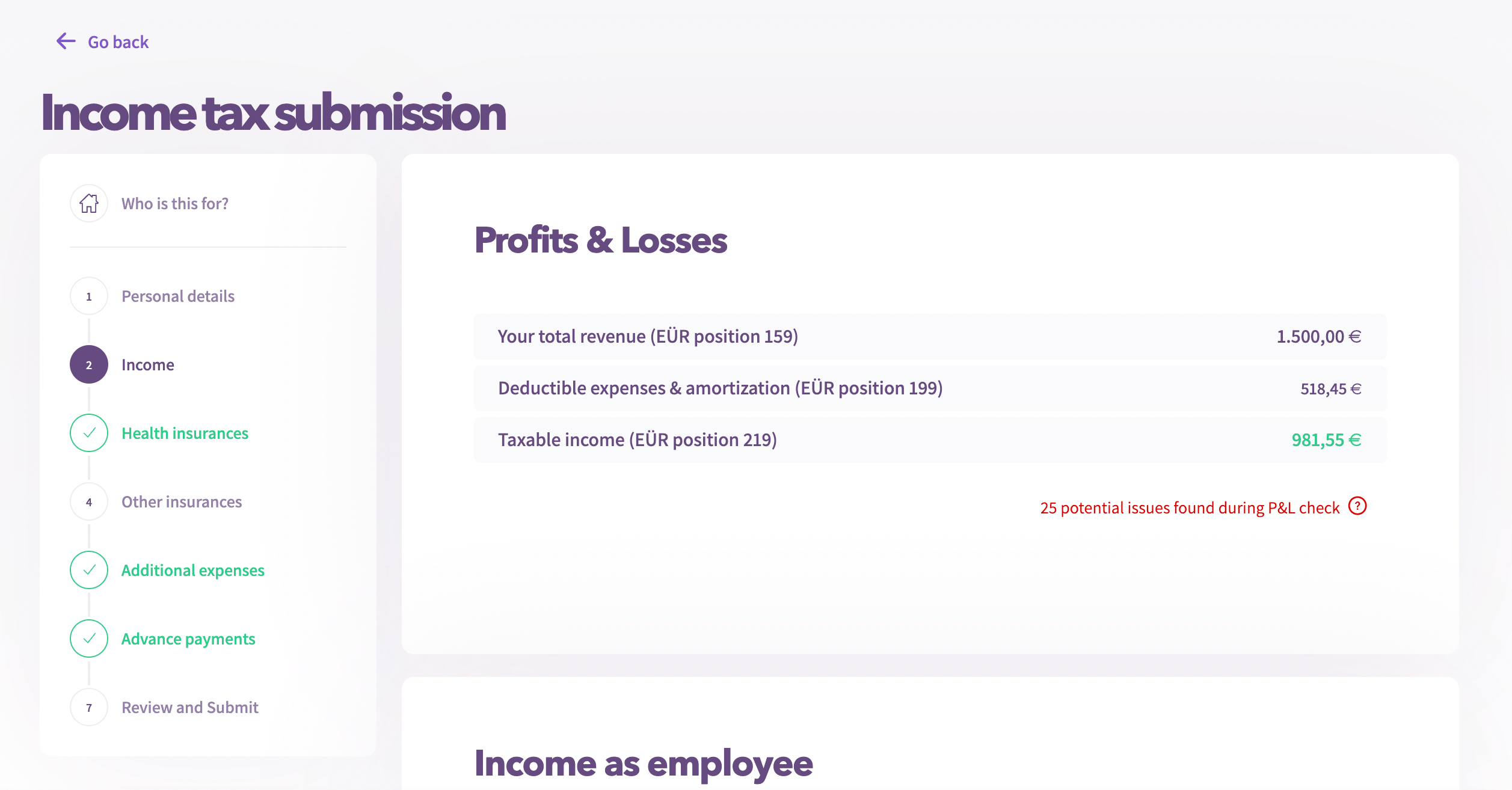

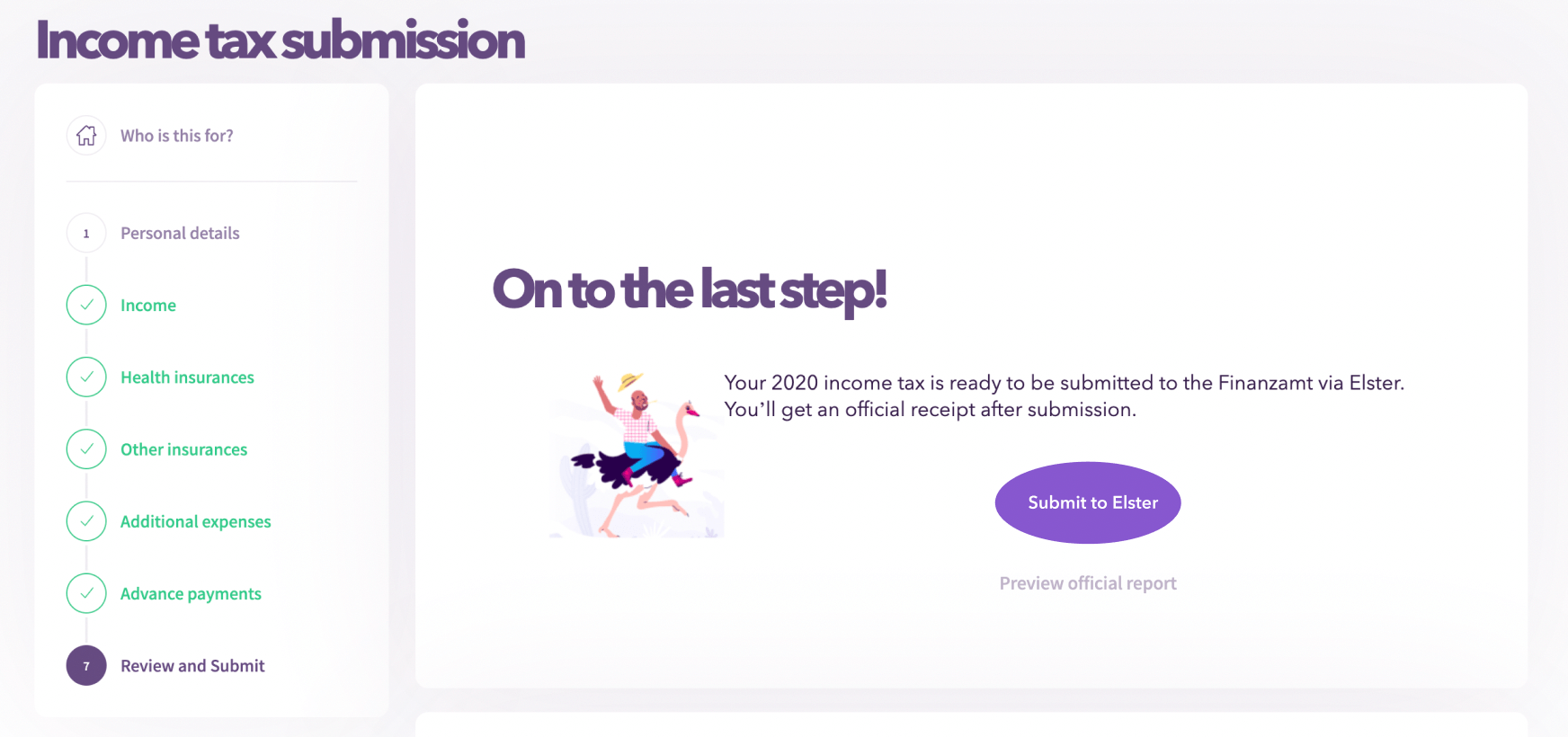

Here you can add additional data like information on income as employee, health insurance and so on. Finally, you will get to the "Submit to ELSTER" page, where you can send your income tax report directly via ELSTER to your Finanzamt. Now you have submitted your complete tax return and are done for the year!

You want to prepare your income tax return with Accountable? Click here and start now!

Here you can add additional data like information on income as employee, health insurance and so on. Finally, you will get to the "Submit to ELSTER" page, where you can send your income tax report directly via ELSTER to your Finanzamt. Now you have submitted your complete tax return and are done for the year!

You want to prepare your income tax return with Accountable? Click here and start now!

20 Kapitel knallhart recherchiert und vom Steuerprofi geprüft

Kostenlos herunterladen

Author - Sophia Merzbach

Sophia has been a key member of the Accountable team for many years, bringing a unique blend of journalistic precision and in-depth tax expertise to her work.

Who is Sophia ?Thank you for your feedback!

Useful

How much income tax is deducted from your income is largely determined by your tax class. There are ...

Read moreWorking as a self-employed professional has many advantages: You are your own boss and you can choos...

Read moreWorking with international clients can be tricky, depending on where exactly they’re located, whet...

Read moreSuper übersichtlich, einfach zu verstehen. Das erste mal, das ich das Gefühl habe, selbst meine Steuer zu verstehen. Normalerweise habe ich nach dem ein Steuerberater meien Unterlagen neu sortiert hat, überhaupt keinen Überblick mehr gehabt ... Kurz um: I love it

Ramona Schmidt

Die App ist super einfach aufgebaut. Für alle mehr als verständlich. Es gibt tolle verschiedene Optionen um Antworten zu bekommen. Wenn die KI nicht helfen kann, antworten die Steuer Coaches immer sehr schnell und sehr freundlich, so dass man direkt weiter arbeiten kann. Hab Accountable schon mehrfach weiterempfohlen.

