This is how easy the Umsatzsteuervoranmeldung / VAT return in Germany can be

Read in 4 minutes

One of the most bothersome tax obligations is the regular submission of the VAT return, in Germany called Umsatzsteuervoranmeldung. Here, self-employed professionals who are subject to VAT (value-added tax ) have to list their income from the previous months and pay the corresponding VAT to the Finanzamt (tax office).

Fortunately, with the app from Accountable, you can keep the effort for your VAT return as low as possible. We’ll show you how you can quickly and easily do your monthly VAT return with Accountable.

Who has to submit VAT?

In Germany, for every product sold and every service provided VAT must be paid to the state. This tax is also often called Mehrwertsteuer in Germany. The regular rate is 19%, which is added to the price when making a purchase. However, there are some cases where there is only added a reduced rate of 7%. For example, when buying magazines, books or even certain foods and beverages.

The Umsatzsteuer earned must be regularly paid to the Finanzamt. In addition, you have to submit the VAT pre-submission. This list of income must be submitted monthly, annually or quarterly, depending on your level of income. The submission deadlines are set by the Finanzamt.

The positive thing about the VAT pre-submission is that you not only have to submit the VAT you have received, but at the same time you can reclaim the VAT you have paid for business-related expenses. This is especially beneficial if you often have larger expenses for technology or other equipment as part of your self-employment.

💡Tip from Accountable: If your annual income is less than 22,000€, you can make use of the Kleinunternehmerregelung (small business regulation) and be exempt from the VAT obligation.

This is how easy the VAT return is with Accountable

Accountable’s free app is specifically designed to meet the needs of freelancers. This means that you can do your taxes and accounting as quickly and easily as possible without any prior knowledge. This also includes your VAT return. You can also easily switch language between English and German to always understand what you’re dealing with and get guidance through Germany’s tax regulations. We’ll show you how it works!

Step 1: Download the Accountable App

The Accountable App is available for both iOS and Android. Alternatively, you can also create a free account directly in the Desktop Version.

Step 2: Create your profile

After you have successfully installed the app, you can create your profile. Simply fill in your information such as your tax number, your VAT number and your job title and click to save.

