How to fill out the Fragebogen zur steuerlichen Erfassung – tax registration as a freelancer in Germany

Read in 7 minutes

In order to register your freelance business in Germany, you will need to fill out a form called the Fragebogen zur steuerlichen Erfassung (in English: tax regulation questionnaire). This is also how you sign up for a VAT number, if you need one. The form can be filled in online, via ELSTER or another service.

With eight pages of questions in German, it would be easy to get overwhelmed trying to answer this form. But don’t panic! On our website, you find the official online form in English! It allows you to get officially started as a freelancer. Plus, we have created this handy guide to walk you through the form in English in 3 steps.

Step 1: Get the form and check a few things before you start

Start with the easy part of opening the online form or downloading the official government form (make sure to use the official form downloaded from www.formulare-bfinv.de).

The following process will go much more smoothly if you already have the following things in order. Make sure you…

…are allowed to work as a freelancer

If you are not a citizen of the EU, you will need a freelance work visa in order to undertake freelance work here in Germany.

… know if you are a Freiberufler or a Gewerbetreibender

In Germany, there is a legal difference between a freelancer (Freiberufler) and a tradesperson (Gewerbetreibender). If you are a Gewerbetreibender, you will need a special license, called a Gewerbeschein – come back and fill in the Fragebogen zur steuerlichen Erfassung once you have this license.

… have an estimate of your revenue for the next two years

You will need to give the Finanzamt an indication of how much you expect to earn in your first year as a freelancer in Germany, as well as for the following year. Note this is revenue, not income, so make some allowances for expense deductions. Figure this out in advance and then filling out the form will be that much simpler (check out our tips on ‘pay attention to tax prepayments‘ to avoid unpleasant surprises).

… have your German bank account details handy

Regardless wether you have a business bank account or a simple personal account, this will make it easier to make bank transfers to and from the Finanzamt.

Step 2: Filling out the Fragebogen zur steuerlichen Erfassung

Now, let’s go through the form section by section. To make this a little easier, we are going to assume you are an independent, individual freelance worker. If you are something slightly different, contact us to discuss what applies to you and how we might be able to support you including advice of a registered tax consultant.

Introduction

In line 1, enter the name of your local Finanzamt. Line 2 is for your Steuernummer, or tax number, if you have it – if not, submitting this form will trigger the Finanzamt to give you one. It’s fine to leave this blank in the meantime. The Steuernummer is not to be confused with your Steuer ID, or tax ID number.

Section 1: General information

Here you give your name, date of birth and address. You should already have some practice at this from when you registered your arrival in Germany.

Line 7 is for your profession – you may need to use a translator to correctly state which kind of work you plan to do as a freelancer.

Line 12 deals with your steuer ID number (see above) and your religious affiliation. EV stands for protestant, RK for Catholic and VD for those who have opted out of paying church tax as they are not affiliated with any religion. For other religions’ codes, there is a separate document called the Ausfüllhilfe (or filling-out help), which you can also obtain at the Finanzamt.

Line 13 is about your marital status. The four boxes stand for: married, widowed, divorced and separated, in that order. If any of these apply to you, state the date they occured. Then, in section 1.2, you can fill out the details of your spouse or partner.

Section 1.3 is for your contact details.

In section 1.4, state the German name for your industry, as well as your Steuernummer if you have one.

Section 1.5: Bank accounts

If you are happy for payments to and from the Finanzamt to come in and out of one account, fill out your bank account details in lines 27 to 29. The two boxes in line 30 are used to indicate whether you account belongs to you (box 5) or your spouse (box 14).

If you would prefer to use separate personal and business bank accounts, use lines 31 to 33 to give your personal bank account details (for example, for income tax payments) and lines 35 to 37 for your business account (for things like VAT payments).

If you give permission for the Finanzamt to take money directly from your account using SEPA direct debits, tick box 39. Some people find this useful as then they don’t have to make manual payments.

