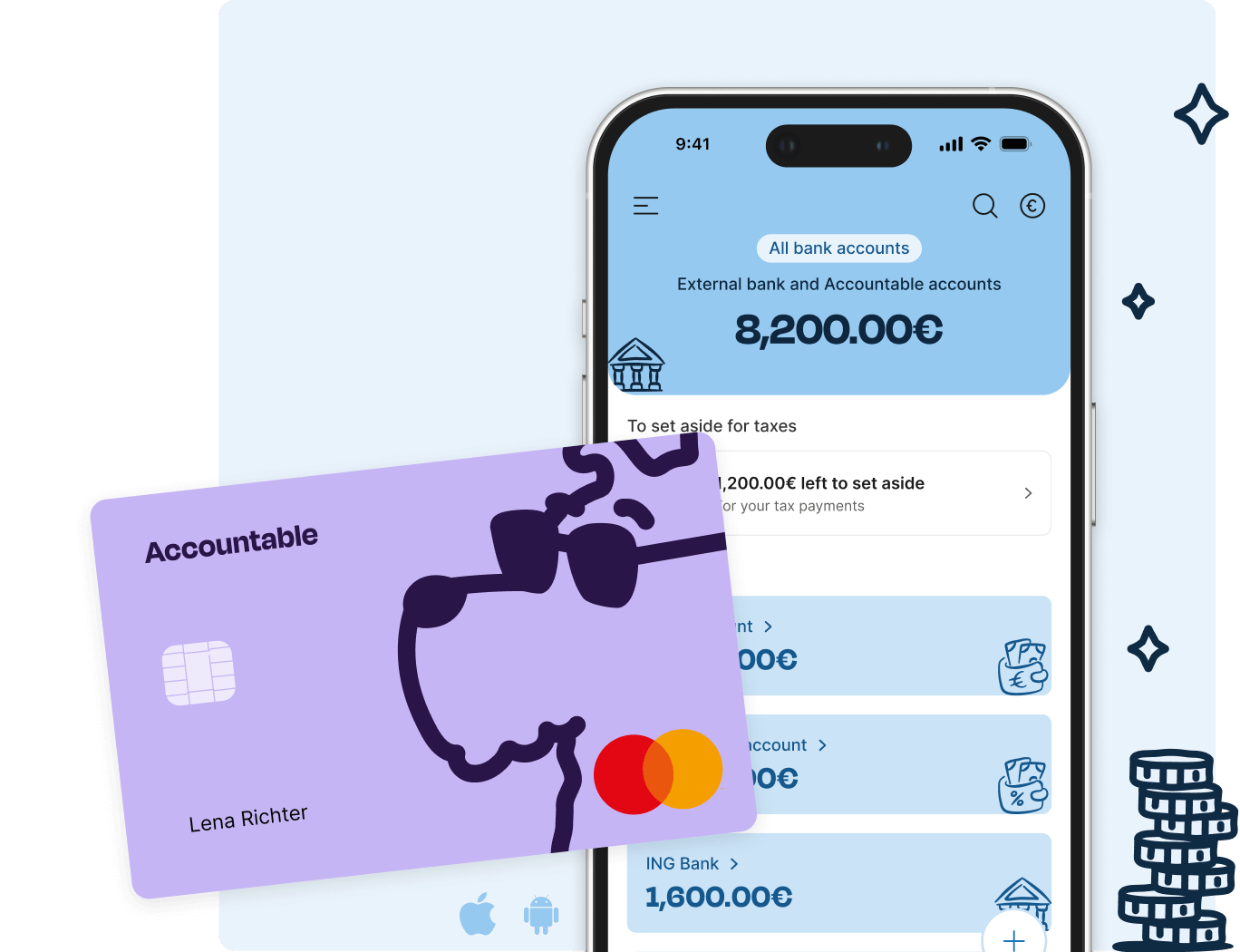

Your free business account that sets aside money for taxes – automatically.