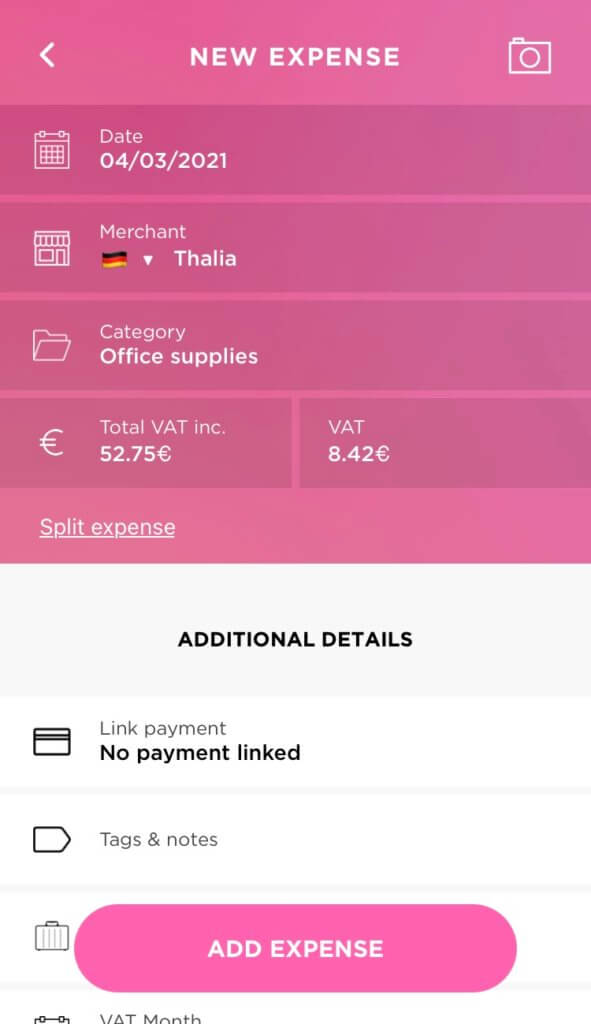

Step 3: Scan your receipts

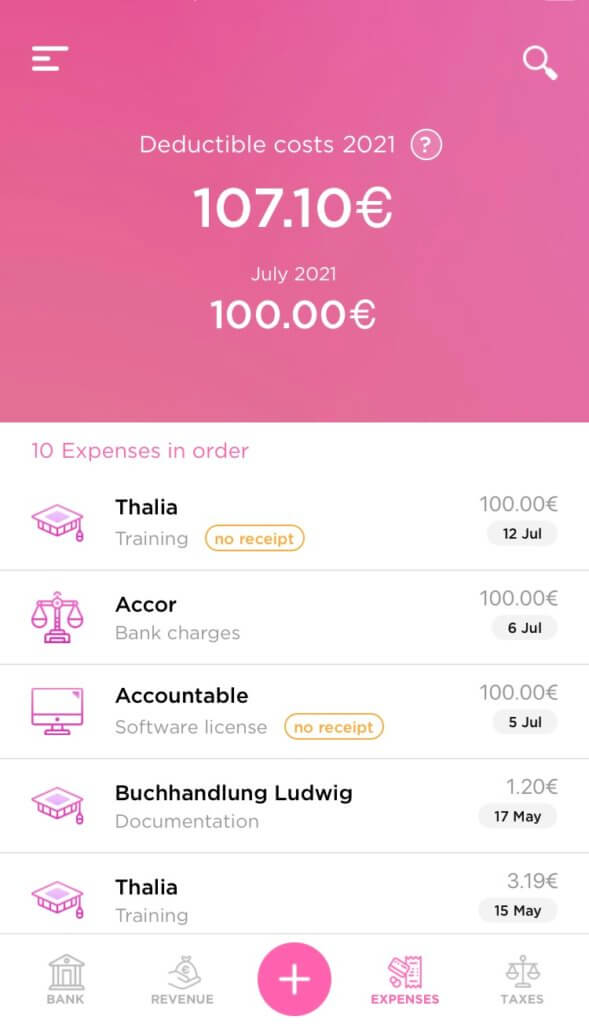

Thanks to our easy receipt recognition, you can now quickly upload all your receipts from business expenses via photo scan and never miss an expense you could have deducted from your taxes. Your expenses are automatically categorized for tax purposes and can be exported to other software.

Enter new receipt

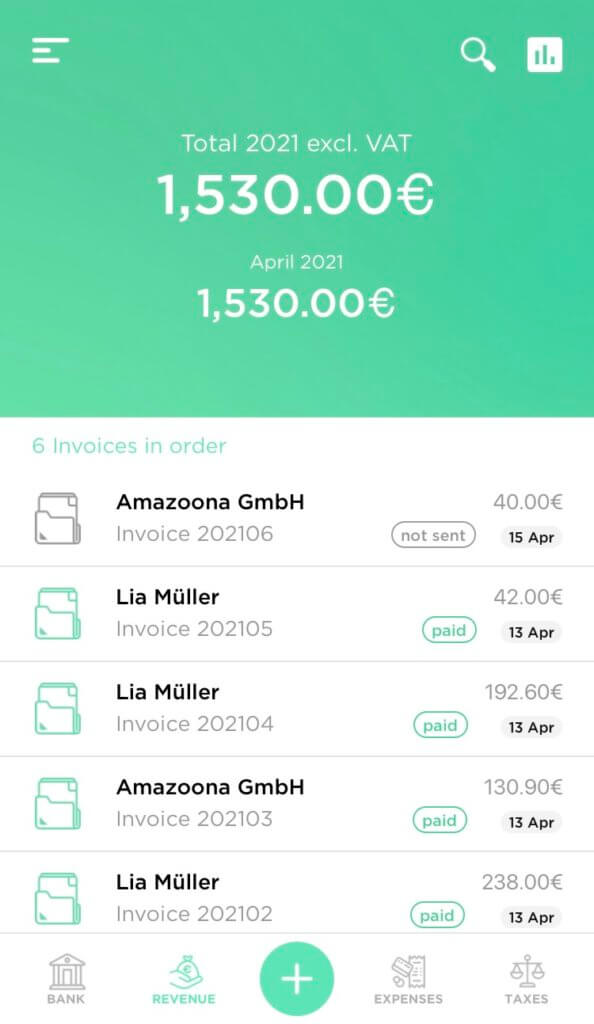

Step 4: Save your invoices

The counterpart to your expenses is the revenue. In the green screen you can either upload existing invoices or simply create them with our templates. You can also add income without invoices, for example cash income. Invoices to clients in Germany have to include VAT, in most cases. So this is the VAT you need to pass on to the Finanzamt in your VAT payment.

