VAT return: What is the Vorauszahlungssoll?

Read in 4 minutes

You need to submit your first VAT this year but have no idea what the so called Vorauszahlungssoll is? No worries! In this article we will explain what Vorauszahlungssoll means, if it is actually relevant for you as a freelancer and how you can easily calculate it.

Vorauszahlungssoll – Explained

The Vorauszahlungssoll serves as the basis for calculating the final VAT payment (or refund) and must therefore be declared in the tax return by every self-employed professional subject to VAT. To be more specific, it is the sum of all Umsatzsteuervoranmeldungen (VAT returns) you submitted throughout the year. It does not matter whether the VAT payments have already been payed to the Finanzamt or are still outstanding.

When you do VAT payments, on top of the Vorauszahlungssoll, a Sondervorauszahlung (special advance payment) is added for a Dauerfristverlängerung (permanent extension). In case the VAT is already determined by the Finanzamt, this amount will be declared as Vorauszahlungssoll in your tax return.

It is possible, that the final calculation of your VAT by the Finanzamt results in a refund. In this positive case, you can either get the money back or use it to pay for possible tax liabilities you might have. But if you don’t submit a special application, you will simply be payed back the amount. On the other hand, it’s also possible that the Finanzamt calculates that you still have to pay an additional sum. If this is the case, you have to pay it to the Finanzamt one month after you submitted your tax return. This is according to the law concerning VAT and the so called Abgabenordnung (general tax code).

Do Kleinunternehmer (small business) also have to submit VAT?

According to the law a Kleinunternehmer does not need to pay VAT, in case certain conditions apply (it’s according to § 19 UStG in the German tax law). In the law it says that you are not required to pay VAT if your income doesn’t exceed 22.000 Euro in your first year and is no higher than 50.000 Euro in the second year. However, even as Kleinunternehmer it is mandatory to submit your VAT (Umsatzsteuererklärung) once a year. This is basically to proof to the Finanzamt that your income is indeed not higher than the maximum of the VAT-free amount.

Example:

In your VAT return 2022 you fill in the profit from 2021 (which should be less than 22.000 Euro). You also fill in the profit from 2022, which cannot be more than 50.000 Euro. Like this, you can benefit from the Kleinunternehmerregelung and thus don’t need to pay VAT.

💡 Tip from Accountable: In our app you can easily track your income and are always aware of your profit. This way there are no bad surprises in case you might earn more than the maximum amount of 22.000 Euro that is free from VAT.

Do freelancers need to submit VAT?

For freelancers it depends on their kind of profession wether they are subject to VAT. There are several freelance occupations that are exempt from the VAT obligation, for example:

- Doctors

- Lawyers

- Engineers

- Heilpraktiker

- Journalists

- Tax advisors

- Translators

- and several others

These freelancers can request to be exempt from paying VAT. If you fall in this category, you should talk to your tax advisor in order to submit an official application to the Finanzamt.

Freelancers whose professions don’t fall under the exemption need to submit a yearly VAT return together with their income tax return.

Calculation of the Sondervorauszahlung

The Sondervorauszahlung is a payment that an entrepreneur needs to extend to the Finanzamt, if he wishes to submit his monthly VAT one month later after the actual deadline. In this case you as entrepreneur need to calculate the prepayment yourself.

The Sondervorauszahlung is calculated on the basis of all collected Umsatzsteuervoranmeldungen (VAT returns) of the previous year. It is 1/11 of this sum.

If a Sondervorauszahlung was already made in the previous year, it must be deducted from the total of the Umsatzsteuervorauszahlungen for the previous year.

An example of this calculation:

- Sondervorauszahlung previous year: 4.000 Euro

- All collected Umsatzsteuervorauszahlungen of the previous year: 18.000 Euro

- With the Umsatzsteuervoranmeldung for December of the previous year the entrepreneur already payed a Sondervorauszahlung of 4.000 Euro.

- So he actually payed 18.000 Euro + 4.000 Euro = 22.000 Euro in taxes.

- Therefore the Sondervorauszahlung for this year is: 22.000 Euro x 1/11 = 2.000 Euro

How to fill in the Vorauszahlungssoll

To enter the Vorauszahlungssoll you can simply log in to ELSTER online using your ID card.

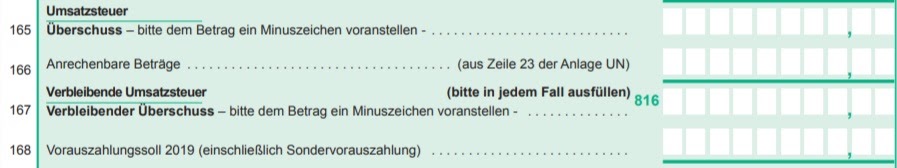

You find the Vorauszahlungssoll in your Umsatzsteuererklärung on page 6, fill in line 168.

Source: Bundesfinanzministerium – Muster der Umsatzsteuererklärung

Conclusion

At first, the concept of the Vorauszahlungssoll seems to be extensive, with lots of information. But in fact, it’s really not as complicated as one might assume. The Vorauszahlungssoll is nothing more than the sum of the declared Umsatzsteuervorauszahlungen, including the Sondervorauszahlung.

Wether the prepayments have already been made or if the Finanzamt has already refunded a sum is not relevant for the Vorauszahlungssoll.

Assuming that it is already determined how much VAT is declared for the given time period, you only need to fill in the VAT as Vorauszahlungssoll.

Did you find what you were looking for?

Happy to hear!

Stay in the know! Leave your email to get notified about updates and our latest tips for freelancers like you.

We’re sorry to hear that.

Can you specify why this article wasn’t helpful for you?

Thank you for your response. 💜

We value your feedback and will use it to optimise our content.