| Service |

Accountable

|

N26 Standard

|

Qonto Basic

|

Kontist free

|

Revolut Basic

|

Commerzbank Klassik

|

DKB Business

|

|---|---|---|---|---|---|---|---|

| Monthly fee | 0€ | 0€ | 0€ | 0€ | 0€ | 15,90€ | 15,90€ |

| Physical Card |

|

|

|

|

|

|

|

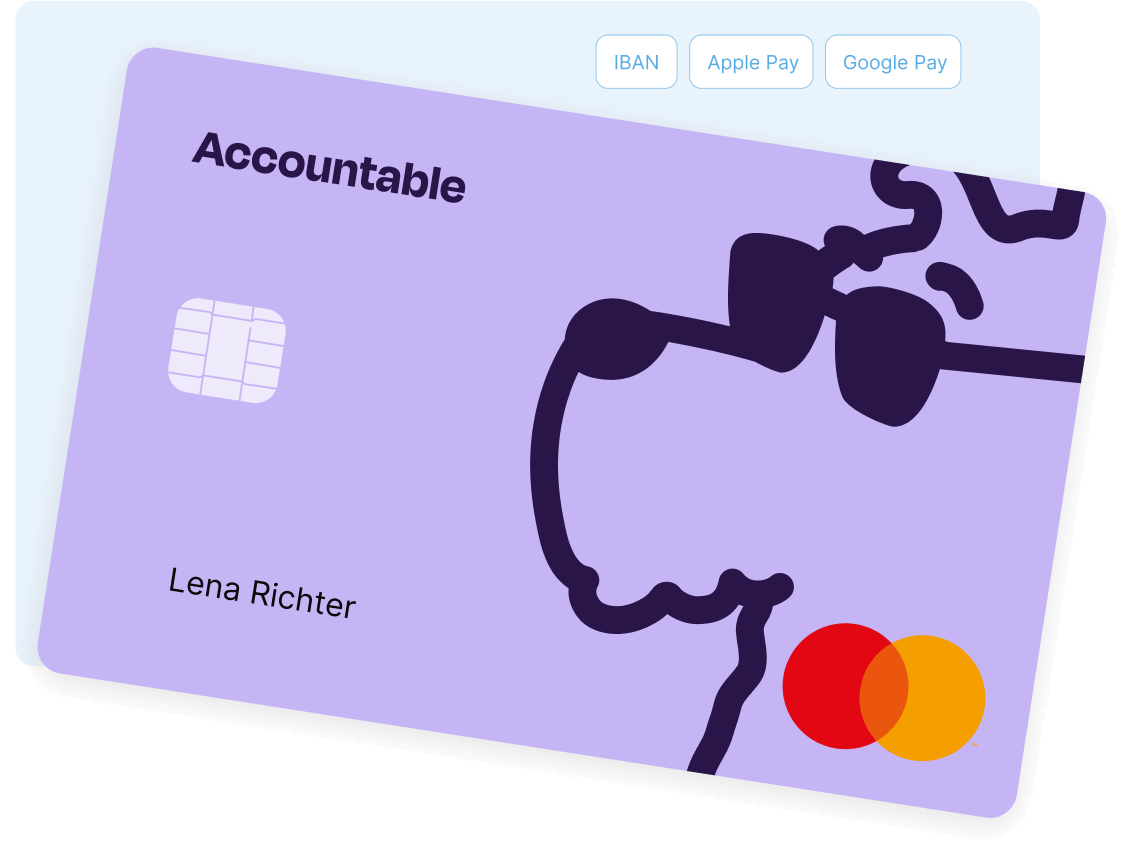

| Virtual Card (Apple & Google Pay) | 0€ |

|

|

|

|

|

|

| German IBAN |

|

|

|

|

|

|

|

| Cost of transactions | €0 | €0 | €0.40 | €0.15 | €0.20 | €0.20 | €0 |

| Amount of monthly free transactions | Unlimited | Unlimited | 30 | 10 | 10 | 10 | Unlimited |

| Receiving/transferring Money abroad | 5€ + 0,6–5% | €12.50 + 0.1% of the transfer amount (starting from €150) | 0,8% transfer (mind. 5€ excl. MwSt.) | Fees for non-SEPA transfers | Fees for non-SEPA transfers | Fees for non-SEPA transfers | 15€ Fee for non-SEPA transfers |

| Costs for Payments in Foreign Currency | 2% | 0% | 2% | 1.70% | 0% | 2.09% | 2.20% |

| Subaccount |

|

|

|

|

|

|

|

| Withdrawals from ATMs within the SEPA Zone | 1€ | 2/Month | One Card: 2€ per transaction | Free up to 200€ per month | Free up to 200€ per month | Abroad €3.50 per withdrawal | Im Ausland 1,75% per withdrawal |

| Standing orders |

|

|

|

|

|

|

|

| Taxes | |||||||

| Tax Savings |

|

|

|

|

|

|

|

| Automatic Calculation of Income Tax Return |

|

|

|

|

|

|

|

| Automatic Calculation of VAT Return |

|

|

|

|

|

|

|

| Own Bookkeeping Tool |

|

|

|

|

|

|

|

| Security | |||||||

| Einlagensicherung (Deposit Insurance) |

|

|

|

|

|

|

|

| 2-Factor Authentication |

|

|

|

|

|

|

|

| Customer Support | In-app chat, phone, email | In-app chat, phone, email | Phone (for card blocking), email | Email, phone | In-app chat, email | In-app chat, email | Phone, email, online mailbox |

No, there are absolutely no hidden costs involved with Accountable Banking. The banking product is available for free, no matter what Accountable plan you are on (FREE, SMALL or PRO), so you can manage your business finances without any surprises.

