Are you tired of the stress and uncertainty that comes with filing your taxes in Germany? Do you wish there was a way to get personalised, trustworthy advice without having to search for and rely on expensive tax advisors? Look no further - the Accountable AI Tax Assistant is here to revolutionise the way you handle your taxes.

As a self-employed professional in Germany, you know how complex and time-consuming taxes can be. From navigating the complexities of German tax law to ensuring that your tax returns are error-free, the process can be overwhelming.

So were you looking for a tax advisor to support you with the difficult German tax system, but couldn't find one? Then you're not alone: The age distribution of tax advisors in Germany shows a concerning decline in the number of those available to assist freelancers and other self-employed professionals.

Also, freelancers have always faced challenges in finding affordable tax advisors, especially when starting their self-employment journey. With tax advisor fees often starting at €2,500 annually, many self-employed professionals, particularly those with lower revenues, have had difficulties finding and paying for tax advisors.

Amidst this backdrop of challenges, the search for alternative solutions is therefore more urgent than ever. The Accountable AI Assistant is designed to address these challenges head-on!

In this time of declining availability of tax advisors in Germany, the launch of an AI Assistant is a logical step to help freelancers with their tax obligations... and potentially revolutionising the bookkeeping and tax landscape.

The Accountable AI Assistant is not just another ChatGPT. Unlike generic AI platforms, the AI Assistant has been meticulously trained with the most current and comprehensive tax information, derived from tax law, expert advice, and Accountable's vast tax knowledge database. This makes it the most sophisticated tool available for self-employed professionals.

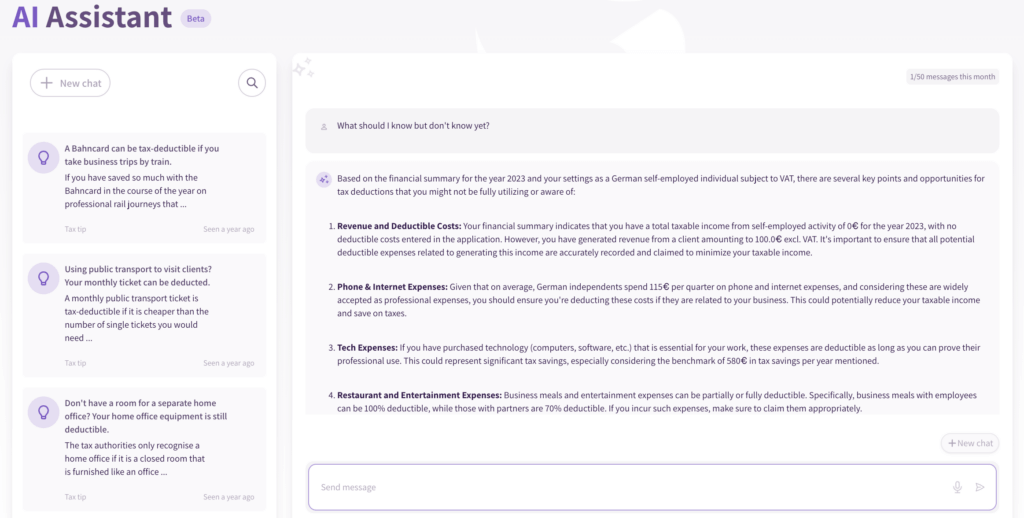

One of the key features of the AI Assistant is its ability to provide personalized advice tailored to your unique situation. By granting it access to your data in Accountable, you can receive bespoke advice on a wide range of tax-related queries. Whether you're unsure about a specific tax deduction or need help understanding a letter from the Finanzamt, the Accountable AI Tax Assistant has you covered.

