate (between 14 and 42%). You have to apply this to your profits. So there is no fixed percentage that applies to everyone.

This is because cryptocurrencies do not fall under 'Kapitalvermögen' (capital assets), such as profits from shares and stocks. There is a fixed tax rate of 25% (plus solidarity surcharge and church tax) that applies to income from capital assets.

Instead, gains or losses from cryptocurrencies are assessed as 'private Veräußerungsgeschäfte' (private sales transactions). These are declared as other income in the Anlage SO (SO annex) in your income tax return.

Also note that as soon as you receive interest on the amount, this is always taxable. It doesn't matter whether you sell your cryptocurrency within a year or later. 'Abgeltungssteuer' (withholding tax) is always due on your interest gains.

There are good news, especially for the self-employed professionals... there is no VAT due on the trading of cryptocurrencies.

To know exactly how much tax you pay on your crypto trading profits, you need to know your tax rate. This is based on a percentage of your income.

It ranges from between 14% and the maximum tax rate of 42%. It is important to know that income tax relates to profits. So it is important to state all professional expenses fully and correctly in your profit & loss statement (Einnahmenüberschussrechnung) which is part of your income tax return. In this way, you can reduce your profit a little and may be subject to a lower tax rate.

If you sell your cryptocurrency at a loss, consider whether you have any gains from other 'privaten Veräußerungsgeschäften' (private sales transactions). You can offset these against it.

You carry out private sales transactions, for example, when you sell real estate that you do not use yourself. This also includes the sale of gold or bitcoins and other cryptocurrencies.

This also applies the other way around. So if you have losses from other sales, you can offset these against possible gains from the sale of crypto shares.

Profits and losses from cryptocurrencies are entered in the income tax return in the Anlage SO (annex SO) for 'other income' in lines 41 to 46. Start with line 41 by entering the type of asset, i.e. what type of income you have. For example, in the case of crypto "Sale/trade in cryptocurrencies" could be noted here.

If you have regularly traded cryptocurrencies throughout the year, it is advisable to prepare another table with detailed evidence of the profits or losses. This way, you have proof should your Finanzamt inquire about it.

If you do not trade in cryptocurrencies as a private individual, but do so as a professional business, different rules apply to you. This is because the profits are not tax-free after one year, but are always taxable.

As things stand, however, it is not yet clear when trading in cryptocurrencies is considered a commercial activity in Germany.

The good news is that even if you trade very often and have frequent reallocations, you are not directly considered a commercial crypto trader. This means that most people do not have to worry about the tax obligations of traders for the time being.

Tip from Accountable💡: It is important to be able to prove your profits to the Finanzamt and, if necessary, be able to verify that you have not made any taxable sales. So remember to always keep evidence and document your trading well.

The easiest way to do this is with a tax software like Accountable. This gives you full control of your bookkeeping and tax returns at all times. Find out more here!

20 Kapitel knallhart recherchiert und vom Steuerprofi geprüft

Kostenlos herunterladen

Author - Sophia Merzbach

Sophia has been a key member of the Accountable team for many years, bringing a unique blend of journalistic precision and in-depth tax expertise to her work.

Who is Sophia ?Thank you for your feedback!

Useful

How much income tax is deducted from your income is largely determined by your tax class. There are ...

Read moreWorking as a self-employed professional has many advantages: You are your own boss and you can choos...

Read moreWorking with international clients can be tricky, depending on where exactly they’re located, whet...

Read moreMir wurde sehr schnell und kompetent geholfen. Der Kontakt war super freundlich und zuvorkommend! Auch für eine weitere Rückfrage wurde sich mit viel Geduld die Zeit genommen, um mir den Sachverhalt detailliert zu erklären.

Christine Höhne

Die Erklärungen waren total plausibel und ich habe mich über die zeitnahe Antwort gefreut.

Lina Gertzmann

Ich bin immer sehr zufrieden mit euren Antworten, die auch immer innerhalb von 24 Stunden erfolgen.

Sandy Kratochwil

Der Umgangston ist super freundlich! Die Antworten kommen immer schnell und sind qualitativ echt gut und verständlich!

Benedikt Schönauer

Meine Erfahrungen mit Accountable sind bisher nur Positiv. Ich als Kleinunternehmer habe jetzt alles in einer App und es ist super easy zu handhaben. Meine Buchhaltung war noch nie so leicht. Ein mega Pluspunkt ist noch, dass man ein Kostenloses Geschäftskonto einrichten kann, welches direkt mit allen Buchhaltungsfunktionen verknüpft ist.

"Tim Friedrichs"

Mit Accountable habe ich meine Buchhaltung im Griff, kann easy meine Umsatzsteuervorauszahlungen einreichen und Rechnungen stellen. Die Steuer-Coaches helfen mir immer schnell, wenn ich mal eine Frage habe. Durch Accountable komme ich bisher locker ohne Steuerberater:in aus. Und wenn ich doch mal Bedarf habe, kann ich mir über Accountable ein/e Expert/in buchen. Alles in allem eine runde Sache. Ich habe Accountable schon oft weiterempfohlen. (Und ganz ehrlich, das Logo von Accountable ist ja wohl sowas von nice.)

Ute Mayer-Dohmen

immer bemüht alle Fragen und Probleme schnell zu klären.

Halil Ibrahim Baran

Arbeiten mit Accountable ist für mich sehr hilfreich und meinen Anliegen werden schnell bearbeitet. Eine der besten Entscheidungen die ich dieses Jahr getroffen haben.

"Hardy Thiele"

konkrete Antworten auf Fragen, gute Vorbereitung und Kommunikation untereinander, sehr gut!

Nils Ohlsen

Hallo Simon, bin Dankbar das ich Accountable benutzen darf. Ich brauche aber Bitte eine Antwort auf mein Anfragen ùber die Steuercoaches, dies dauert zu Lange gerade while ich dann warte sehr Lange auf eine Antwort obwohl ich in den Promax Version bin. Bitte daher um einen Antwort auf mein Anliegen gerade geht es um die EKSteurerklarung von 2024. Danke und einen schønen Tag noch. Freundlichen Grùssen aus Lùbeck, Stuart Brown

Stuart Brown