If you are in our FREE plan and would like to unlock all of Accountable’s tax and accounting features, including our web app, you can choose to upgrade. To learn more, please visit the pricing page on our website where everything is clearly outlined.

Don’t hesitate to reach out in case you have any questions about this!

Yes, your money is guaranteed under the European Deposit Guarantee Scheme. All funds deposited in your Accountable Banking account are held with our licensed banking partner Swan.io, who in turn keeps them securely with BNP Paribas in France. We do not, and cannot, invest or use your money in any way.

In the unlikely event that Accountable, Swan, or BNP Paribas were to go bankrupt, your money would still be protected up to €100,000 by the French Fonds de Garantie des Dépôts et de Résolution (the French deposit protection scheme, which is part of the European Deposit Guarantee Scheme).

If you have any questions about this, don’t hesitate to reach out.

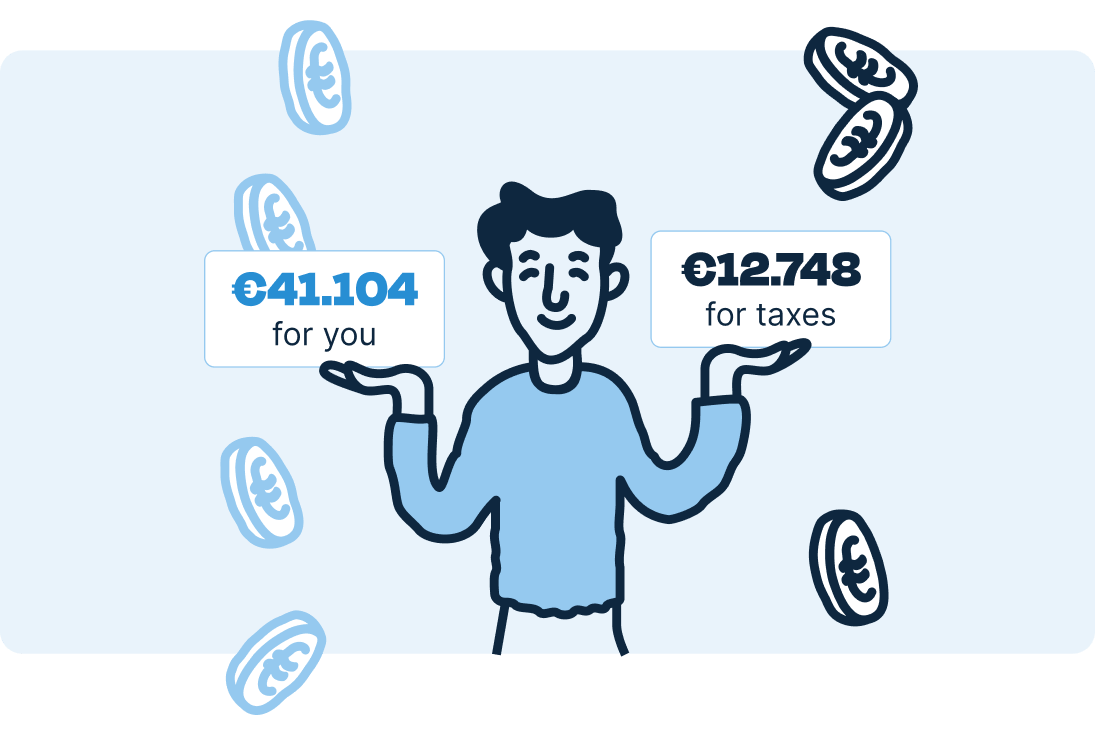

Yes, Accountable calculates the exact amount of taxes you need to set aside based on your business expenses and revenue.

As long as you keep your expenses and revenues up to date in the app, you can trust that the calculation is accurate. We’re fully transparent about how we calculate taxes, and if you ever have questions, our tax coaches are here to help. Plus, we offer a tax guarantee, so you’re protected against fines in case of any mistakes.

If you ever have any questions about your taxes, don’t hesitate to reach out to our tax coaches.