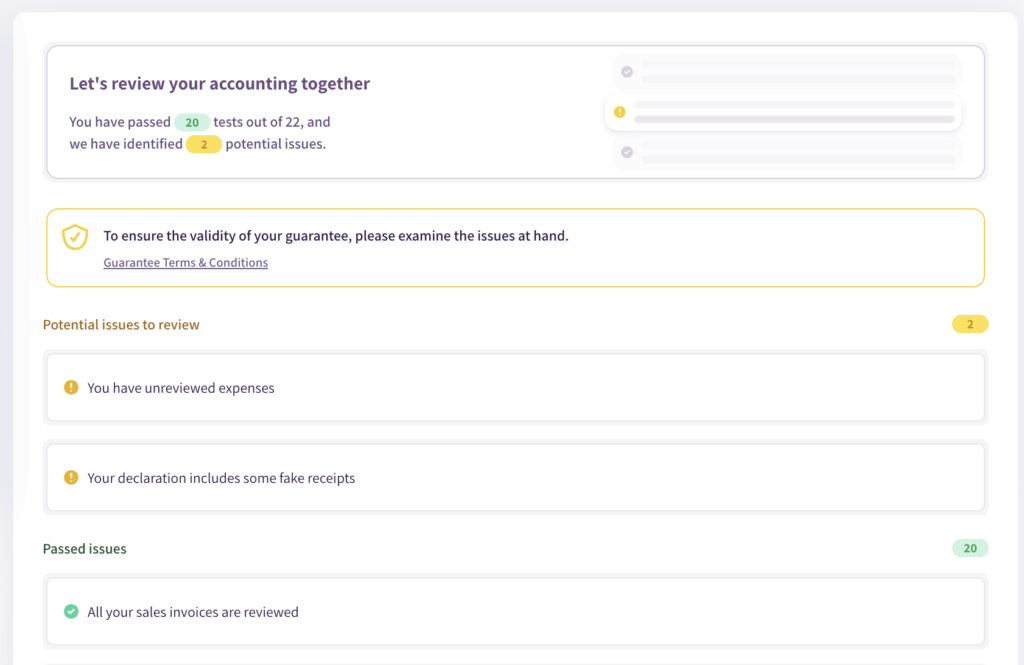

The AI Assistant does not only answer your questions. It also includes proactive assistance with tax checks and automated expense categorization, ensuring that users' tax affairs are always in order. Because the AI Assistant can also automatically check and validate the data you enter, ensuring that your tax returns are accurate and compliant. So you don't have to worry about false tax statements anymore.