Section 1.6: Your tax advisor’s details

If you have a tax advisor, you might like to ask them to fill out this part of the form for you.

Section 1.7 is about authorising them to receive mail from the Finanzamt on your behalf. We recommend you talk to your tax advisor about these options.

Section 1.8: Previous address

If you have lived at your current address for less than 12 months, enter your previous address in section 1.8.

Section 2: Freelance business information

Enter the name of your business in lin 66, and then enter your business address and contact details through section 2.1.

Section 2.2 is for your business’s start date.

Section 2.3 asks whether your business has any additional branches in other districts. Select yes or no – if yes, fill out the details of the other branches.

If you have registered a trade, enter these details in section 2.4.

Section 2.5 deals with your business’s registration. For the purposes of this article, we are assuming you are an individual freelancer, so you do not need to fill out this section.

Finally, section 2.6 asks: “Did you run a business, work as a freelancer, perform agricultural or silvicultural activity or own at least 1% of a corporation in the last five years?” Yes or no – if yes, then fill out this section with details of your previous business.

Section 3: Income tax estimations

Use line 111 to fill out, in this order:

- How much revenue you expect to earn as a freelancer in this financial year (which runs from January to December in Germany)

- The second column is for your spouse’s income. If they are an employee, put this figure into row 112 instead.

- Now repeat for the following year: how much freelance revenue you expect to earn next year

- Your partner’s expected earnings next year

Section 4: Profit determination

This section is about how you plan to determine and document your earnings. As a freelancer, you are most likely to use “Einnahmenüberschussrechnung”, or single-entry bookkeeping, so tick the box in line 118. More on how to document your income for the Finanzamt.

In line 122, tick “no” to say that your business year does not differ from the usual January-December financial year.

Section 5 and 6

Section 5 covers income tax exemptions, which most likely don’t apply to you (if your tax consultant says otherwise, ask them to help you with this section).

And section 6 is about employees, which you shouldn’t have, if you are a freelancer.

As long as you are a regular freelancer, you can go ahead and skip both these sections.

Section 7: Registration and payment of VAT

Use line 131 to again enter your expected revenue for this year and the following year.

Section 7.2 covers the transfer of business. You can leave it blank.

Section 7.3 is about whether or not you are a Kleinunternehmer, or small business. This is a legal classification which applies to you if you are expected to earn less than 22,000 EUR per year (17,500 EUR per year until 2019). In that case, you can choose not to deal with VAT.

If your income is likely to sit under this threshold, you can tick the box in line 133 to avoid having to deal with VAT.

If you have decided that you would like to charge and pay VAT, despite sitting under this threshold, tick box 134.

You can skip sections 7.4 to 7.7, as they do not apply to freelancers.

Section 7.8 deals with how your VAT will be calculated. Unless you have received other advice from a registered tax accountant, tick the first box to indicate that you will calculate your VAT payments based on the invoices you charge to clients. This is by far the most common option for freelancers.

Section 7.9 is about obtaining a VAT number. Tick the box in line 153 if you would like the Finanzamt to send you a VAT number – this is necessary if you are planning to charge VAT.

If you already have a VAT number, tick the box in line 154 and enter your VAT number below, as well as the date on which you received it.

You can safely skip the rest of section 7.

Section 8: Participation in a business partnership or business association

We will assume that as an independent freelancer this section does not apply to you. If for some reason it does, please ask your business partner or association for support filling out this section of the form.

Finally, in line 166, put your current location and date, and then sign the form. Then enter your Steuernummer one more time below, if you have it.

If you have decided to allow SEPA direct debits in section 1.5, you will need to attach a direct debit authorisation (“Teilnahmeerklärung für das SEPA-Lastschriftverfahren”) to this form. Tick the box in line 167 to say you have done so.

Step 3: Send the form to your Finanzamt

That wasn’t so bad, was it?