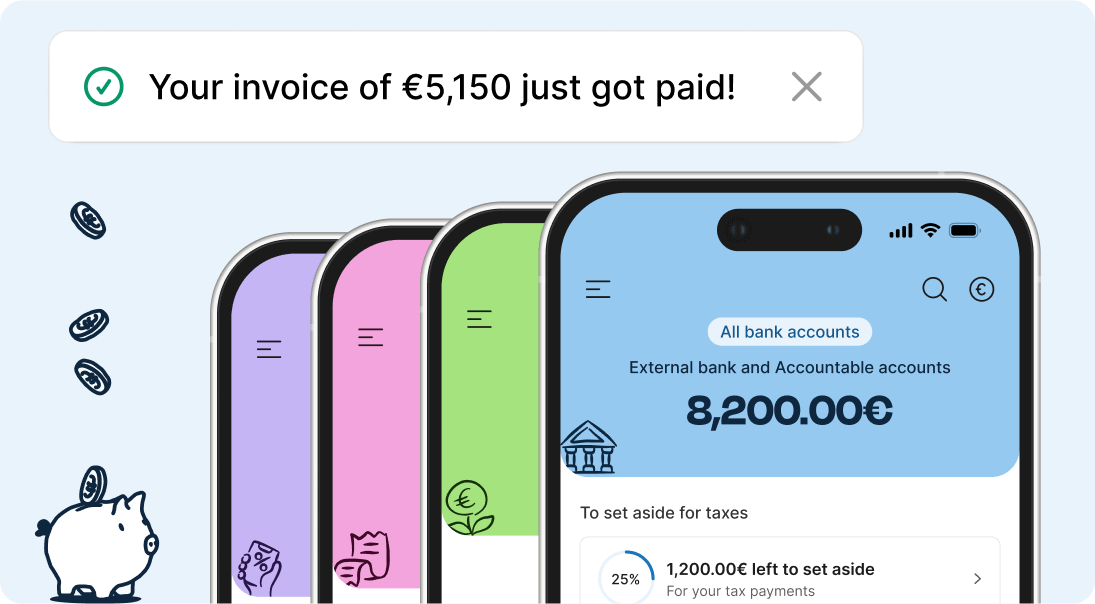

Yes, with Accountable Banking you get all the main services you’d expect from a traditional bank. These services are provided by our regulated banking partner Swan.io, ensuring the highest standards of security and compliance. Through the Accountable platform, you can easily manage your business finances, make payments, receive transfers, and much more, all in one seamless experience.

Absolutely! Through our partnership with Swan.io (our regulated banking service provider), Accountable is able to offer you secure banking products. Your money is stored in a safe, closed account with BNP Paribas in France, and we are never allowed to use or invest your funds.

If Accountable, Swan, or BNP Paribas were ever to go bankrupt, your money would remain protected under the French Fonds de Garantie des Dépôts et de Résolution, which covers deposits up to €100,000.

If you’d like to learn more about how your money is kept safe or about the deposit guarantee, please don’t hesitate to reach out to one of our tax coaches.

The Accountable Banking professional account is 100% free, available in every Accountable plan. Furthermore, most of the functionalities of Accountable Banking are free as well, except for a few international operations.

|

Functionality |

Fee |

|

Monthly fee |

€0 |

|

Virtual debit card (Apple/Google pay) |

€0 |

|

Domestic transfers (incoming + outgoing) |

€0 |

|

Transfers (incoming + outgoing) within the SEPA zone (see below) |

€0 |

|

Instant transfers |

€0 |

|

Standing orders (coming soon) |

€0 |

|

Direct debits |

€0 |

|

ATM withdrawals within the SEPA zone |

€1 |

|

Non-EUR transfers (see full list below) |

€5 + 0.6-5% of amount |

|

ATM withdrawals outside the SEPA zone |

2% of the amount withdrawn |

Countries within the SEPA zone

Austria, Belgium, Bulgaria, Croatia, Cyprus, the Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, and Sweden, Switzerland, the UK, San Marino, Vatican City, Andorra, Monaco, Iceland, Norway, and Liechtenstein.

Fees for incoming and outgoing credit transfers in foreign currencies

|

Currency |

Fee |

|

PLN, HRK, HUF, CZK, RON, DKK, |

5€ + 0.6% |

|

KES, PKR, MXN, INR, VND, MYR, |

5€ + 1% |

|

UGX, ARS, NPR, EGP, TZS, BRL, |

5€ + 2% |

|

BWP, UYU, FJD, COP, MAD, CRC, |

5€ + 5% |

All above fees will be directly billed to you by our Banking partner Swan. Accountable is not allowed to bill any Banking fees to you.

To open your Accountable professional account, you simply need to create a free account in the app. Once you are in the app, you can click on the button to get started in your Bank screen.

Clicking on this link will take you to the onboarding flow, that allows you to open an account in just a few minutes.

To confirm your identity, we will ask you a couple of questions about yourself and your professional activity, as well as ask you to upload a picture of your ID and a selfie.

Once we have received all your information, we will perform a check to make sure everything is in order and activate your account within 2 business days.