Anonym

What I really appreciate is that you can quickly help me with my doubts about taxes, invoicing, and how to do things right in Germany. I've never been freelance and I am not German, so for my this support is crucial, especially because it's so hard to find an advisor in Berlin that I was almost going to give up, but I am happy I started with Accountable. The only thing I would do better is to see in my dashboard the status of the application as freelance to the finanzamt, since that was done through your site and there is no connection to that in my dashboard.

Francisco Javier Aguilar Sanchez

Mein Steuercoach hat zunächst versucht meine Frage besser zu verstehen und Nachfragen gestellt. Nachdem der Sachverhalt nicht direkt geklärt werden konnte, blieb man hartnäckig und hat sich mit Kollegen ausgetauscht, bis ich eine Lösung hatte. Das war genau so, wie ich es mir vorgestellt hatte. Bin sehr zufrieden

Michael Hofmann

Ich bin echt begeistert von Accountable.

Anonym

Ich hatte ein Problem mit dem Importieren von Eingangsrechnung (Fahrtkosten). Die Aufgabe hat Anahita übernommen und gelöst. Mein Problem wurde ernst genommen, sie hat Kontakt gehalten und schlussendlich wurde es von der IT gelöst. Vielen Dank.

Heinz Wiemers

Simon gave me a quick response and explained everything very kindly and clearly. I really appreciate his excellent customer support.

Yuki Shiroi

super einfach , Unterstützung von jede Seite ! Ki super gut ! TOP !

Alexander Abel

Ich liebe die Einfachheit, die KI-Unterstützung und dass ich schnell Rückmeldung erhalte:).

Anonym

Hallo! Also ich muss sagen, ich bin so so so positiv überrascht wie hilfsbereit das Accountable Team ist und wie ambitioniert mir bis jetzt geholfen wurde. Sowas habe ich noch nie erlebt :> Ich werde die App weiterhin gerne nutzen. Lg Kristin Speck

Kristin Speck