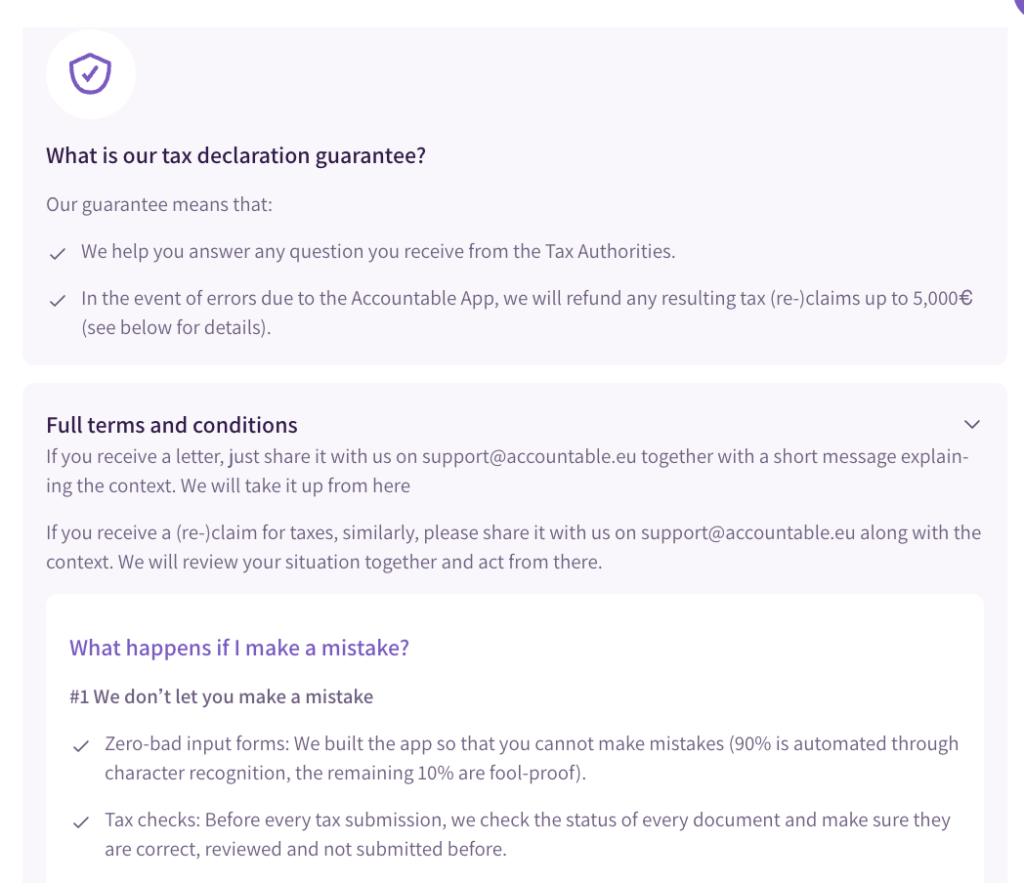

The AI Assistant is also what ensures the Accountable Tax Guarantee. Everything you save and want to submit to the Finanzamt will be checked and guaranteed.

As a 24/7 personal tax AI at your fingertips, the Assistant supports the beloved Tax Coaches in their work of answering your tax questions and supporting you all the way, offering individualized advice and a sense of security. So you can succeed in your freelance career.

⚡️Experience the future of taxes.⚡️

Accountable is the tax software for self-employed professionals in Germany. Manage your taxes and bookkeeping without tax knowledge and stress. The app is user-friendly and offers support from the AI and our tax coaches at every step. Test it now for free!

20 Kapitel knallhart recherchiert und vom Steuerprofi geprüft

Kostenlos herunterladen

Author - Andreas Reichert

Andreas Reichert is a highly experienced tax advisor and partner of Accountable.

Who is Andreas ?Thank you for your feedback!

Useful

How much income tax is deducted from your income is largely determined by your tax class. There are ...

Read moreWorking as a self-employed professional has many advantages: You are your own boss and you can choos...

Read moreWorking with international clients can be tricky, depending on where exactly they’re located, whet...

Read moreAccountable ist sehr einfach zu bedienen. Und macht Steuern für Solo selbständige so einfach wie nie zu vor.

Anonym

Accountble ist einfach zu bedienen und übersichtlich.

Regine Müller-Waldeck

Die Kommunikation war sehr gut und sehr genau. Im Fall wie es bei mir war hätte ich mich gefreut ein Telefonat zu führen. Es wäre auch sehr gut eine Telefonnummer zu haben wo man sich an einen Mitarbeiter wenden hätte können. Heute bekommt man sehr viele Spam Nachrichten die täuschend echt sind.

Peter Goerke

Ich bin schwer begeistert, die Platform ist wirklich ausgereift, man ist kein Versuchskaninchen, außerdem ist es trotz Digitalisierung sehr persönlich und direkt, ich fühle mich richtig aufgehoben und die Kundenservice ist unübertroffen, einziges Manko ist das ext. Steuerbüro Consentes, auf Fragen wird nicht oder spät geantwortet, verlangen jedoch einen horrenden Betrag nur um mit dem Finanzamt zu sprechen, da greife ich lieber selber zum Hörer, das soll das Erlebnis mit Accountable, aber in keinem Fall schmälern, endlich eine All-in-One Lösung, die hält was Sie verspricht!

Anonym

Bis jetzt alles Top, guter Sapport.

John Niehaus

sehr guter technischer support zum Abo. Steuerfragen hatte ich noch nicht.

Sergej Rothermel

Sehr guter Kundenservice, individuell und verständlich. Ausgezeichnete Fachkompetenz! Besser als jeder Steuerberater hier bei uns. Absolut empfehlenswert!

Birgit Kleinert

Zuerst einmal möchte ich mich ganz herzlich bedanken, für die intensive und professionelle Betreuung meiner Steuerangelegenheit. Bei wirklich all meinen Fragen und es waren nicht wenige, hat Daniela mir geholfen. Besonders hervorheben möchte ich, das man hier auf eine Frage die man bezüglich der Steuer stellt, nicht lange auf seine Antwort warten muss. Accountable, ein "Rund-um-Sorglos-Paket"! Vielen Dank Peter Albuscheit

Peter Albuscheit

Alles super, sehr freundlich und hat mir bei der Lösung meines Problems geholfen.

Alexander Adam

Sehr schnelle und kompetente Rückmeldung.

Frank Meier