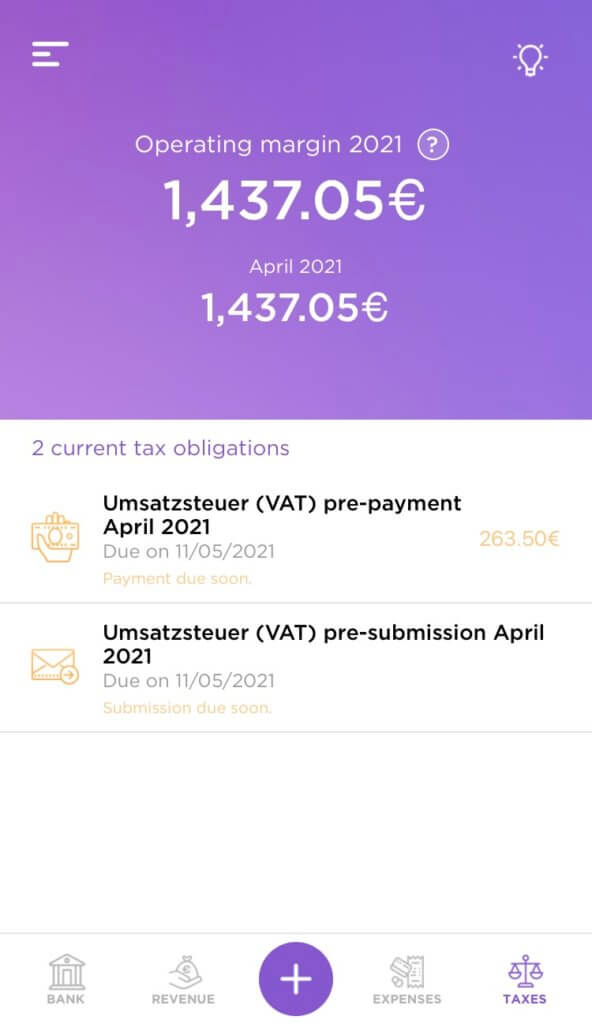

Step 5: Create your VAT return

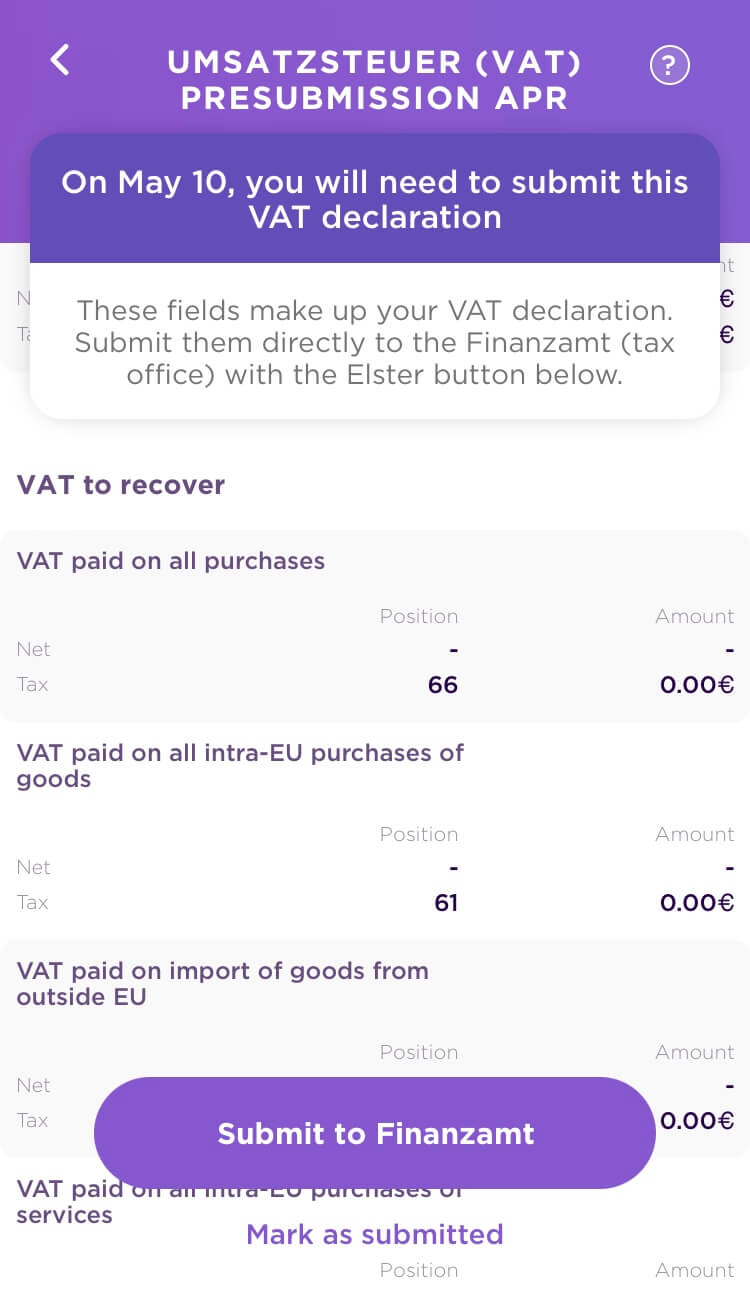

In the taxes tab you will always find all relevant submission deadlines for your tax returns at a glance. Here you can also see when your next VAT return is due. It’s usually the 10th of the following month.

The amount of VAT you have to pay is calculated from the sum of your income entered in the app minus your business expenses.

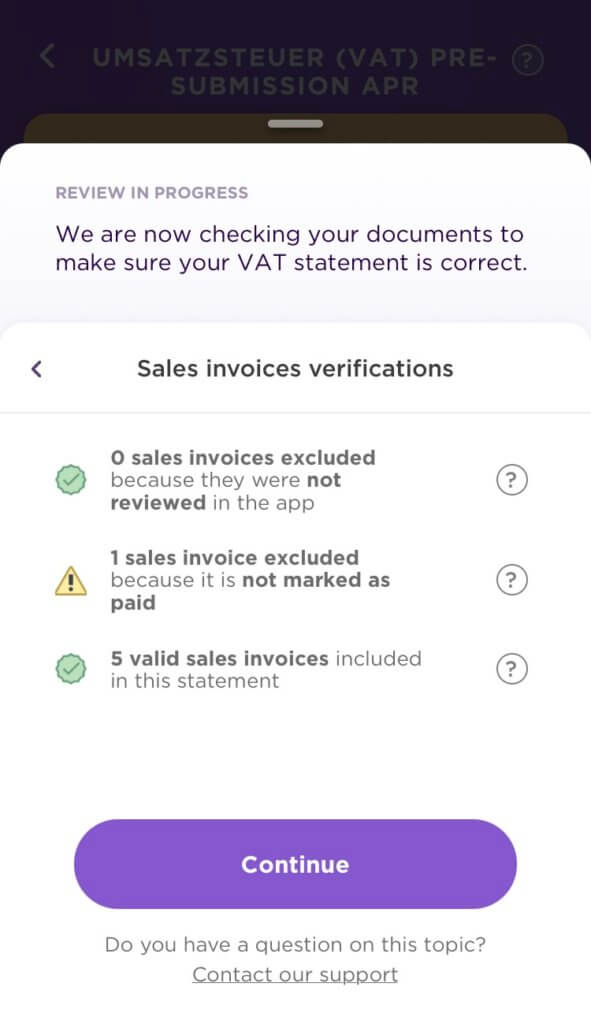

By clicking on the corresponding VAT return, you will find an overview of the relevant data, which you then transmit directly to your Finanzamt via our official ELSTER interface. You don’t need an extra ELSTER account for it. Click on “Send to Finanzamt” to have your data checked once again.

As soon as the verification is completed, you can send your VAT return directly to your Finanzamt. A protocol of the transfer is automatically sent to the e-mail address you have entered in your account.

Congrats! You just sent your VAT return, it’s that easy. Now you only have to pay the stated sum of VAT to the Finanzamt. Accountable automatically calculates the amount you have to pay and also shows you the account details of your Finanzamt. As soon as you have transferred the money, you can mark the VAT payment for the relevant month as paid and fully concentrate on your work again!

Wrap up – submit your VAT return

The VAT return must be submitted regularly to the Finanzamt by self-employed workers who are subject to VAT. If you organize your income and expenses with Accountable, you can automatically create your VAT return with just a few clicks and send the data directly to your Finanzamt.

Based on your accounting, the VAT is also directly calculated for you. You only have to transfer the amount due and can then focus on your actual work again.

💡Accountable is the tax solution for the self-employed. Download the free app or create an account online. This way, you have your bookkeeping and tax obligations like VAT return under control right from the start. Our team will also help you personally in the chat at any time!

Did you find what you were looking for?

Happy to hear!

Stay in the know! Leave your email to get notified about updates and our latest tips for freelancers like you.

We’re sorry to hear that.

Can you specify why this article wasn’t helpful for you?

Thank you for your response. 💜

We value your feedback and will use it to optimise our content.