Now you just need to deliver your filled-out form to the Finanzamt. You can either do this in person, via e-mail or mail it to them the old-fashioned way. To find the contact details of your Finanzamt follow this link and type in the name of your city or administrative district (in Berlin, e.g. Prenzlauer Berg) you live in.

You can expect to receive your Steuernummer and VAT number by mail in four to six weeks. As soon as you have these numbers you are able to put them on your invoices and start invoicing your clients.

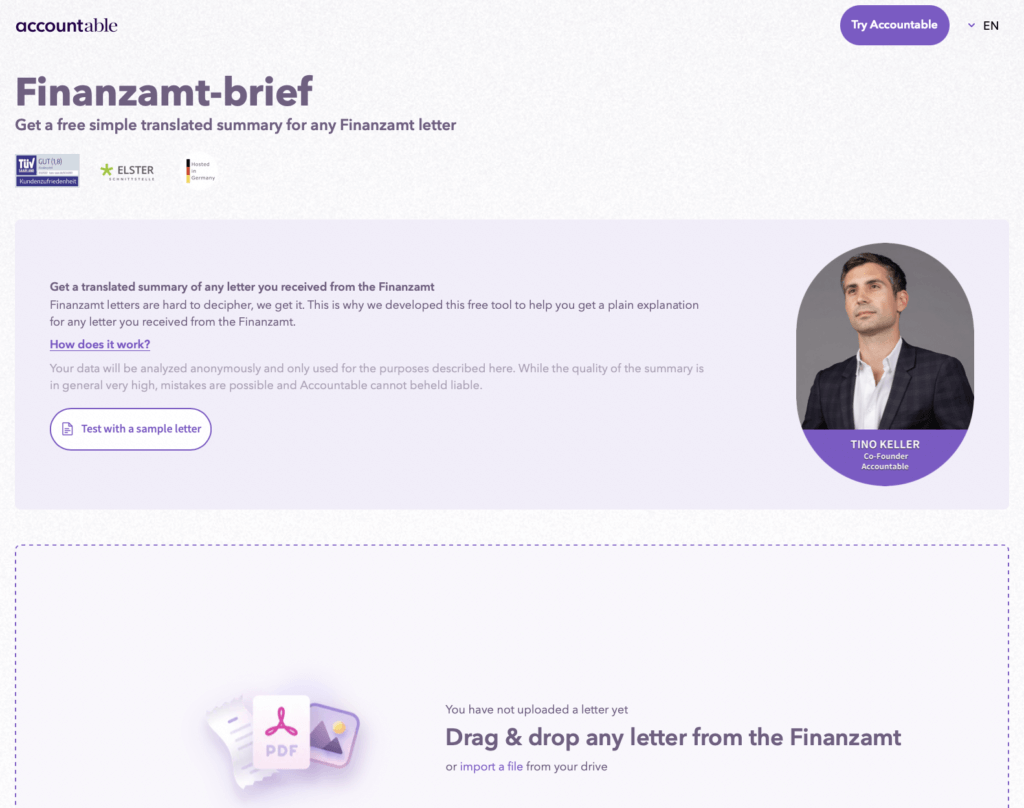

Received your Steuernummer letter from the Finanzamt?

Once you registered your self-employment, you start receiving letters from the Finanzamt. Should you have difficulties understanding the German bureaucratic language, worry no more! Use our free AI tool!

Simply upload your letter and our tool will translate the letter and explain what you have to do next! Test it now for free!

💡Accountable is the tax solution for the self-employed. Download the free app or create an account online. This way, you have your bookkeeping and tax obligations under control right from the start. Our team will also help you personally in the chat at any time!

Did you find what you were looking for?

Happy to hear!

Stay in the know! Leave your email to get notified about updates and our latest tips for freelancers like you.

We’re sorry to hear that.

Can you specify why this article wasn’t helpful for you?

Thank you for your response. 💜

We value your feedback and will use it to optimise our content.